UPS 2011 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2011 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

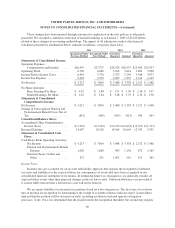

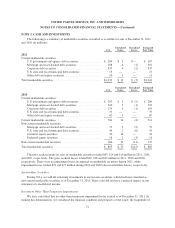

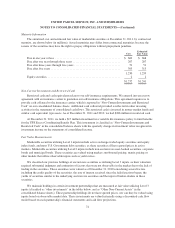

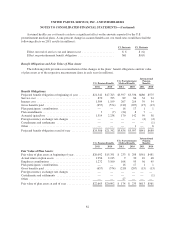

The following table presents the changes in the above Level 3 instruments measured on a recurring basis for

the years ended December 31, 2011 and 2010 (in millions).

Marketable

Securities

Other

Investments Total

Balance on January 1, 2010 ......................................... $216 $301 $ 517

Transfers into (out of) Level 3 ....................................... — — —

Net realized and unrealized gains (losses):

Included in earnings (in investment income) ........................ (27) (34) (61)

Included in accumulated other comprehensive income (pre-tax) ......... 59 — 59

Purchases ....................................................... — — —

Settlements ...................................................... (110) — (110)

Balance on December 31, 2010 ...................................... $138 $267 $ 405

Transfers into (out of) Level 3 ....................................... — — —

Net realized and unrealized gains (losses):

Included in earnings (in investment income) ........................ — (50) (50)

Included in accumulated other comprehensive income (pre-tax) ......... — — —

Purchases ....................................................... — — —

Settlements ...................................................... (138) — (138)

Balance on December 31, 2011 ...................................... $— $217 $ 217

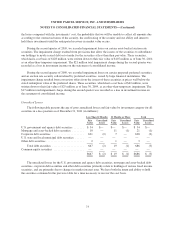

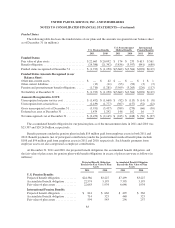

NOTE 3. FINANCE RECEIVABLES

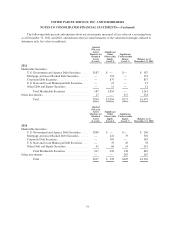

The following is a summary of finance receivables at December 31, 2011 and 2010 (in millions):

2011 2010

Commercial term loans .................................................. $197 $266

Other financing receivables ............................................... 154 245

Gross finance receivables ................................................ 351 511

Less: Allowance for credit losses .......................................... (16) (20)

Balance at December 31 ................................................. $335 $491

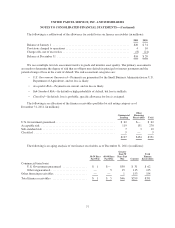

Our finance receivables portfolio consists of two product groups: commercial term loans and other financing

receivables. Other financing receivables consist of investments in finance leases, asset-based lending, cargo

finance and receivable factoring. The current portion of finance receivables is included in “Other current assets”

and the non-current portion of finance receivables is included in “Other non-current assets” on our consolidated

balance sheets. Outstanding receivable balances at December 31, 2011 and 2010 are net of unearned income of

$12 and $15 million, respectively.

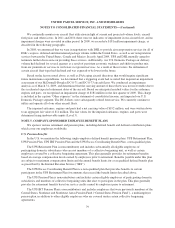

When we “factor” (i.e., purchase) a customer invoice from a client, we record the customer receivable as an

asset and also establish a liability for the funds due to the client, which is recorded in accounts payable on the

consolidated balance sheets. As of December 31, 2011 and 2010, the amounts due to clients under our factoring

programs were $79 and $71 million, respectively.

76