Rogers 2009 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2009 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

102 ROGERS COMMUNICATIONS INC. 2009 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

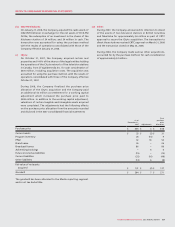

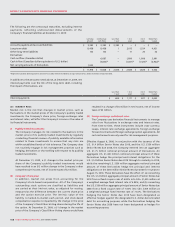

asset group was determined to be impaired and its carrying

value exceeded its fair value. The Company determined the

fair value of the Citytv brand name using the Capitalized

Royalty Method.

The fair values of the broadcast licences and brand name

declined in 2008 primarily as a result of the weakening of

industry expectations in the conventional television business

and declines in advertising revenues.

The Company has made certain assumptions within the

Greenfield income approach and Capitalized Royalty Method

which may differ or change quickly depending on economic

conditions or other events. Therefore, it is possible that

future changes in assumptions may negatively impact future

valuations of intangible assets which would result in further

impairment losses.

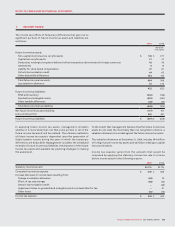

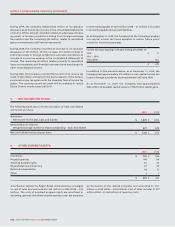

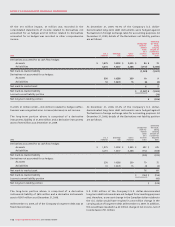

(B) GOODWILL:

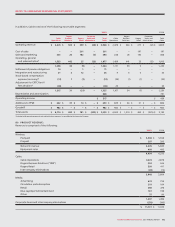

A summary of the changes to goodwill is as follows:

2009 2008

Opening balance $ 3,024 $ 3,027

Acquisition of K-Rock and Kix Country (note 4(a)(i)) 6–

Adjustments to Outdoor Life Network purchase price allocation (note 4(b)(i)) (12) 31

Acquisition of Aurora Cable (note 4(b)(ii)) –56

Acquisition of channel m (note 4(b)(iii)) –48

Other acquisitions and adjustments –9

Adjustments to Citytv purchase price allocation(note 4(b)(v)) –7

Impairment charge on conventional television reporting unit (note 11(a)(i)) –(154)

$ 3,018 $ 3,024

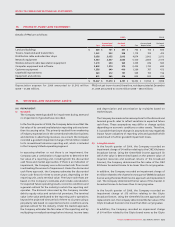

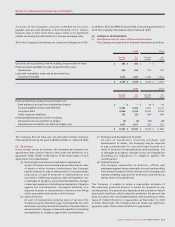

(C) INTANGIBLE ASSETS:

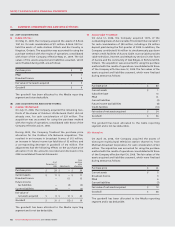

Details of intangible assets are as follows:

2009 2008

Cost

prior to

impairment

losses

Accumulated

amortization

Impairment

losses

(note 11 (a)(ii))

Net book

value

Cost

prior to

impairment

losses

Accumulated

amortization

Impairment

losses

(note 11 (a)(ii))

Net book

value

Indefinite life:

Spectrum licences $ 1,969 $ – $ – $ 1,969 $ 1,929 $ – $ – $ 1,929

Broadcast licences 115 – 5 110 164 –75 89

Definite life:

Brand names 420 188 – 232 437 158 14 265

Subscriber bases 1,001 992 – 9 999 900 –99

Roaming agreements 523 225 –298 523 181 –342

Dealer networks 41 41 – – 41 41 – –

Marketing agreement 52 27 –25 52 15 –37

Wholesale agreement ––––13 13 – –

Advertising bookings ––––6 6 – –

$ 4,121 $ 1,473 $ 5 $ 2,643 $ 4,164 $ 1,314 $ 89 $ 2,761