Rogers 2009 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2009 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2009 ANNUAL REPORT 119

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

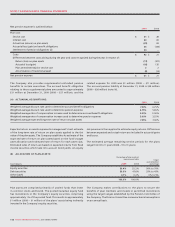

(c) Deferred share units:

The deferred share unit plan enables directors and certain

key executives of the Company to elect to receive certain

types of remuneration in deferred share units, which are

classified as a liability on the consolidated balance sheets

(2009 – $20 million; 2008 – $27 million). During the year ended

December 31, 2009, the Company granted 110,516 deferred

share units (2008 – 186,084). At December 31, 2009, 613,777

(2008 – 730,454) deferred share units were outstanding. Stock-

based compensation recovery for the year ended December

31, 2009 related to these deferred share units was $2 million

(2008 – $3 million). There is no unrecognized compensation

expense related to deferred share units, since these awards

vest immediately when granted.

(d) Employee share accumulation plan:

The employee share accumulation plan allows employees to

voluntarily participate in a share purchase plan. Under the

terms of the plan, employees of the Company can contribute a

specified percentage of their regular earnings through payroll

deductions. The designated administrator of the plan then

purchases, on a monthly basis, Class B Non-Voting shares of

the Company on the open market on behalf of the employee.

At the end of each month, the Company makes a contribution

of 25% to 50% of the employee’s contribution in the month,

which is recorded as compensation expense. The administrator

then uses this amount to purchase additional shares of the

Company on behalf of the employee, as outlined above.

Compensation expense related to the employee share

accumulation plan amounted to $17 million (2008 – $14 million)

for the year ended December 31, 2009.

20. CONSOLIDATED STATEMENTS OF CASH FLOWS AND SUPPLEMENTAL INFORMATION:

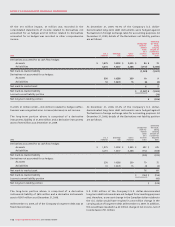

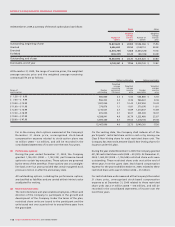

(A) CHANGE IN NON-CASH OPERATING WORKING CAPITAL ITEMS:

2009 2008

Decrease (increase) in accounts receivable $ 93 $ (166)

Decrease (increase) in other assets 76 (176)

Increase in accounts payable and accrued liabilities 50 115

Increase in unearned revenue 45 12

$ 264 $ (215)

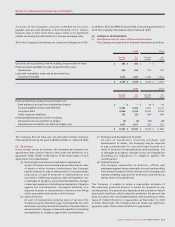

(B) SUPPLEMENTAL CASH FLOW INFORMATION:

2009 2008

Income taxes paid $ 8 $ 1

Interest paid 632 532