Rogers 2009 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2009 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42 ROGERS COMMUNICATIONS INC. 2009 ANNUAL REPORT

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

20092008

2007

2008

2007

2009

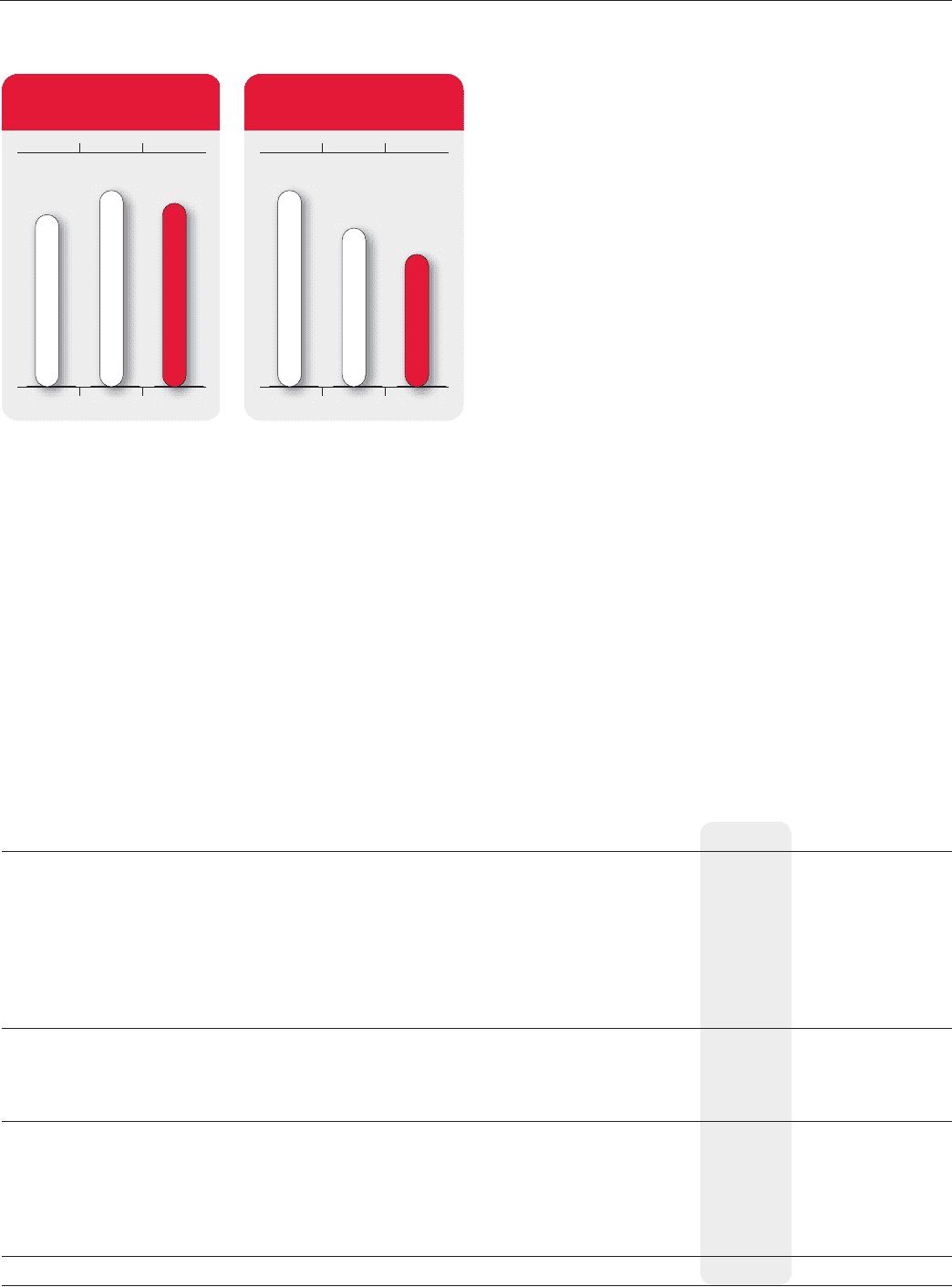

$119$142$176

MEDIA ADJUSTED

OPERATING PROFIT

(In millions of dollars)

20092008

2007

200

8

2007

2009

$1,407$1,496$1,317

MEDIA REVENUE

(In millions of dollars)

The challenging economic conditions have resulted in a weakening

of revenue expectations for certain parts of our broadcasting

portfolio. As a result of the challenging conditions and declines in

advertising revenues, we recorded a non-cash impairment charge

of $18 million related to certain of our broadcast assets. See the

section entitled “Impairment Losses on Goodwill, Intangible Assets

and Other Long-Term Assets” for further details.

Media Additions to PP&E

Media’s PP&E additions in 2009 declined from 2008 due to cost

containment initiatives. A significant portion of Media’s additions

reflect the construction of a new television production facility for

the combined Ontario operations of Citytv and OMNI, which was

completed in 2009.

Other Media Developments

In October 2009, the CRTC amended its regulation relating to Part II

fees. These fees going forward will be approximately one-third less

than the historical rate of approximately $6 million annually. For the

three months ended December 31, 2009, the $19 million adjustment

represents the reversal of Part II fees for the period from September

1, 2006 to August 31, 2009. For the year ended December 31, 2009,

the $15 million adjustment represents the reversal of Part II fees

for the period from September 1, 2006 to December 31, 2008. The

remaining $4 million was related to the period from January 1,

2009 to August 31, 2009, and has been recorded as a credit within

adjusted operating profit.

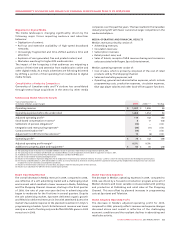

RECONCILIATION OF NET INCOME TO OPERATING

PROFIT AND ADJUSTED OPERATING PROFIT

FOR THE PERIOD

The items listed below represent the consolidated income and

expense amounts that are required to reconcile net income as

defined under Canadian GAAP to the non-GAAP measures operating

profit and adjusted operating profit for the year. See the section

entitled “Supplementary Information: Non-GAAP Calculations”

for a full reconciliation to adjusted operating profit, adjusted

net income and adjusted net income per share. For details

of these amounts on a segment-by-segment basis and for an

understanding of intersegment eliminations on consolidation, the

following section should be read in conjunction with Note 3 to the

2009 Audited Consolidated Financial Statements entitled

“Segmented Information”.

Years ended December 31,

(In millions of dollars) 2009 2008 %Chg

Net income $ 1,478 $ 1,002 48

Income tax expense 502 424 18

Other (income) expense, net (6) (28) (79)

Change in the fair value of derivative instruments 65 (64) n/m

Loss on repayment of long-term debt 7 – n/m

Foreign exchange (gain) loss (136) 99 n/m

Debt issuance costs 11 16 (31)

Interest on long-term debt 647 575 13

Operating income 2,568 2,024 27

Impairment losses on goodwill, intangible assets and

other long-term assets 18 294 (94)

Depreciation and amortization 1,730 1,760 (2)

Operating profit 4,316 4,078 6

Stock-based compensation expense (recovery) (33) (100) (67)

Settlement of pension obligations 30 – n/m

Integration and restructuring expenses 117 51 129

Contract termination fees 19 – n/m

Adjustment for CRTC Part II fees decision (61) 31 n/m

Adjusted operating profit $ 4,388 $ 4,060 8