Rogers 2009 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2009 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

108 ROGERS COMMUNICATIONS INC. 2009 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

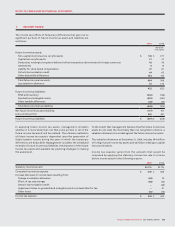

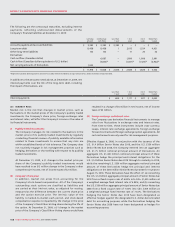

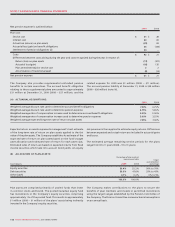

The following are the contractual maturities, excluding interest

payments, reflecting undiscounted disbursements of the

Company’s financial liabilities at December 31, 2009:

Carrying

amount

Contractual

cash flows

Less than

1 year

1 to 3

years

4 to 5

years

More than

5 years

Accounts payable and accrued liabilities $ 2,383 $ 2,383 $ 2,383 $ – $ – $ –

Long-term debt 8,458 8,458 12,012 1,524 4,921

Other long-term liabilities 133 133 –71 20 42

Derivatives:

Cash outflow (Canadian dollar) 6,687 –1,890 1,806 2,991

Cash inflow (Canadian dollar equivalent of U.S. dollar) (5,833)* –(1,387)* (1,524)* (2,922)*

Net carrying amounts of Derivatives 1,002

$ 11,976 $ 11,828 $ 2,384 $ 2,586 $ 1,826 $ 5,032

*Represents Canadian dollar equivalent amount of U.S. dollar inflows matched to an equal amount of U.S. dollar maturities in long-term debt.

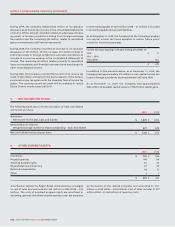

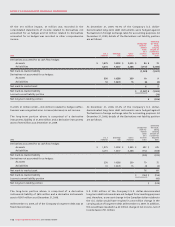

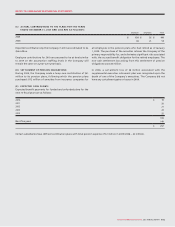

In addition to the amounts noted above, at December 31, 2009, net

interest payments over the life of the long-term debt, including

the impact of Derivatives, are:

Less than

1 year

1 to 3

years

4 to 5

years

More than

5 years

Interest payments $ 680 $ 1,171 $ 827 $ 2,443

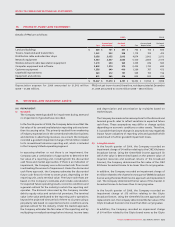

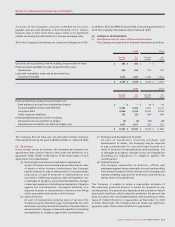

(D) MARKET RISK:

Market risk is the risk that changes in market prices, such as

fluctuations in the market prices of the Company’s publicly traded

investments, the Company’s share price, foreign exchange rates

and interest rates, will affect the Company’s income or the value of

its financial instruments.

(i) Publicly traded investments:

The Company manages its risk related to fluctuations in the

market prices of its publicly traded investments by regularly

conducting financial reviews of publicly available information

related to these investments to ensure that any risks are

within established levels of risk tolerance. The Company does

not routinely engage in risk management practices such as

hedging, derivatives or short selling with respect to its publicly

traded investments.

At December 31, 2009, a $1 change in the market price per

share of the Company’s publicly traded investments would

have resulted in an $13 million change in the Company’s other

comprehensive income, net of income taxes of $2 million.

(ii) Company’s share price:

In addition, market risk arises from accounting for the

Company’s stock-based compensation. All of the Company’s

outstanding stock options are classified as liabilities and

are carried at their intrinsic value, as adjusted for vesting,

measured as the difference between the current share price

and the option exercise price. The intrinsic value of the

liability is marked-to-market each period, and stock-based

compensation expense is impacted by the change in the price

of the Company’s Class B Non-Voting shares during the life of

the option. At December 31, 2009, a $1 change in the market

price of the Company’s Class B Non-Voting shares would have

resulted in a change of $6 million in net income, net of income

taxes of $3 million.

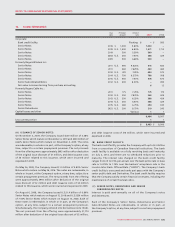

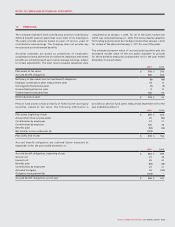

(iii) Foreign exchange and interest rates:

The Company uses derivative financial instruments to manage

risks from fluctuations in exchange rates and interest rates.

From time-to-time, these instruments include cross-currency

swaps, interest rate exchange agreements, foreign exchange

forward contracts and foreign exchange option agreements. All

such instruments are only used for risk management purposes.

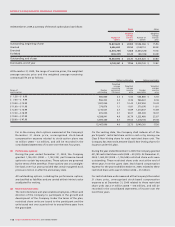

Effective August 6, 2008, in conjunction with the issuance of the

U.S. $1.4 billion Senior Notes due 2018, and the U.S. $350 million

Senior Notes due 2038, the Company entered into an aggregate

U.S. $1.75 billion notional principal amount of Derivatives. An

aggregate U.S. $1,400 million notional principal amount of these

Derivatives hedge the principal and interest obligations for the

U.S. $1.4 billion Senior Notes due 2018 through to maturity in 2018,

while the remaining U.S. $350 million aggregate notional principal

amount of these Derivatives hedge the principal and interest

obligations on the $350 million Senior Notes due 2038 for 10 years to

August 15, 2018. These Derivatives have the effect of: (a) converting

the U.S. $1.4 billion aggregate principal amount of Senior Notes due

2018 from a fixed coupon rate of 6.80% into Cdn. $1,435 million at

a weighted average fixed interest rate of 6.80%; and (b) converting

the U.S. $350 million aggregate principal amount of Senior Notes due

2038 from a fixed coupon rate of 7.50% into Cdn. $359 million at

a weighted average fixed interest rate of 7.53%. The Derivatives

hedging the Senior Notes due 2018 have been designated as

effective hedges against the designated U.S. dollar-denominated

debt for accounting purposes, while the Derivatives hedging the

Senior Notes due 2038 have not been designated as hedges for

accounting purposes.