Rogers 2009 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2009 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2009 ANNUAL REPORT 33

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

intelligent services infrastructure while using connections between

its co-located equipment and customer premises, provided largely

by other carriers.

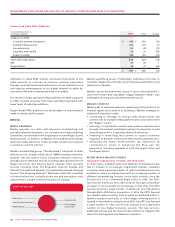

CABLE’S STRATEGY

Cable seeks to maximize subscribers, revenue, operating profit,

and return on invested capital by leveraging its technologically

advanced cable network to meet the information, entertainment

and communications needs of its residential and small business

customers, from basic cable television to advanced two-way cable

services, including digital cable, pay-per-view (“PPV”), video-on-

demand (“VOD”), subscription video-on-demand (“SVOD”), PVR

and HDTV, Internet access, voice-over-cable telephony service, as

well as the continued expansion of its services into the business

telecom and data networking market. The key elements of the

strategy are as follows:

• Clustering of interconnected cable systems in and around

metropolitan areas;

• Offeringawideselectionofproductsandservices;

• Maintainingtechnologicallyadvancedcablenetworks;

• Continuing to focus on increased quality and reliability of

service, and customer satisfaction;

• Tailoring services to the changing demographic of the Cable

customer base, including expansion of products directly serving

several multicultural communities;

• Continuing to enhance and evolve product features, includ-

ing expanding available TV content, including HDTV and VOD

selection, faster tiers of Internet service and new telephony

service offerings;

• Expandingtheavailabilityofhigh-qualitydigital primaryline

voice-over-cable telephony service into most of the markets in its

cable service areas; and

• Further focusing on the business and international carrier market.

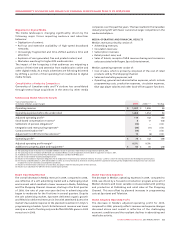

RECENT CABLE INDUSTRY TRENDS

Investment in Improved Cable Television Networks and

Expanded Service Offerings

In recent years, North American cable television companies have

made substantial investments in the installation of fibre-optic cable

and electronics in their respective networks and in the development

of Internet, digital cable and voice-over-cable telephony services.

These investments have enabled cable television companies to

offer expanded packages of digital cable television services,

including VOD and SVOD, pay television packages, PVR, HDTV

programming, multiple increasingly fast tiers of Internet services,

and telephony services.

Increased Competition from Alternative Broadcasting

Distribution Undertakings

As fully described in the section of this MD&A entitled “Competition

in our Businesses”, Canadian cable television systems generally face

legal and illegal competition from several alternative multi-channel

broadcasting distribution systems.

Growth of Internet Protocol-Based Services

The availability of television shows and movies streaming over

the Internet has become a direct competitor to Canadian cable

television systems. Voice-over-Internet Protocol (“VoIP”) local

services are being provided by non-facilities-based providers, such

as Vonage, who market VoIP local services to the subscribers of

ILEC, cable and other companies’ high-speed Internet services.

In the enterprise market, there is a continuing shift to IP-based

services, in particular from asynchronous transfer mode (“ATM”)

and frame relay (two common data networking technologies) to IP

delivered through virtual private networking (“VPN”) services. This

transition results in lower costs for both users and carriers.

Increasing Availability of Online Access to Cable TV Content

Cable and content providers in the U.S. and Canada have begun to

create platforms and portals which allow online access to certain

television content via broadband Internet connections instead

of traditional cable television access. These platforms, including

one launched in late 2009 by Cable called Rogers On Demand

Online, generally provide features which control and limit access

to content which is subscribed to at the user’s residence. The

launch and development of these online content platforms are in

the early stages and are subject to ongoing discussions between

content providers and cable companies with respect to how access

to televised and on-demand content is granted, controlled and

monetized. It is unclear today whether such platforms will be

complimentary or competitive to Cable’s business over time.

Facilities-Based Telephony Services Competitors

Competition has remained intense for a number of years in the

long-distance telephony service markets with the average price

per minute continuing to decline year-over-year. Competition in

the local telephone market also continues to be intense between

Cable, ILECs and various VoIP providers.

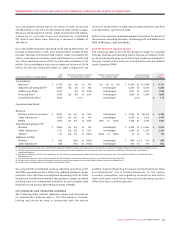

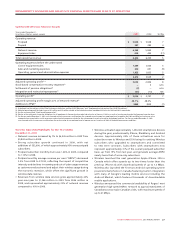

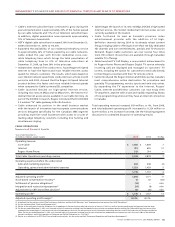

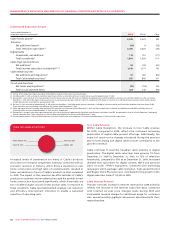

CABLE OPERATING AND FINANCIAL RESULTS

For purposes of this discussion, revenue has been classified

according to the following categories:

• Cable,whichincludesrevenuederivedfrom:

• analog cable service, consisting of basic cable service fees plus

extended basic (or tier) service fees, and access fees for use of

channel capacity by third and related parties; and

• digital cable service revenue, consisting of digital channel ser-

vice fees, including premium and specialty service subscription

fees, PPV service fees, VOD service fees, and revenue earned

on the sale and rental of digital cable set-top terminals;

• Internet, which includes monthly and additional use service

revenues from residential and small business Internet access

service and modem sale and rental fees;

• RogersHomePhone,whichincludesrevenuesfromresidential

and small business local telephony service, calling features such

as voice mail and call-waiting, and long-distance;

• RBS,whichincludeslocalandlong-distancerevenues,enhanced

voice and data services revenue from enterprise and government

customers, as well as the sale of these offerings on a wholesale

basis to other telecommunications carriers; and

• RogersRetail,whichincludescommissionsearnedwhileactingas

an agent to sell other Rogers’ services, such as wireless, Internet,

digital cable and cable telephony, as well as the sale and rental

of DVDs and video games and confectionary sales.

Operating expenses are segregated into the following categories

for assessing business performance:

• Sales and marketing expenses, which include sales and

retention-related advertising and customer communications as

well as other customer acquisition costs, such as sales support

and commissions as well as costs of operating, advertising and

promoting the Rogers Retail chain;