Rogers 2009 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2009 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46 ROGERS COMMUNICATIONS INC. 2009 ANNUAL REPORT

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Financing

Our long-term debt instruments are described in Note 14 and Note

15 to the 2009 Audited Consolidated Financial Statements. During

2009, the following financing activities took place.

On May 26, 2009, we issued $1.0 billion principal amount of public

debt securities, comprised of 5.80% Senior Notes due 2016 (the

“2016 Notes”). The 2016 Notes were issued at a discount of 99.767%

for an effective yield of 5.841% per year. RCI received aggregate

net proceeds of $993 million from the issuance of the 2016 Notes

after deducting the issue discount, underwriting commission and

other related expenses. The 2016 Notes are unsecured and are

guaranteed on an unsecured basis by each of Rogers Wireless

Partnership and Rogers Cable Communications Inc. and rank pari

passu with all of RCI’s other senior unsecured and unsubordinated

notes and debentures and bank credit facility.

On November 4, 2009, we issued $1.0 billion aggregate principal

amount of public debt securities, comprised of $500 million of

5.38% Senior Notes due 2019 (the “2019 Notes”) and $500 million

of 6.68% Senior Notes due 2039 (the “2039 Notes”). The 2019 Notes

were issued at a discount of 99.931% for an effective yield of 5.389%

per year and the 2039 Notes were issued at a discount of 99.897%

for an effective yield of 6.688% per year. RCI received aggregate

net proceeds of $993 million from the issuance of the 2019 Notes

and the 2039 Notes after deducting the respective issue discounts,

underwriting commissions and other related expenses. The 2019

Notes and the 2039 Notes are unsecured and are guaranteed on an

unsecured basis by each of Rogers Wireless Partnership and Rogers

Cable Communications Inc. and rank pari passu with all of RCI’s

other senior unsecured and unsubordinated notes and debentures

and bank credit facility.

On December 15, 2009, we redeemed the entire outstanding

principal amount of our US$400 million (Cdn$424 million) 8.00%

Senior Subordinated Notes due 2012 at the prescribed redemption

price of 102% of the principal amount, or US$408 million (Cdn$432

million). As a result, we incurred a net loss on repayment of long

term debt of $7 million, which is expensed in the consolidated

statement of income, comprised of the $8 million cash payment for

the 2% redemption premium, partially offset by a corresponding

$1 million non-cash write-down of the related fair value increment

arising from purchase accounting.

In addition, during 2009, an aggregate $585 million net repayment

was made under our bank credit facility. As of December 31,

2009, there were no advances outstanding under our $2.4 billion

bank credit facility that matures in July 2013 and the full amount

is available to be drawn, excluding letters of credit of $47 million.

This liquidity position is also enhanced by the fact that our earliest

scheduled debt maturity is in May 2011.

Shelf Prospectuses

In order to maintain financial flexibility, in November 2007, we

filed shelf prospectuses with securities regulators to qualify debt

securities of RCI for sale in Canada and/or in the U.S. These shelf

prospectuses were scheduled to expire in December 2009. To replace

these expiring shelf prospectuses, in November 2009, we filed two

new shelf prospectuses with securities regulators to qualify debt

securities of RCI, one for the sale of up to Cdn$4 billion of debt

securities in Canada and the other for the sale of up to US$4 billion

in the United States and Ontario. These new shelf prospectuses

expire in December 2011. The notice set forth in this paragraph

does not constitute an offer of any securities for sale.

Normal Course Issuer Bid

In February 2009, we filed a NCIB authorizing us to repurchase up

to the lesser of 15 million of RCI’s Class B Non-Voting shares and

that number of Class B Non-Voting shares that can be purchased

under the NCIB for an aggregate purchase price of $300 million.

This NCIB, which expires on February 19, 2010, replaced a previously

filed NCIB which expired in January 2009.

In May 2009, we amended the NCIB to provide that we may, during

the twelve-month period commencing February 20, 2009 and

ending February 19, 2010, purchase on the TSX up to the lesser of

48 million of RCI’s Class B Non-Voting shares and that number of

Class B Non-Voting shares that can be purchased under the NCIB

for an aggregate purchase price of $1.5 billion.

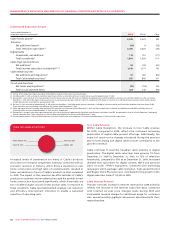

2009 USES OF CASH

(In millions of dollars)

2009

Acquisition of spectrum licenses: $40

Additions to program rights: $185

Acquisitions and other net investments: $198

Payments under bank credit facility: $585

Dividends: $704

Repurchase of shares: $1,347

$5,393

Additions to PP&E: $1,910

Redemption of subordinated note: $424

20092008

2007

2008

2007

2009

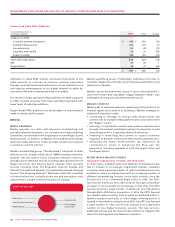

2.1x2.1x2.1x

RATIO OF DEBT TO

ADJUSTED OPERATING PROFIT

20092008

2007

200

8

2007

2009

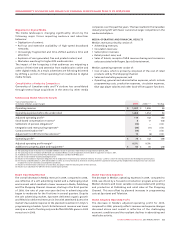

$1,886$1,464$1,328

ADJUSTED OPERATING PROFIT

LESS CAPEX AND INTEREST (FCF)

(In millions of dollars)