Rogers 2009 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2009 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

104 ROGERS COMMUNICATIONS INC. 2009 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

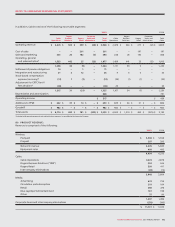

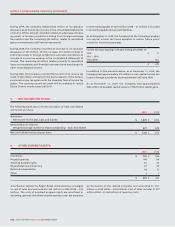

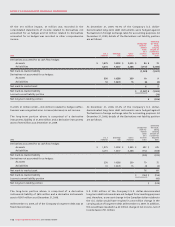

13. OTHER LONG-TERM ASSETS:

2009 2008

Restated –

(note 2(p)(i))

Deferred pension asset (note 17) $ 134 $ 62

Acquired program rights 39 48

Indefeasible right of use agreements 29 31

Long-term receivables 23 25

Deferred installation costs 16 16

Deferred compensation 12 25

Cash surrender value of life insurance 11 10

CRTC commitments 624

Other 10 12

$ 280 $ 253

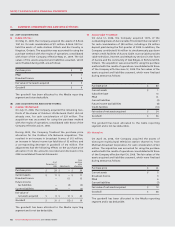

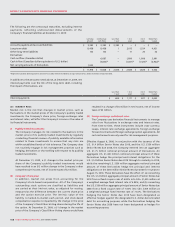

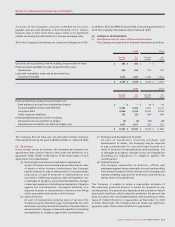

Amortization of certain long-term assets for 2009 amounted to

$6 million (2008 – $24 million). Accumulated amortization as at

December 31, 2009, amounted to $6 million (2008 – $76 million).

During 2009, the Company recorded an impairment charge of

$13 million related to CRTC commitments as the carrying value

of the OMNI asset group was determined to be in excess of fair

value during impairment testing (note 11(a)(ii)). During 2008, the

Company recorded an impairment charge of $51 million related to

CRTC commitments as the carrying value of the Citytv asset group

was determined to be in excess of fair value during impairment

testing (note 11(a)(ii)).

During 2008, the CRTC commitments increased by $24 million, due

to the CRTC grant of two new television licences ($10 million over

seven years) and one new radio station ($1 million over six years),

and the acquisition of channel m ($8 million over seven years),

Outdoor Life Network ($4 million over seven years), and CIKZ-FM

Kitchener ($1 million over seven years). The liability for CRTC

committed expenditures is recorded upon granting of the licence

with a corresponding asset. The liability is reduced as the qualifying

expenditures are made. The amount of these liabilities, included

in accounts payable and accrued liabilities and other long-term

liabilities, is $62 million at December 31, 2009 (2008 – $83 million).