UPS 2011 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2011 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of

Equity Securities

Our class A common stock is not listed on a national securities exchange or traded in an organized

over-the-counter market, but each share of our class A common stock is convertible into one share of our class B

common stock.

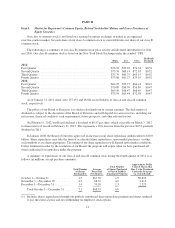

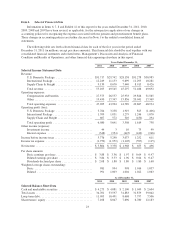

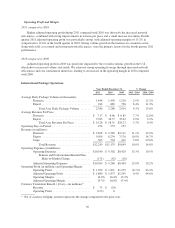

The following is a summary of our class B common stock price activity and dividend information for 2011

and 2010. Our class B common stock is listed on the New York Stock Exchange under the symbol “UPS.”

High Low Close

Dividends

Declared

2011:

First Quarter ................................................. $76.99 $70.22 $74.32 $0.52

Second Quarter ............................................... $75.58 $68.14 $72.93 $0.52

Third Quarter ................................................ $75.79 $60.75 $63.15 $0.52

Fourth Quarter ............................................... $73.80 $61.27 $73.19 $0.52

2010:

First Quarter ................................................. $64.95 $55.77 $64.41 $0.47

Second Quarter ............................................... $70.89 $56.70 $56.89 $0.47

Third Quarter ................................................ $69.50 $56.47 $66.69 $0.47

Fourth Quarter ............................................... $73.94 $65.44 $72.58 $0.47

As of January 31, 2012, there were 157,455 and 18,024 record holders of class A and class B common

stock, respectively.

The policy of our Board of Directors is to declare dividends out of current earnings. The declaration of

dividends is subject to the discretion of the Board of Directors and will depend on various factors, including our

net income, financial condition, cash requirements, future prospects, and other relevant factors.

On February 9, 2012, our Board declared a dividend of $0.57 per share, which is payable on March 7, 2012

to shareowners of record on February 21, 2012. This represents a 10% increase from the previous $0.52 quarterly

dividend in 2011.

In January 2008, the Board of Directors approved an increase in our share repurchase authorization to $10.0

billion. Share repurchases may take the form of accelerated share repurchases, open market purchases, or other

such methods as we deem appropriate. The timing of our share repurchases will depend upon market conditions.

Unless terminated earlier by the resolution of our Board, the program will expire when we have purchased all

shares authorized for repurchase under the program.

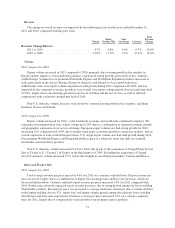

A summary of repurchases of our class A and class B common stock during the fourth quarter of 2011 is as

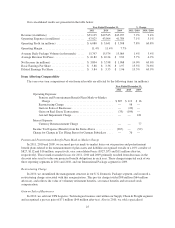

follows (in millions, except per share amounts):

Total Number

of Shares

Purchased(1)

Average

Price Paid

Per Share(1)

Total Number

of Shares Purchased

as Part of Publicly

Announced Program

Approximate Dollar

Value of Shares that

May Yet be Purchased

Under the Program

(as of month-end)

October 1—October 31 .............. 1.5 $67.78 1.5 $2,895

November 1—November 30 .......... 4.2 68.72 4.0 2,615

December 1—December 31 ........... 1.4 70.18 1.3 2,525

Total October 1—December 31 .... 7.1 $68.79 6.8

(1) Includes shares repurchased through our publicly announced share repurchase program and shares tendered

to pay the exercise price and tax withholding on employee stock options.

21