Rogers 2009 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2009 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2009 ANNUAL REPORT 81

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

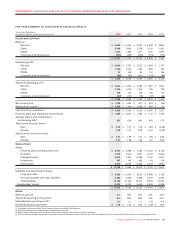

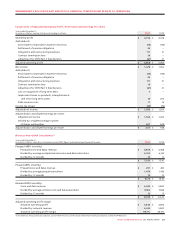

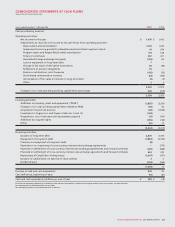

Years ended December 31,

(In millions of dollars, number of shares outstanding in millions) 2009 2008

Operating profit $ 4,316 $ 4,078

Add (deduct):

Stock-based compensation expense (recovery) (33) (100)

Settlement of pension obligations 30 –

Integration and restructuring expenses 117 51

Contract termination fees 19 –

Adjustment for CRTC Part II fees decision (61) 31

Adjusted operating profit $ 4,388 $ 4,060

Net income $ 1,478 $ 1,002

Add (deduct):

Stock-based compensation expense (recovery) (33) (100)

Settlement of pension obligations 30 –

Integration and restructuring expenses 117 51

Contract termination fees 19 –

Adjustment for CRTC Part II fees decision (61) 31

Loss on repayment of long-term debt 7 –

Impairment losses on goodwill, intangible assets

and other long-term assets 18 294

Debt issuance costs 11 16

Income tax impact (30) (34)

Adjusted net income $ 1,556 $ 1,260

Adjusted basic and diluted earnings per share:

Adjusted net income $ 1,556 $ 1,260

Divided by: weighted average number

of shares outstanding 621 638

Adjusted basic and diluted earnings per share $ 2.51 $ 1.98

Calculations of Adjusted Operating Profit, Net Income and Earnings Per Share

(1) For definitions of key performance indicators and non-GAAP measures, see the section entitled “Key Performance Indicators and Non-GAAP Measures”.

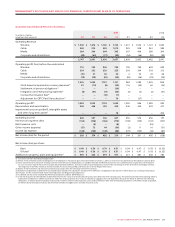

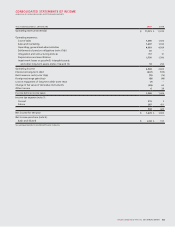

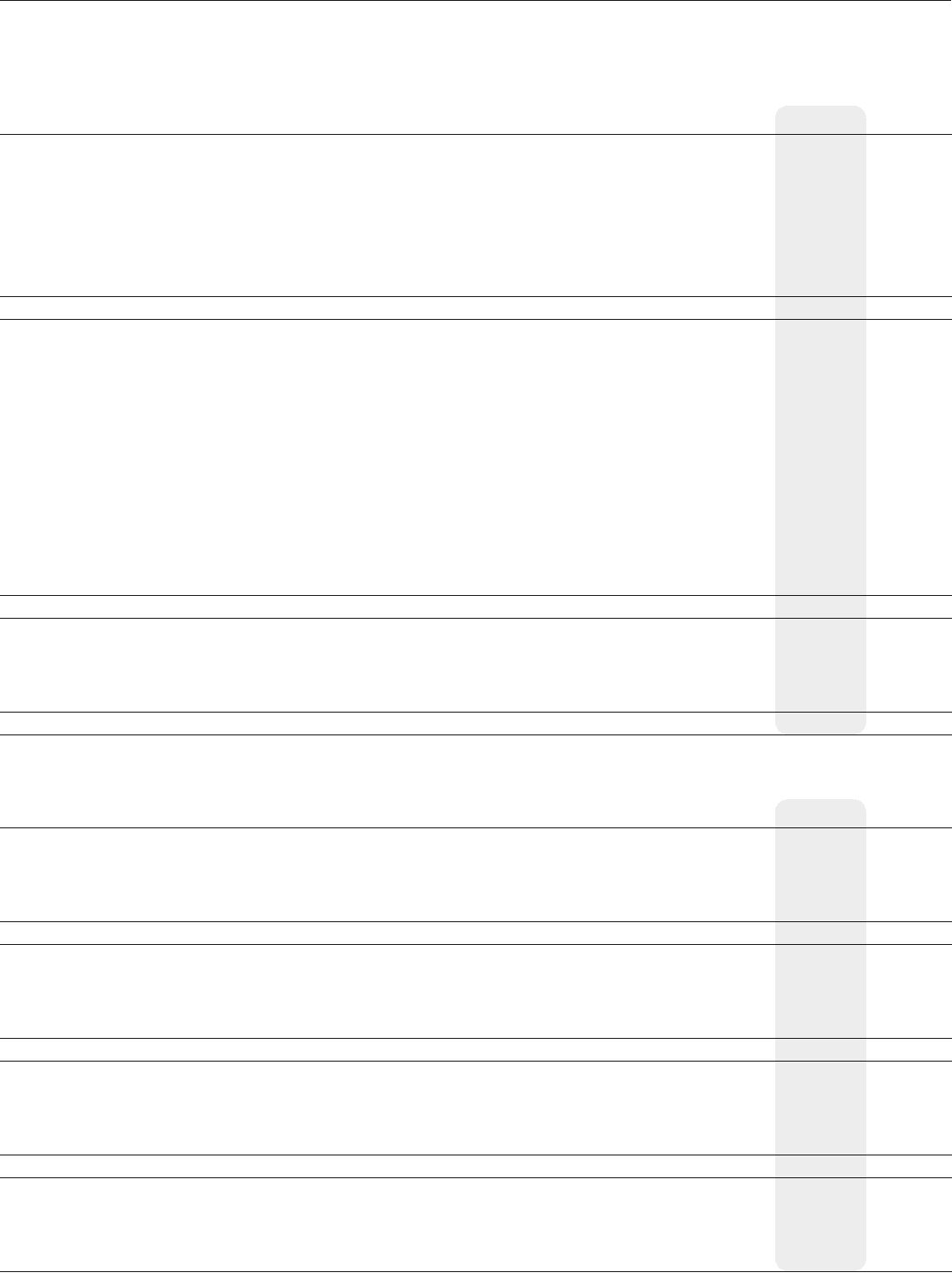

Years ended December 31,

(In millions of dollars, subscribers in thousands, except ARPU figures and adjusted operating profit margin) 2009 2008

Postpaid ARPU (monthly)

Postpaid (voice and data) revenue $ 5,948 $ 5,558

Divided by: average postpaid wireless voice and data subscribers 6,705 6,142

Divided by: 12 months 12 12

$ 73.93 $ 75.41

Prepaid ARPU (monthly)

Prepaid (voice and data) revenue $ 297 $ 285

Divided by: average prepaid subscribers 1,479 1,426

Divided by: 12 months 12 12

$ 16.73 $ 16.65

Blended ARPU (monthly)

Voice and data revenue $ 6,245 $ 5,843

Divided by: average wireless voice and data subscribers 8,184 7,568

Divided by: 12 months 12 12

$ 63.59 $ 64.34

Adjusted operating profit margin

Adjusted operating profit $ 3,042 $ 2,806

Divided by: network revenue 6,245 5,843

Adjusted operating profit margin 48.7% 48.0%

Wireless Non-GAAP Calculations(1)