Rogers 2009 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2009 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2009 ANNUAL REPORT 111

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

A portion of the Company’s accounts receivable and accounts

payable and accrued liabilities is denominated in U.S. dollars;

however, due to their short-term nature, there is no significant

market risk arising from fluctuations in foreign exchange rates.

All of the Company’s Derivatives are unsecured obligations of RCI.

In addition, RCCI and RWP have provided unsecured guarantees for

all of the Company’s Derivatives (notes 14(d) and 15(b)).

(E) FINANCIAL INSTRUMENTS:

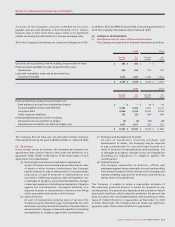

(i) Classification and fair values of financial instruments:

The Company has classified its financial instruments as follows:

The Company did not have any non-derivative held-to-maturity

financial assets during the years ended December 31, 2009 and 2008.

(ii) Guarantees:

In the normal course of business, the Company has entered into

agreements that contain features that meet the definition of a

guarantee under GAAP. A description of the major types of such

agreements is provided below:

(a) Business sale and business combination agreements:

As part of transactions involving business dispositions, sales

of assets or other business combinations, the Company

may be required to pay counterparties for costs and losses

incurred as a result of breaches of representations and

warranties, intellectual property right infringement, loss

or damages to property, environmental liabilities, changes

in laws and regulations (including tax legislation), litigation

against the counterparties, contingent liabilities of a

disposed business or reassessments of previous tax filings

of the corporation that carries on the business.

(b) Sales of services:

As part of transactions involving sales of services, the

Company may be required to pay counterparties for costs

and losses incurred as a result of breaches of representations

and warranties, changes in laws and regulations (including

tax legislation) or litigation against the counterparties.

(c) Purchases and development of assets:

As part of transactions involving purchases and

development of assets, the Company may be required

to pay counterparties for costs and losses incurred as a

result of breaches of representations and warranties, loss

or damages to property, changes in laws and regulations

(including tax legislation) or litigation against the

counterparties.

(d) Indemnifications:

The Company indemnifies its directors, officers and

employees against claims reasonably incurred and resulting

from the performance of their services to the Company, and

maintains liability insurance for its directors and officers as

well as those of its subsidiaries.

The Company is unable to make a reasonable estimate of

the maximum potential amount it would be required to pay

counterparties. The amount also depends on the outcome of future

events and conditions, which cannot be predicted. No amount has

been accrued in the consolidated balance sheets relating to these

types of indemnifications or guarantees at December 31, 2009

or 2008. Historically, the Company has not made any significant

payments under these indemnifications or guarantees.

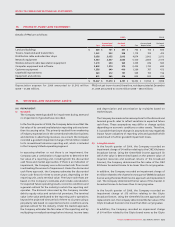

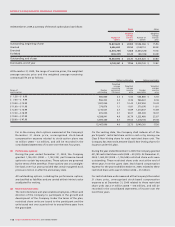

2009 2008

Carrying

amount

Fair

value

Carrying

amount

Fair

value

Cash and cash equivalents, held-for-trading, measured at fair value $ 383 $ 383 $ – $ –

Financial assets, available-for-sale, measured at fair value:

Investments 496 496 319 319

Loans and receivables, measured at amortized cost:

