Rogers 2009 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2009 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

126 ROGERS COMMUNICATIONS INC. 2009 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

$16 million) to other comprehensive income, net of income taxes

of $16 million (2008 – $6 million) to reflect the current period

increase in the funded status differences.

(G) INCOME TAXES:

Included in the caption “Income taxes” is the tax effect of various

adjustments where appropriate.

United States GAAP requires the valuation allowance to be allocated

on a pro rata basis between current and non-current future tax

assets for the relevant tax jurisdiction. This GAAP difference would

result in a decrease in current future tax assets under United

States GAAP of $4 million and a decrease in non-current future tax

liabilities of the same amount.

(H) INSTALLATION REVENUES AND COSTS, NET:

For Canadian GAAP purposes, cable installation revenues for both

new connects and re-connects are deferred and amortized over the

customer relationship period. For United States GAAP purposes,

installation revenues are immediately recognized in income to

the extent of direct selling costs, with any excess deferred and

amortized over the customer relationship period.

(I) CONSOLIDATED STATEMENTS OF CASH FLOWS:

(i) Canadian GAAP permits the disclosure of a subtotal of the

amount of funds provided by operations before changes in

non-cash operating working capital items in the consolidated

statements of cash flows. United States GAAP does not permit

this subtotal to be included.

(ii) Canadian GAAP permits bank advances to be included in the

determination of cash and cash equivalents in the consolidated

statements of cash flows. United States GAAP requires that

bank advances be reported as financing cash flows. As a result,

under United States GAAP, the total increase in cash and cash

equivalents in 2009 in the amount of $402 million reflected

in the consolidated statements of cash flows would be $383

million and cash used by financing activities would increase by

$19 million. The total increase in cash and cash equivalents in

2008 in the amount of $42 million reflected in the consolidated

statements of cash flows would be nil and cash provided by

financing activities would increase by $42 million.

(J) OTHER DISCLOSURES:

United States GAAP requires the Company to disclose accrued

liabilities, which is not required under Canadian GAAP. Accrued

liabilities included in accounts payable and accrued liabilities as at

December 31, 2009, were $1,843 million (2008 – $1,712 million). At

December 31, 2009, accrued liabilities in respect of PP&E totalled

$108 million (2008 – $130 million), accrued interest payable totalled

$144 million (2008 – $142 million), accrued liabilities related to payroll

totalled $337 million (2008 – $388 million), and CRTC commitments

totalled $10 million (2008 – $64 million).

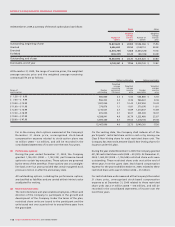

(K) PENSIONS:

The following summarizes the additional disclosures required and

different pension-related amounts recognized or disclosed in the

Company’s accounts under United States GAAP:

2009 2008

Current service cost (employer portion) $ 16 $ 27

Interest cost 41 40

Expected return on plan assets (39) (43)

Settlement of pension obligations 30 –

Amortization:

Transitional asset (6) (10)

Realized gains included in income 22

Net actuarial loss 45

Net periodic pension cost under United States GAAP $ 48 $ 21

Accrued benefit asset under Canadian GAAP $ 134 $ 62

One-time adjustment for change in measurement period (6) (6)

Net periodic pension cost difference 3–

Accumulated other comprehensive loss under United States GAAP, on a pre-tax basis (159) (101)

Net amount recognized in the consolidated balance sheets under United States GAAP $ (28) $ (45)

In addition to the amounts disclosed above, under United States GAAP,

the net amount recognized in the consolidated balance sheets related

to the Company’s supplemental unfunded pension benefits for certain

executives was $32 million (2008 – $27 million). The total accumulated

other comprehensive loss associated with the supplemental plan

amounts to $3 million (2008 – nil), on a pre-tax basis.