Rogers 2009 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2009 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90 ROGERS COMMUNICATIONS INC. 2009 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

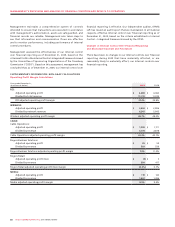

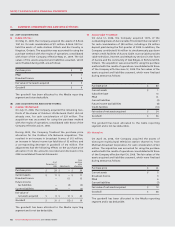

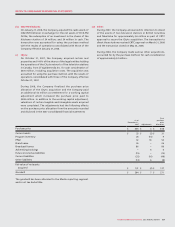

(H) FINANCIAL AND DERIVATIVE INSTRUMENTS:

(i) Adoption of new financial instruments standards:

Effective December 31, 2009, the Company adopted The

Canadian Institute of Chartered Accountants’ (“CICA”)

amended Section 3862, Financial Instruments – Disclosures,

to include additional disclosure requirements about fair

value measurement for financial instruments and liquidity

risk disclosures. These amendments require disclosure of the

three-level hierarchy that reflects the significance of the inputs

used in making the fair value measurements. Fair value of

financial assets and financial liabilities included in Level 1 are

determined by reference to quoted prices in active markets

for identical assets and liabilities. Financial assets and financial

liabilities in Level two include valuations using inputs based on

observable market data, either directly or indirectly other than

the quoted prices. Level three valuations are based on inputs

that are not based on observable market data. The adoption

of these standards did not have any impact on the classification

and measurement of the Company’s financial instruments or

the liquidity risk disclosures. The new disclosures pursuant to

this amended Handbook Section are included in note 15.

On January 1, 2008, the Company adopted CICA Handbook

Section 3862, Financial Instruments – Disclosures (“CICA 3862”),

and CICA Handbook Section 3863, Financial Instruments –

Presentation (“CICA 3863”).

CICA 3862 requires entities to provide disclosures in their

financial statements that enable users to evaluate the

significance of financial instruments on the entity’s financial

position and its performance and the nature and extent of

risks arising from financial instruments to which the entity is

exposed during the year and at the balance sheet date, and

how the entity manages those risks.

CICA 3863 establishes standards for presentation of financial

instruments and non-financial derivatives. It deals with the

classification of financial instruments, from the perspective of

the issuer, between liabilities and equities, the classification of

related interest, dividends, gains and losses, and circumstances

in which financial assets and financial liabilities are offset.

The adoption of these standards did not have any impact on

the classification and measurement of the Company’s financial

instruments. The disclosures pursuant to these Handbook

Sections are included in note 15.

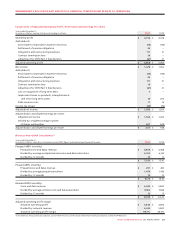

(ii) Financial instruments:

Cash and cash equivalents are classified as held-for-trading.

Held-for-trading financial assets are recorded at fair value on

the consolidated balance sheets with changes in fair value

recorded in the consolidated statements of income.

The Company’s other financial assets are classified as

available-for-sale or loans and receivables. Available-for-sale

investments are carried at fair value on the balance sheet, with

changes in fair value recorded in other comprehensive income,

until such time as the investments are disposed of or an other-

than-temporary impairment has occurred, in which case the

impairment is recorded in income. Loans and receivables and

all financial liabilities are carried at amortized cost using the

effective interest method. The Company determined that none

of its non-derivative financial assets are classified as held-to-

maturity and none of its non-derivative financial liabilities are

classified as held-for-trading.

The Company records all transaction costs for financial assets

and financial liabilities in the consolidated statements of

income as incurred, except for transaction costs paid to a

lending institution relating to the bank credit facility which

are deferred and amortized over the term of the facility.

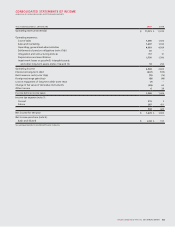

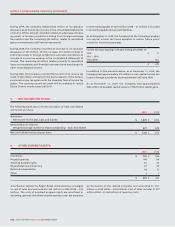

(iii) Derivative instruments:

All derivatives, including embedded derivatives that must

be separately accounted for, are measured at fair value,

with changes in fair value recorded in the consolidated

statements of income unless they are effective cash flow

hedging instruments.

When hedge accounting is applied, the Company formally

documents the relationship between derivative instruments

and the hedged items, as well as its risk management objective

and strategy for undertaking various hedge transactions. At

the instrument’s inception, the Company also formally assesses

whether the derivatives are highly effective at reducing or

modifying interest rate or foreign exchange risk related to

the future anticipated interest and principal cash outflows

associated with the hedged item. Effectiveness requires a high

correlation of changes in fair values or cash flows between the

hedged item and the hedging item. On a quarterly basis, the

Company confirms that the derivative instruments continue

to be highly effective at reducing or modifying interest rate

or foreign exchange risk associated with the hedged items.

Any hedge ineffectiveness is recognized in the consolidated

statements of income immediately.

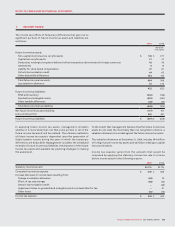

The fair value of the Company’s cross-currency interest rate

exchange agreements (“Derivatives”) is determined using an

estimated credit-adjusted mark-to-market valuation which

involves increasing the treasury-related discount rates used to

calculate the risk-free estimated mark-to-market valuation by

an estimated credit spread (“Credit Spread”) for the relevant

term and counterparty for each Derivative. In the case of

Derivatives in an asset position (i.e., those Derivatives for

which the counterparties owe the Company on a net basis),

the Credit Spread for the counterparty is added to the risk-

free discount rate to determine the estimated credit-adjusted

value. In the case of Derivatives in a liability position (i.e., those

Derivatives for which the Company owes the counterparties on

a net basis), the Company’s Credit Spread is added to the risk-

free discount rate. The changes in fair value of the Derivatives

designated as hedges for accounting purposes are recorded in

other comprehensive income, to the extent effective, until the

variability of cash flows relating to the hedged asset or liability

is recognized in the consolidated statements of income.