Accounts receivable 1,310 1,310 1,403 1,403

$ 2,189 $ 2,189 $ 1,722 $ 1,722

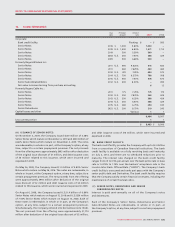

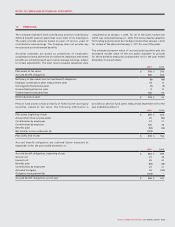

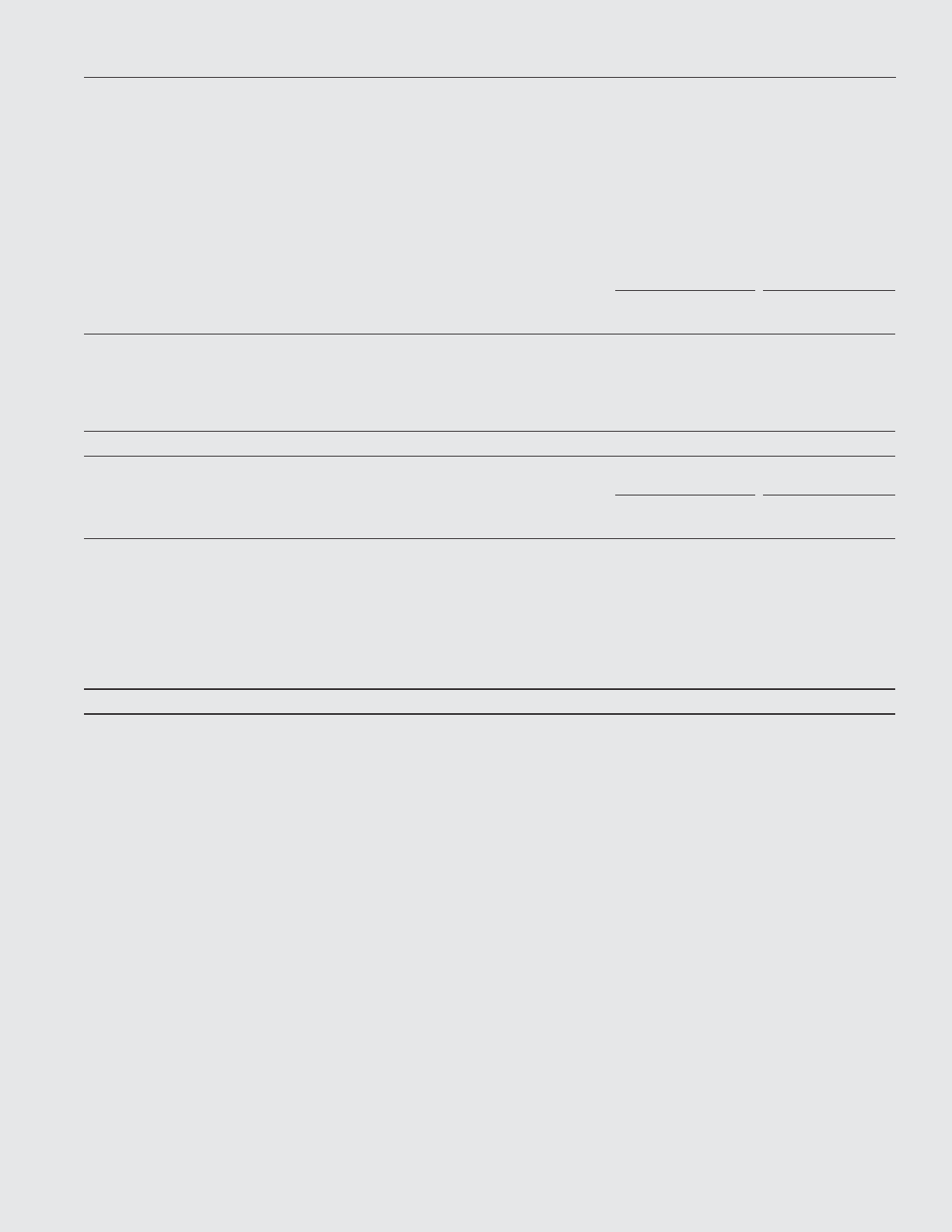

2009 2008

Carrying

amount

Fair

value

Carrying

amount

Fair

value

Financial liabilities, measured at amortized cost:

Bank advances, arising from outstanding cheques $ – $ – $ 19 $ 19

Accounts payable and accrued liabilities 2,383 2,383 2,412 2,412

Long-term debt 8,464 9,315 8,507 8,700

Other long-term liabilities 133 133 184 184

Financial liabilities (assets), held-for-trading:

Derivatives not accounted for as hedges (5) (5) (69) (69)

Derivatives accounted for as cash flow hedges, net 1,007 1,007 223 223

$ 11,982 $ 12,833 $ 11,276 $ 11,469