Rogers 2009 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2009 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80 ROGERS COMMUNICATIONS INC. 2009 ANNUAL REPORT

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

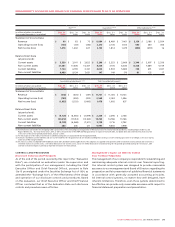

Management maintains a comprehensive system of controls

intended to ensure that transactions are executed in accordance

with management’s authorization, assets are safeguarded, and

financial records are reliable. Management also takes steps to

see that information and communication flows are effective

and to monitor performance, including performance of internal

control procedures.

Management assessed the effectiveness of our internal control

over financial reporting as of December 31, 2009, based on the

criteria set forth in the Internal Control-Integrated Framework issued

by the Committee of Sponsoring Organizations of the Treadway

Commission (“COSO”). Based on this assessment, management has

concluded that, as of December 31, 2009, our internal control over

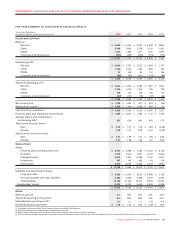

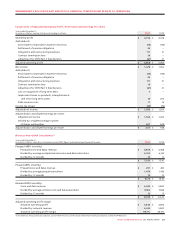

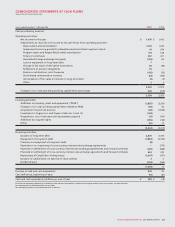

Years ended December 31,

(In millions of dollars) 2009 2008

RCI:

Adjusted operating profit $ 4,388 $ 4,060

Divided by total revenue 11,731 11,335

RCI adjusted operating profit margin 37.4% 35.8%

WIRELESS:

Adjusted operating profit $ 3,042 $ 2,806

Divided by network revenue 6,245 5,843

Wireless adjusted operating profit margin 48.7% 48.0%

CABLE:

Cable Operations:

Adjusted operating profit $ 1,298 $ 1,171

Divided by revenue 3,074 2,878

Cable Operations adjusted operating profit margin 42.2% 40.7%

Rogers Business Solutions:

Adjusted operating profit $ 35 $ 59

Divided by revenue 503 526

Rogers Business Solutions adjusted operating profit margin 7.0% 11.2%

Rogers Retail:

Adjusted operating profit (loss) $ (9) $ 3

Divided by revenue 399 417

Rogers Retail adjusted operating profit (loss) margin (2.3%) 0.7%

MEDIA:

Adjusted operating profit $ 119 $ 142

Divided by revenue 1,407 1,496

Media adjusted operating profit margin 8.5% 9.5%

SUPPLEMENTARY INFORMATION: NON-GAAP CALCULATIONS

Operating Profit Margin Calculations

financial reporting is effective. Our independent auditor, KPMG

LLP, has issued an audit report that we maintained, in all material

respects, effective internal control over financial reporting as of

December 31, 2009, based on the criteria established in Internal

Control – Integrated Framework issued by the COSO.

Changes in Internal Control Over Financial Reporting

and Disclosure Controls and Procedures

There have been no changes in our internal controls over financial

reporting during 2009 that have materially affected, or are

reasonably likely to materially affect, our internal controls over

financial reporting.