Rogers 2009 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2009 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

112 ROGERS COMMUNICATIONS INC. 2009 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

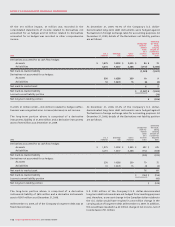

(iii) Fair values:

The Company has determined the fair values of its financial

instruments as follows:

(a) The carrying amounts in the consolidated balance sheets

of cash and cash equivalents, accounts receivable, bank

advances arising from outstanding cheques and accounts

payable and accrued liabilities approximate fair values

because of the short-term nature of these financial

instruments.

(b) The fair values of investments that are publicly traded are

determined by the quoted market values for each of the

investments.

(c) The fair values of each of the Company’s public debt

instruments are based on the year-end trading values.

(d) The fair values of the Company’s Derivatives and

other derivative instruments are based on estimated

mark-to-market value at year-end and credit-adjusted

mark-to-market valuation models.

(e) The fair values of the Company’s other long-term financial

assets and financial liabilities are not significantly different

from their carrying amounts.

Fair value estimates are made at a specific point in time, based on

relevant market information and information about the financial

instruments. These estimates are subjective in nature and involve

uncertainties and matters of significant judgment and, therefore,

cannot be determined with precision. Changes in assumptions

could significantly affect the estimates.

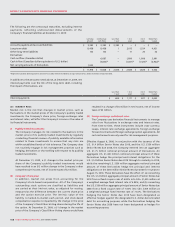

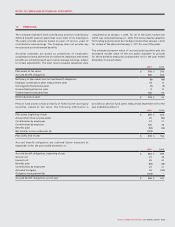

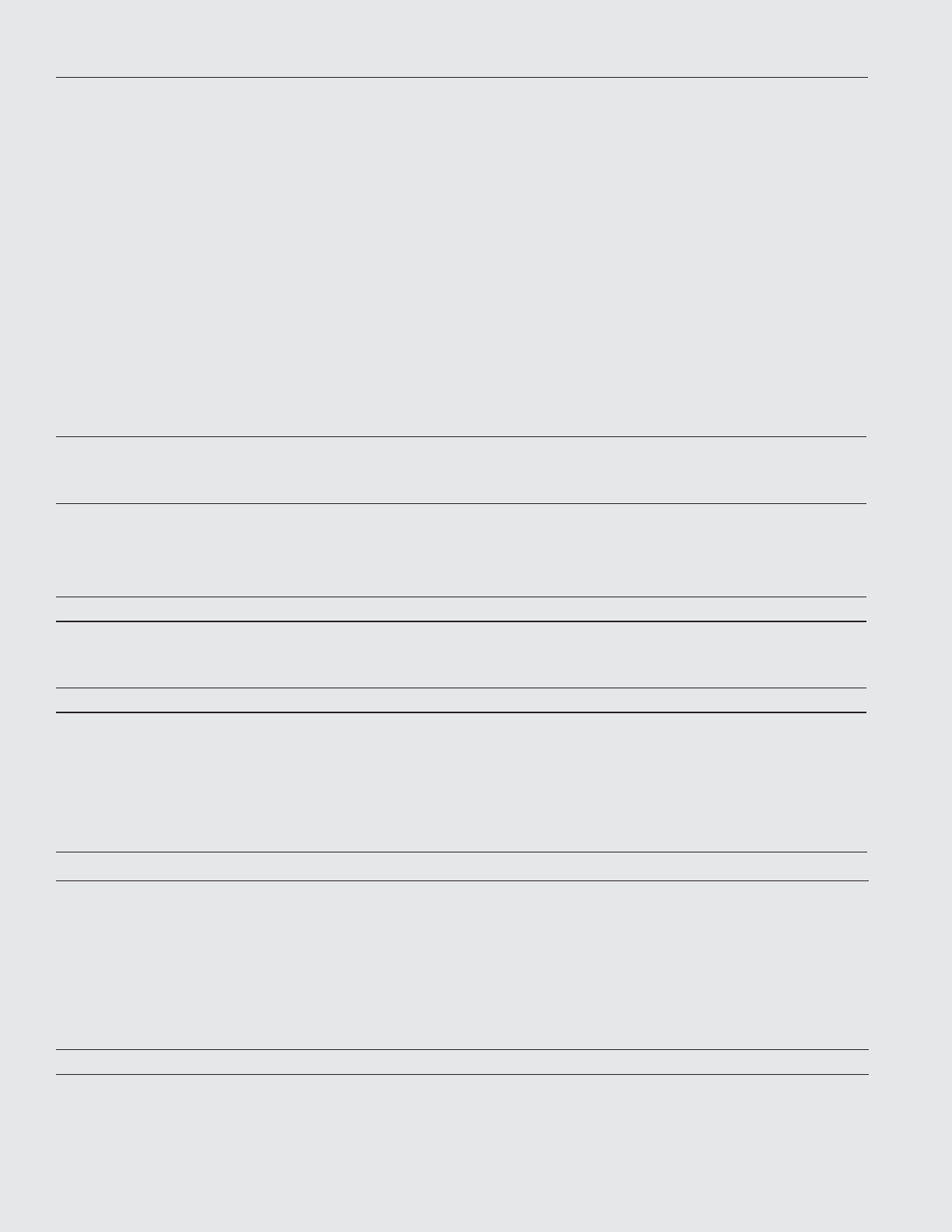

The table below presents the Level in the fair value hierarchy into

which the fair values of financial instruments that are carried at fair

value on the consolidated balance sheets are categorized:

There were no financial instruments categorized in Level 3

(valuation technique using non-observable market inputs) as at

December 31, 2009.

Level 1 Level 2

Quoted

market

price

Valuation

technique

using

observable

market inputs

Financial assets:

Cash and cash equivalents $ 383 $ –

Investments 496 –

Derivatives accounted for as cash flow hedges –73

Derivatives not accounted for as hedges – 9

Total financial assets $ 879 $ 82

Financial liabilities:

Derivatives accounted for as cash flow hedges $ – $ 1,080

Derivatives not accounted for as hedges – 4

Total financial liabilities $ – $ 1,084

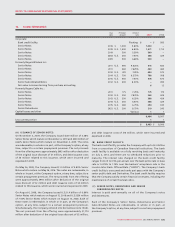

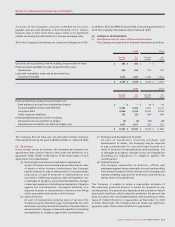

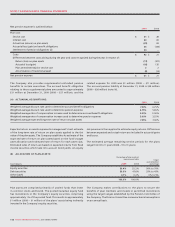

16. OTHER LONG-TERM LIABILITIES:

2009 2008

CRTC commitments (note 13) $ 45 $ 63

Deferred compensation 18 33

Program rights liability 11 29

Supplemental executive retirement plan (note 17) 29 26

Deferred gain on contribution of spectrum licences,

net of accumulated amortization of $10 million (2008 – $6 million) (note 5) 14 18

Restricted share units 12 9

Liabilities related to stock options 22

Other 24

$ 133 $ 184