Rogers 2009 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2009 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78 ROGERS COMMUNICATIONS INC. 2009 ANNUAL REPORT

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

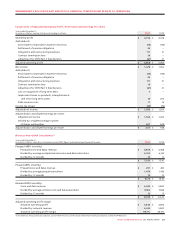

SUMMARY FINANCIAL RESULTS OF LONG-TERM

DEBT GUARANTORS

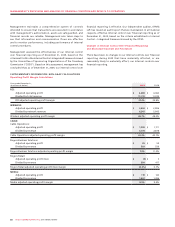

The Company’s outstanding public debt, $2.4 billion bank credit

facility and Derivatives are unsecured obligations of RCI. RCI’s

public debt originally issued by Rogers Cable Inc. has Rogers

Cable Communications Inc. (“RCCI”), a wholly owned subsidiary,

as a co-obligor and Rogers Wireless Partnership (“RWP”), a wholly

owned subsidiary, as an unsecured guarantor while RCI’s public debt

originally issued by Rogers Wireless Inc. has RWP as a co-obligor

and RCCI as an unsecured guarantor. Similarly, RCCI and RWP have

provided unsecured guarantees for the public debt issued by RCI,

the bank credit facility and the Derivatives. Accordingly, RCI’s

bank debt, senior public debt and Derivatives rank pari passu on

an unsecured basis. Prior to its redemption in December 2009, the

Company’s US$400 million 8.00% Senior Subordinated Notes were

subordinated to its senior debt.

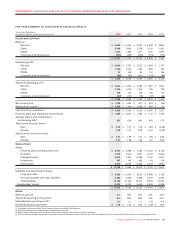

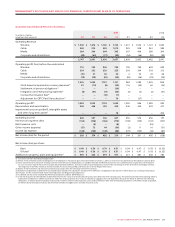

The following table sets forth the selected unaudited consolidating

summar y financial information for RCI for the periods

identified below, presented with a separate column for: (i) RCI;

(ii) RWP and RCCI (the “Guarantors”), on a combined basis;

(iii) our non-guarantor subsidiaries (“Other Subsidiaries”) on a

combined basis; (iv) consolidating adjustments; and (v) the total

consolidated amounts.

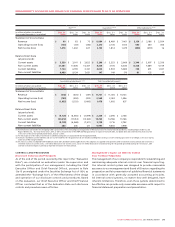

(1) This quarterly summary has been adjusted to exclude stock-based compensation (recovery) expense, integration and restructuring expenses, contract termination fees, an adjustment to CRTC Part II

fees related to prior periods, pension settlement, debt issuance costs, loss on repayment of long-term debt, impairment losses on goodwill, intangible assets and other long-term assets, and the

income tax impact related to the above items. Certain prior year numbers have been reclassified to conform to the current year presentation. See the section entitled “Key Performance Indicators

and Non-GAAP Measures”.

(2) As defined. See the section entitled “Key Performance Indicators and Non-GAAP Measures”.

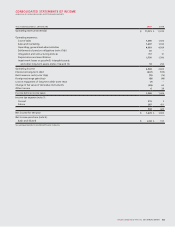

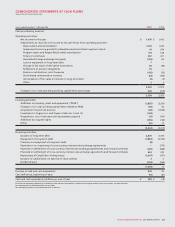

2009 2008

(in millions of dollars,

except per share amounts) Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

Operating Revenue

Wireless $ 1,544 $ 1,616 $ 1,760 $ 1,734 $ 1,431 $ 1,522 $ 1,727 $ 1,655

Cable 968 972 989 1,019 925 938 961 985

Media 284 366 364 393 307 409 386 394

Corporate and eliminations (49) (63) (77) (89) (54) (66) (92) (93)

2,747 2,891 3,036 3,057 2,609 2,803 2,982 2,941

Adjusted operating profit (loss)(2)

Wireless 710 742 846 744 705 769 693 639

Cable 324 332 329 325 303 304 318 313

Media (10) 37 36 52 2 52 43 46

Corporate and eliminations (19) (28) (30) (20) (26) (36) (29) (30)

1,005 1,083 1,181 1,101 984 1,089 1,025 968

Depreciation and amortization 444 446 416 424 440 420 429 471

Adjusted operating income 561 637 765 677 544 669 596 497

Interest on long-term debt (152) (156) (166) (173) (138) (133) (147) (157)

Other income (expense) (17) 73 44 (23) (3) 11 16 (31)

Income tax expense (136) (142) (138) (111) (133) (183) – (145)

Adjusted net income for the period $ 256 $ 412 $ 505 $ 370 $ 270 $ 364 $ 465 $ 164

Adjusted net income per share:

Basic $ 0.40 $ 0.65 $ 0.82 $ 0.61 $ 0.42 $ 0.57 $ 0.73 $ 0.26

Diluted $ 0.40 $ 0.65 $ 0.82 $ 0.61 $0.42 $ 0.57 $ 0.73 $ 0.26

Additions to property, plant and equipment(2) $ 359 $ 434 $ 491 $ 571 $321 $ 481 $ 436 $ 783

Adjusted Quarterly Consolidated Financial Summary(1)