UPS 2011 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2011 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Commodity Price Risk

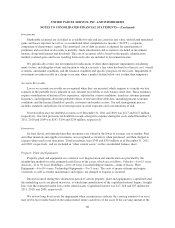

We are exposed to changes in the prices of refined fuels, principally jet-A, diesel and unleaded gasoline.

Currently, the fuel surcharges that we apply to our domestic and international package and LTL services are the

primary means of reducing the risk of adverse fuel price changes. Additionally, we periodically use a

combination of option contracts to provide partial protection from changing fuel and energy prices. As of

December 31, 2011 and 2010, however, we had no commodity option contracts outstanding.

Foreign Currency Exchange Risk

We have foreign currency risks related to our revenue, operating expenses and financing transactions in

currencies other than the local currencies in which we operate. We are exposed to currency risk from the

potential changes in functional currency values of our foreign currency-denominated assets, liabilities and cash

flows. Our most significant foreign currency exposures relate to the Euro, the British Pound Sterling and the

Canadian Dollar. We use a combination of purchased and written options and forward contracts to hedge

forecasted cash flow currency exposures. These derivative instruments generally cover forecasted foreign

currency exposures for periods of 12 to 24 months. Additionally, we utilize cross-currency interest rate swaps to

hedge the currency risk inherent in the interest and principal payments associated with foreign currency

denominated debt obligations. The terms of these swap agreements are commensurate with the underlying debt

obligations.

Interest Rate Risk

We have issued debt instruments, including debt associated with capital leases, that accrue expense at fixed

and floating rates of interest. We use a combination of interest rate swaps as part of our program to manage the

fixed and floating interest rate mix of our total debt portfolio and related overall cost of borrowing. The notional

amount, interest payment and maturity dates of the swaps match the terms of the associated debt. We also utilize

forward starting swaps and similar instruments to lock in all or a portion of the borrowing cost of anticipated debt

issuances. Our floating rate debt and interest rate swaps subject us to risk resulting from changes in short-term

(primarily LIBOR) interest rates.

We also are subject to interest rate risk with respect to our pension and postretirement benefit obligations, as

changes in interest rates will effectively increase or decrease our liabilities associated with these benefit plans,

which also results in changes to the amount of pension and postretirement benefit expense recognized in future

periods.

We have investments in debt securities, as well as cash-equivalent instruments, some of which accrue

income at variable rates of interest. Additionally, we hold a portfolio of finance receivables that accrue income at

fixed and floating rates of interest.

Equity Price Risk

We hold investments in various common equity securities that are subject to price risk. These securities are

primarily in the form of equity index funds.

Sensitivity Analysis

The following analysis provides quantitative information regarding our exposure to commodity price risk,

foreign currency exchange risk, interest rate risk and equity price risk embedded in our existing financial

instruments. We utilize valuation models to evaluate the sensitivity of the fair value of financial instruments with

exposure to market risk that assume instantaneous, parallel shifts in exchange rates, interest rate yield curves and

57