Rogers 2009 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2009 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2009 ANNUAL REPORT 123

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

The consolidated financial statements of the Company have been

prepared in accordance with GAAP as applied in Canada. In the

following respects, GAAP, as applied in the United States, differs

from that applied in Canada.

If United States GAAP were employed, net income for the years

ended December 31, 2009 and 2008 would be adjusted as follows:

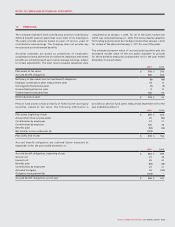

25. CANADIAN AND UNITED STATES ACCOUNTING POLICY DIFFERENCES:

2009 2008

Net income for the year based on Canadian GAAP $ 1,478 $ 1,002

Gain on sale of cable systems (b) (4) (4)

Capitalized interest, net of related depreciation (c) 611

Financial instruments (d) 145 (76)

Stock-based compensation (e) 13 (32)

Net periodic pension cost (f) 3–

Income taxes (g) (28) 90

Installation revenues and costs, net (h) 410

Other –(1)

Net income for the year based on United States GAAP $ 1,617 $ 1,000

Net income per share based on United States GAAP:

Basic $ 2.60 $ 1.57

Diluted 2.60 1.57

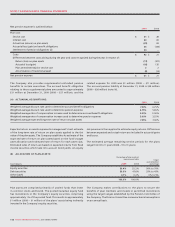

If United States GAAP were employed, comprehensive income for

the years ended December 31, 2009 and December 31, 2008 would

be adjusted as follows:

2009 2008

Comprehensive income for the year based on Canadian GAAP $ 1,616 $ 857

Impact of United States GAAP differences on net income 139 (2)

Reclassification to net income of change in fair value of derivative instruments not accounted for

as hedges under United States GAAP, net of income taxes of $26 (2008 – $88) (d) (113) 5

Change in funded status of pension plans for unrecognized amounts, net of income taxes of $16 (2008 – $6) (f) (45) 16

Comprehensive income for the year based on United States GAAP $ 1,597 $ 876

The cumulative effect of these adjustments on the consolidated

shareholders’ equity of the Company is as follows:

2009 2008

Shareholders' equity based on Canadian GAAP $ 4,273 $ 4,716

Cumulative impact of differences in business combinations and consolidation accounting (a) (8) (8)

Gain on sale of cable systems (b) 101 105

Capitalized interest (c) 85 79

Financial instruments (d) 49 43

Stock-based compensation (e) 13 8

Pension liability (f), (k) (165) (107)

Income taxes (g) (14) (25)

Installation revenues and costs, net (h) 16 12

Other (7) (7)

Shareholders' equity based on United States GAAP $ 4,343 $ 4,816