Rogers 2009 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2009 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2009 ANNUAL REPORT 27

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

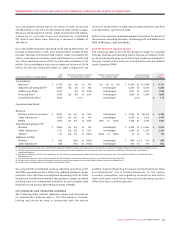

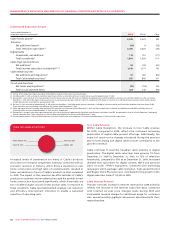

Wireless Operating Highlights for the Year Ended

December 31, 2009

• Networkrevenueincreasedby7%to$6,245millionin2009from

$5,843 million in 2008.

• Strong subscriber grow th continued in 2009, with net

additions of 552,000, of which approximately 95% were postpaid

subscribers.

• Postpaidsubscribermonthlychurnwas1.06%in2009,compared

to 1.10% in 2008.

• Postpaidmonthlyaveragerevenueperuser(“ARPU”)decreased

2.0% from 2008 to $73.93, reflecting the impact of competitive

intensity and declines in roaming and out-of-plan usage revenues

as customers reduce travel and adjust their wireless usage during

the economic recession, which offset the significant growth in

wireless data revenue.

• Revenuesfromwirelessdataservicesgrewapproximately44%

year-over-year to $1,366 million in 2009 from $946 million in

2008, and represented approximately 22% of network revenue

compared to 16% in 2008.

• Wirelessactivatedapproximately1,450,000smartphonedevices

during the year, predominantly iPhone, BlackBerry and Android

devices. Approximately 45% of these activations were for

subscribers new to Wireless and 55% being for existing Wireless

subscribers who upgraded to smartphones and committed

to new term contracts. Subscribers with smartphones now

represent approximately 31% of the overall postpaid subscriber

base, up from 19% from last year, and generate average ARPU

nearly twice that of voice only subscribers.

• Wireless launched the next generation Apple iPhone 3GS in

Canada which offers speeds up to two times faster than the

previous iPhone 3G with download speeds of up to 7.2 Mbps.

Wireless also launched the first two Android operating system

powered smartphones in Canada featuring built-in integration

with many of Google’s leading mobile services including the

Android Market, which features thousands of downloadable

mobile applications.

• WirelessannouncedthecommercialavailabilityofRogers’ next

generation high-speed HSPA+ network to approximately 85% of

Canadians across major Canadian cities, with maximum speeds of

up to 21 Mbps.

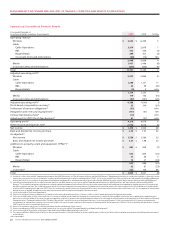

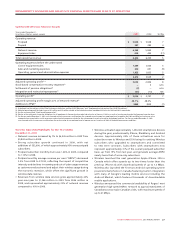

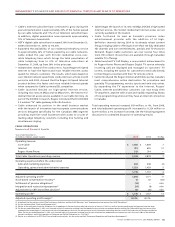

Summarized Wireless Financial Results

Years ended December 31,

(In millions of dollars, except margin) 2009 2008 %Chg

Operating revenue

Postpaid $ 5,948 $ 5,558 7

Prepaid 297 285 4

Network revenue 6,245 5,843 7

Equipment sales 409 492 (17)

Total operating revenue 6,654 6,335 5

Operating expenses before the undernoted

Cost of equipment sales 1,059 1,005 5

Sales and marketing expenses 630 691 (9)

Operating, general and administrative expenses 1,923 1,833 5

3,612 3,529 2

Adjusted operating profit(1)(2) 3,042 2,806 8

Stock-based compensation recovery (expense)(3) – 5 n/m

Settlement of pension obligations(4) (3) – n/m

Integration and restructuring expenses(5) (33) (14) 136

Operating profit(1) $ 3,006 $ 2,797 7

Adjusted operating profit margin as % of network revenue(1) 48.7% 48.0%

Additions to PP&E(1) $865 $929 (7)

(1) As defined. See the sections entitled “Key Performance Indicators and Non-GAAP Measures” and “Supplementary Information: Non-GAAP Calculations”.

(2) Adjusted operating profit includes losses of $13 million and $14 million related to the Inukshuk wireless broadband initiative for 2009 and 2008, respectively.

(3) See the section entitled “Stock-based Compensation”.

(4) Relates to the settlement of pension obligations for all employees in the pension plans who had retired as of January 1, 2009 as a result of annuity purchases by the Company’s pension plans.

(5) For the year ended December 31, 2009, costs incurred relate to severances resulting from the targeted restructuring of our employee base to combine the Cable and Wireless businesses into a

communications organization and to severances and restructuring expenses related to the outsourcing of certain information technology functions. For the year ended December 31, 2008,

costs incurred relate to severances resulting from the restructuring of our employee base to improve our cost structure in light of the declining economic conditions.