UPS 2011 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2011 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

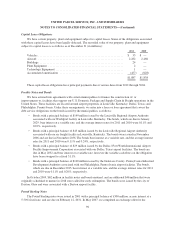

existing notes. Holders of £434 million of the notes accepted the exchange offer, and as a result, these notes were

exchanged for new notes with a principal amount of £455 million, bearing interest at 5.13% and due in February

2050. The new notes are callable at our option at a redemption price equal to the greater of 100% of the principal

amount and accrued interest, or the sum of the present values of the remaining scheduled payout of principal and

interest thereon discounted to the date of redemption at a benchmark U.K. government bond yield plus 15 basis

points and accrued interest. The £66 million of existing notes that were not exchanged continue to bear interest at

5.50% and are due in 2031. We maintain cross-currency interest rate swaps to hedge the foreign currency risk

associated with the bond cash flows. The average fixed interest rate payable on the swaps is 5.72%.

Contractual Commitments

We lease certain aircraft, facilities, land, equipment and vehicles under operating leases, which expire at

various dates through 2038. Certain of the leases contain escalation clauses and renewal or purchase options.

Rent expense related to our operating leases was $629, $615 and $622 million for 2011, 2010, and 2009,

respectively.

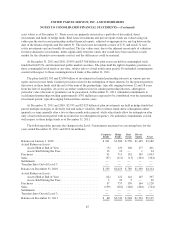

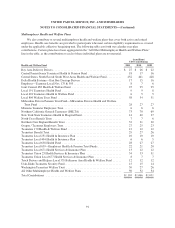

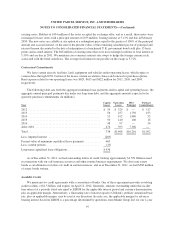

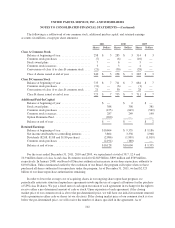

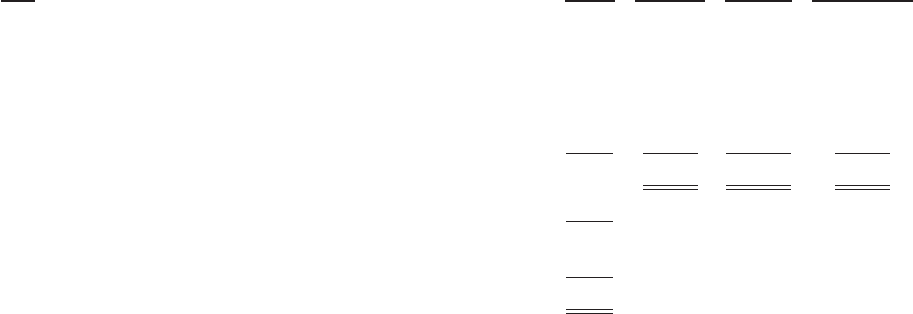

The following table sets forth the aggregate minimum lease payments under capital and operating leases, the

aggregate annual principal payments due under our long-term debt, and the aggregate amounts expected to be

spent for purchase commitments (in millions).

Year

Capital

Leases

Operating

Leases

Debt

Principal

Purchase

Commitments

2012 .................................................. $ 59 $ 329 $ — $ 517

2013 .................................................. 56 257 1,750 453

2014 .................................................. 51 192 1,000 32

2015 .................................................. 50 140 100 16

2016 .................................................. 48 97 — 34

After 2016 ............................................. 474 393 7,366 —

Total .................................................. 738 $1,408 $10,216 $1,052

Less: imputed interest .................................... (269)

Present value of minimum capitalized lease payments ........... 469

Less: current portion ..................................... (33)

Long-term capitalized lease obligations ...................... $436

As of December 31, 2011, we had outstanding letters of credit totaling approximately $1.551 billion issued

in connection with our self-insurance reserves and other routine business requirements. We also issue surety

bonds as an alternative to letters of credit in certain instances, and as of December 31, 2011, we had $583 million

of surety bonds written.

Available Credit

We maintain two credit agreements with a consortium of banks. One of these agreements provides revolving

credit facilities of $1.5 billion, and expires on April 12, 2012. Generally, amounts outstanding under this facility

bear interest at a periodic fixed rate equal to LIBOR for the applicable interest period and currency denomination,

plus an applicable margin. Alternatively, a fluctuating rate of interest equal to Citibank’s publicly announced base

rate, plus an applicable margin, may be used at our discretion. In each case, the applicable margin for advances

bearing interest based on LIBOR is a percentage determined by quotations from Markit Group Ltd. for our 1-year

97