Rogers 2009 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2009 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

96 ROGERS COMMUNICATIONS INC. 2009 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

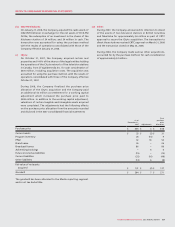

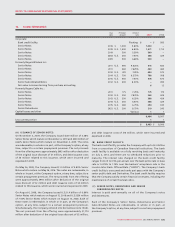

As at

December 31,

2008 Adjustments

Final

purchase

price

allocation

Purchase price $ 39 $ – $ 39

Current assets $ 11 $ – $ 11

Broadcast licence –15 15

Future income

tax liabilities –(3) (3)

Current liabilities (3) –(3)

Fair value of

net assets acquired $ 8 $ 12 $ 20

Goodwill $ 31 $ (12) $ 19

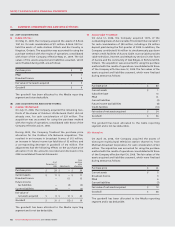

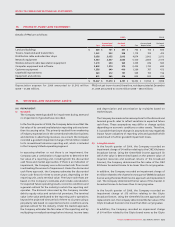

(A) 2009 ACQUISITIONS:

(i) K-Rock 1057 Inc.:

On May 31, 2009, the Company acquired the assets of K-Rock

1057 Inc. for cash consideration of $11 million. K-Rock 1057 Inc.

held the assets of radio stations K-Rock and Kix Country in

Kingston, Ontario. The acquisition was accounted for using the

purchase method with the results of operations consolidated

with those of the Company effective May 31, 2009. The fair

values of the assets acquired and liabilities assumed, which

were finalized during 2009, are as follows:

Purchase price $ 11

PP&E $ 1

Broadcast licence 4

Fair value of net assets acquired $ 5

Goodwill $ 6

The goodwill has been allocated to the Media reporting

segment and is tax deductible.

(B) 2008 ACQUISITIONS AND DIVESTITURES:

(i) Outdoor Life Network:

On July 31, 2008, the Company acquired the remaining two-

thirds of the shares of Outdoor Life Network that it did not

already own, for cash consideration of $39 million. The

acquisition was accounted for using the purchase method

with the results of operations consolidated with those of the

Company effective July 31, 2008.

During 2009, the Company finalized the purchase price

allocation for the Outdoor Life Network acquisition. This

resulted in an increase in broadcast licence of $15 million,

an increase in future income tax liabilities of $3 million, and

a corresponding decrease in goodwill of $12 million. The

adjustments had the following effects on the purchase price

allocation from the amounts recorded and disclosed in the

2008 consolidated financial statements:

The goodwill has been allocated to the Media reporting

segment and is not tax deductible.

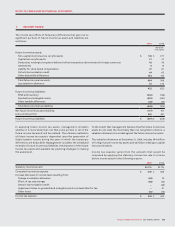

(ii) Aurora Cable TV Limited:

On June 12, 2008, the Company acquired 100% of the

outstanding shares of Aurora Cable TV Limited (“Aurora Cable”)

for cash consideration of $80 million, including a $16 million

deposit paid during the first quarter of 2008. In addition, the

Company contributed $10 million to simultaneously pay down

certain credit facilities of Aurora Cable. Aurora Cable provides

cable television, Internet and telephony services in the Town

of Aurora and the community of Oak Ridges, in Richmond Hill,

Ontario. The acquisition was accounted for using the purchase

method with the results of operations consolidated with those

of the Company effective June 12, 2008. The fair values of the

assets acquired and liabilities assumed, which were finalized

during 2008 are as follows:

Purchase price $ 80

Current assets $ 1

Subscriber base 13

PP&E 31

Current liabilities (3)

Future income tax liabilities (8)

Credit facilities (10)

Fair value of net assets acquired $ 24

Goodwill $ 56

The goodwill has been allocated to the Cable reporting

segment and is not tax deductible.

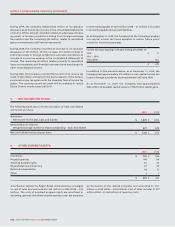

(iii) channel m:

On April 30, 2008, the Company acquired the assets of

Vancouver multicultural television station channel m, from

Multivan Broadcast Corporation, for cash consideration of $61

million. The acquisition was accounted for using the purchase

method with the results of operations consolidated with those

of the Company effective April 30, 2008. The fair values of the

assets acquired and liabilities assumed, which were finalized

during 2008 are as follows:

Purchase price $ 61

Current assets $ 5

Broadcast licence 9

PP&E 6

Current liabilities (7)

Fair value of net assets acquired $ 13

Goodwill $ 48

The goodwill has been allocated to the Media reporting

segment and is tax deductible.

4. BUSINESS COMBINATIONS AND DIVESTITURES: