Rogers 2009 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2009 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2009 ANNUAL REPORT 41

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

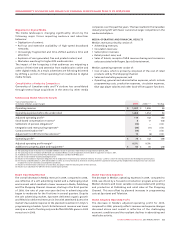

Migration to Digital Media

The media landscape is changing significantly; driven by the

following major forces impacting audience and advertiser

behaviour:

• Digitizationofcontent;

• Roll-out and extensive availability of high-speed broadband

networks;

• Increasingly fragmented and time-shifted audience time and

attention;

• Explosionofuser-generated,freeandpiratedcontent;and

• Marketerssearchingforhigher-ROImediavehicles.

The impact of the foregoing is that audiences are migrating a

portion of their time and attention from traditional to online and

other digital media. As a result, advertisers are following this trend

by shifting a portion of their spending from traditional to digital

media formats.

Consolidation of Industry Competitors

Ownership of Canadian radio and TV stations has consolidated

through several large acquisitions in the sector by other media

companies over the past five years. This has resulted in the Canadian

industry being left with fewer owners but larger competitors in the

media marketplace.

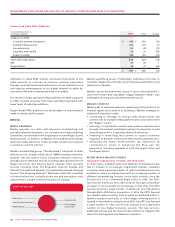

MEDIA OPERATING AND FINANCIAL RESULTS

Media’s revenues primarily consist of:

• Advertisingrevenues;

• Circulationrevenues;

• Subscriptionrevenues;

• Retailproductsales;and

• Salesoftickets,receiptsofMLBrevenuesharingandconcession

sales associated with Rogers Sports Entertainment.

Media’s operating expenses consist of:

• Costofsales,whichisprimarilycomprisedofthecostofretail

products sold by The Shopping Channel;

• Salesandmarketingexpenses;and

• Operating,generalandadministrativeexpenses,whichinclude

programming costs, production expenses, circulation expenses,

Blue Jays player salaries and other back-office support functions.

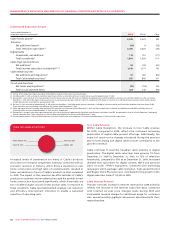

Media Operating Revenue

The overall decrease in Media revenue in 2009, compared to 2008,

was reflective of a soft advertising market and a challenging retail

environment which resulted in lower revenues in Radio, Publishing

and The Shopping Channel. However, starting in the third quarter

of 2009, the rate of year-over-year decline in advertising sales

began to moderate for the first time in several quarters. Despite

the soft advertising market, Sportsnet delivered organic growth

and Television delivered revenues in line with 2008 levels due to the

market’s favourable response to the planned investment in Citytv’s

programming schedule. Sports Entertainment revenue was lower

mainly as a result of hosting only one Buffalo Bills NFL game in 2009

versus two in 2008.

Media Operating Expenses

The decrease in Media’s operating expenses in 2009, compared to

2008, was driven by a focused cost reduction program across all of

Media’s divisions and lower variable costs associated with printing

and production at Publishing and retail sales at The Shopping

Channel. This was offset by planned increases in programming

costs at Sportsnet and Television.

Media Adjusted Operating Profit

The decrease in Media’s adjusted operating profit for 2009,

compared to 2008, primarily reflects revenue and expense changes

discussed above and overall is reflective of the challenging

economic conditions and the resultant declines in advertising and

retail sales activity.

(1) The operating results of channel m are included in Media’s results of operations from the date of acquisition on April 30, 2008.

(2) The operating results of Outdoor Life Network are included in Media’s results of operations from the date of acquisition on July 31, 2008.

(3) As defined. See the section entitled “Key Performance Indicators and Non-GAAP Measures”.

(4) See the section entitled “Stock-based Compensation”.

(5) Relates to the settlement of pension obligations for all employees in the pension plans who had retired as of January 1, 2009 as a result of annuity purchases by the Company’s pension plans.

(6) For the year ended December 31, 2009 and December 31, 2008, costs incurred relate to severances resulting from the targeted restructuring of our employee base to improve our cost structure

in light of the current economic and competitive conditions.

(7) Relates to the termination and release of certain Blue Jays players from the remaining term of their contracts.

(8) Relates to an adjustment for CRTC Part II fees related to prior periods.

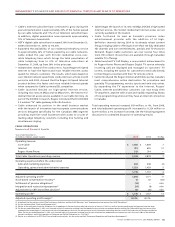

Summarized Media Financial Results

Years ended December 31,

(In millions of dollars, except margin) 2009 2008(1)(2) %Chg

Operating revenue $ 1,407 $ 1,496 (6)

Operating expenses before the undernoted 1,288 1,354 (5)

Adjusted operating profit(3) 119 142 (16)

Stock-based compensation recovery(4) 8 17 (53)

Settlement of pension obligations(5) (15) – n/m

Integration and restructuring expenses(6) (35) (11) n/m

Contract termination fee(7) (19) – n/m

Adjustment for CRTC Part II fees decision(8) 15 (6) n/m

Operating profit(3) $ 73 $ 142 (49)

Adjusted operating profit margin(3) 8.5% 9.5%

Additions to property, plant and equipment(3) $ 62 $ 81 (23)