UPS 2011 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2011 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

NOTE 7. BUSINESS ACQUISITIONS, GOODWILL AND INTANGIBLE ASSETS

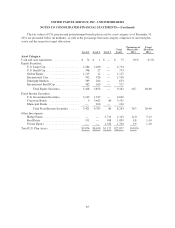

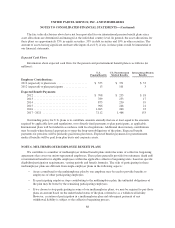

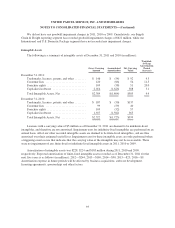

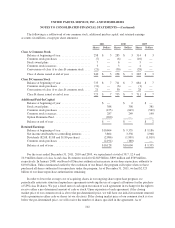

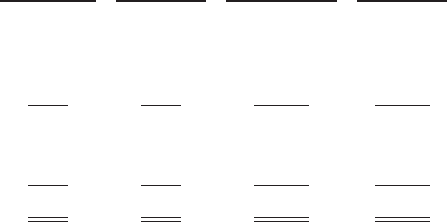

The following table indicates the allocation of goodwill by reportable segment (in millions):

U.S. Domestic

Package

International

Package

Supply Chain &

Freight Consolidated

December 31, 2009 balance ...................... $— $374 $1,715 $2,089

Acquired ................................. — — — —

Purchase Accounting Adjustments ............ — 5 (2) 3

Currency / Other .......................... — (2) (9) (11)

December 31, 2010 balance ...................... $— $377 $1,704 $2,081

Acquired ................................. — — 46 46

Currency / Other .......................... — (16) (10) (26)

December 31, 2011 balance ...................... $— $361 $1,740 $2,101

Business Acquisitions

The increase in goodwill within the Supply Chain & Freight segment in 2011 was due to the December

acquisition of the Pieffe Group (“Pieffe”), an Italian pharmaceutical logistics company. Pieffe offers storage,

distribution and other logistics services to some of the world’s leading pharmaceutical companies. The purchase

price allocation was not complete as of December 31, 2011, and therefore adjustments to the recorded amount of

goodwill may occur in 2012 prior to the one year anniversary of the acquisition. This increase in goodwill was

partially offset by the impact of the strengthening of the U.S. Dollar on the translation of non-U.S. Dollar

goodwill balances.

The increase to goodwill in the International Package segment during 2010 was due to adjustments to the

purchase price allocation for Unsped Paket Servisi San ve Ticaret A.S. (“Unsped”), which was acquired in

August 2009. This increase in goodwill was partially offset by the impact of the strengthening of the U.S. Dollar

on the translation of non-U.S. Dollar goodwill balances.

Pro forma results of operations have not been presented for these acquisitions, because the effects of these

transactions were not material. The results of operations of these acquired companies have been included in our

statements of consolidated income from the date of acquisition.

Goodwill Impairment

We test our goodwill for impairment annually, as of October 1st, on a reporting unit basis. Our reporting

units are comprised of the Europe, Asia, and Americas reporting units in the International Package reporting

segment, and the Forwarding, Logistics, UPS Freight, MBE / The UPS Store, and UPS Capital reporting units in

the Supply Chain & Freight reporting segment.

In assessing our goodwill for impairment, we initially evaluate qualitative factors to determine if it is more

likely than not that the fair value of a reporting unit is less than its carrying amount. If the qualitative assessment

is not conclusive and it is necessary to calculate the fair value of a reporting unit, then we utilize a two-step

process to test goodwill for impairment. First, a comparison of the fair value of the applicable reporting unit with

the aggregate carrying value, including goodwill, is performed. We primarily determine the fair value of our

reporting units using a discounted cash flow model, and supplement this with observable valuation multiples for

comparable companies, as applicable. If the carrying amount of a reporting unit exceeds the reporting unit’s fair

value, we perform the second step of the goodwill impairment test to determine the amount of impairment loss.

The second step includes comparing the implied fair value of the affected reporting unit’s goodwill with the

carrying value of that goodwill.

92