Rogers 2009 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2009 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2009 ANNUAL REPORT 115

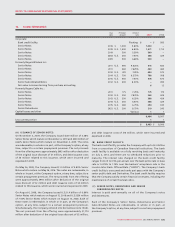

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

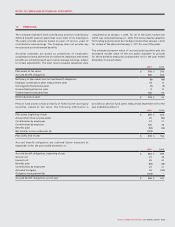

Expected contributions by the Company in 2010 are estimated to be

$56 million.

Employee contributions for 2010 are assumed to be at levels similar

to 2009 on the assumption staffing levels in the Company will

remain the same on a year-over-year basis.

(D) SETTLEMENT OF PENSION OBLIGATIONS:

During 2009, the Company made a lump-sum contribution of $61

million to its pension plans, following which the pension plans

purchased $172 million of annuities from insurance companies for

all employees in the pension plans who had retired as of January

1, 2009. The purchase of the annuities relieves the Company of the

primary responsibility for, and eliminates significant risk associated

with, the accrued benefit obligation for the retired employees. The

non-cash settlement loss arising from this settlement of pension

obligations was $30 million.

In 2008, a curtailment loss of $8 million associated with the

supplemental executive retirement plan was recognized upon the

death of one of the Company’s executives. The Company did not

have any curtailment gains or losses in 2009.

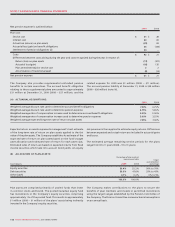

(C) ACTUAL CONTRIBUTIONS TO THE PLANS FOR THE YEARS

ENDED DECEMBER 31, 2009 AND 2008 ARE AS FOLLOWS:

Employer Employee Total

2009 $ 120 $ 21 $ 141

2008 38 21 59

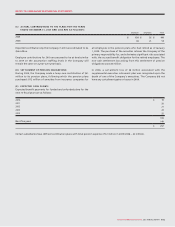

(E) EXPECTED CASH FLOWS:

Expected benefit payments for funded and unfunded plans for the

next 10 fiscal years are as follows:

2010 $ 19

2011 20

2012 21

2013 23

2014 25

108

Next five years 149

$ 257

Certain subsidiaries have defined contribution plans with total pension expense of $2 million in 2009 (2008 – $2 million).