UPS 2011 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2011 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Other investing activities include the cash settlement of derivative contracts used in our currency hedging

programs, the timing of aircraft purchase contract deposits on our Boeing 767-300 and Boeing 747-400 aircraft

orders, and the equity investments in five new leveraged aircraft leases. We received (paid) cash related to

purchases and settlements of energy and currency derivative contracts used in our hedging programs of $(78),

$111 and $117 million during 2011, 2010 and 2009, respectively.

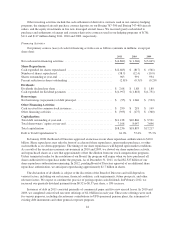

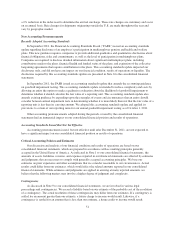

Financing Activities

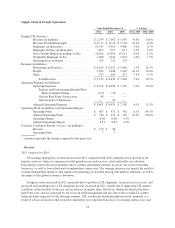

Our primary sources (uses) of cash for financing activities are as follows (amounts in millions, except per

share data):

2011 2010 2009

Net cash used in financing activities ................................. $(4,862) $ (1,346) $ (3,045)

Share Repurchases:

Cash expended for shares repurchased ............................... $(2,665) $ (817) $ (561)

Number of shares repurchased ...................................... (38.7) (12.4) (10.9)

Shares outstanding at year-end ..................................... 963 991 994

Percent reduction in shares outstanding ............................... (2.8)% (0.3)% (0.2)%

Dividends:

Dividends declared per share ....................................... $ 2.08 $ 1.88 $ 1.80

Cash expended for dividend payments ............................... $(1,997) $ (1,818) $ (1,751)

Borrowings:

Net borrowings (repayments) of debt principal ......................... $ (95) $ 1,246 $ (522)

Other Financing Activities:

Cash received for common stock issuances ............................ $ 290 $ 218 $ 149

Other financing activities .......................................... $ (395) $ (175) $ (360)

Capitalization:

Total debt outstanding at year-end ................................... $11,128 $10,846 $ 9,521

Total shareowners’ equity at year-end ................................ 7,108 8,047 7,696

Total capitalization .............................................. $18,236 $18,893 $17,217

Debt to Total Capitalization % ..................................... 61.0% 57.4% 55.3%

In January 2008, the Board of Directors approved an increase in our share repurchase authorization to $10.0

billion. Share repurchases may take the form of accelerated share repurchases, open market purchases, or other

such methods as we deem appropriate. The timing of our share repurchases will depend upon market conditions.

As a result of the uncertain economic environment in 2010 and 2009, we slowed our share repurchase activity,

and repurchased shares at a rate that approximately offset the dilution from our stock compensation programs.

Unless terminated earlier by the resolution of our Board, the program will expire when we have purchased all

shares authorized for repurchase under the program. As of December 31, 2011, we had $2.525 billion of our

share repurchase authorization remaining. In 2012, pending Board of Directors approval of an additional share

repurchase authorization, we anticipate repurchasing approximately $2.7 billion in shares.

The declaration of dividends is subject to the discretion of the Board of Directors and will depend on

various factors, including our net income, financial condition, cash requirements, future prospects, and other

relevant factors. We expect to continue the practice of paying regular cash dividends. In February 2012, we

increased our quarterly dividend payment from $0.52 to $0.57 per share, a 10% increase.

Issuances of debt in 2011 consisted primarily of commercial paper and five new aircraft leases. In 2010 and

2009, we completed senior fixed rate note offerings of $2.0 billion in each year. These note offerings were used

for various purposes, including discretionary contributions to UPS-sponsored pension plans, the retirement of

existing debt instruments and other general corporate purposes.

44