Rogers 2009 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2009 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40 ROGERS COMMUNICATIONS INC. 2009 ANNUAL REPORT

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Media’s publishing group (“Publishing”) publishes more than 70

consumer magazines and trade and professional publications and

directories in Canada.

Media’s sports entertainment group (“Sports Entertainment”)

owns the Toronto Blue Jays Major League Baseball (“MLB”) club

and Rogers Centre sports and entertainment venue.

MEDIA’S STRATEGY

Media seeks to maximize revenues, operating profit and return on

invested capital across each of its businesses. Media’s strategies to

achieve this objective include:

• Continuing to leverage its strong media brand names and

content over its multiple media platforms and in association with

the “Rogers” brand;

• Focusing on specialized content and audience development

through its broadcast, publication and sports properties, as well

its growing portfolio of specialty channel investments;

• Investing in technology and content to support audience

migration to the web, wireless and other mobile platforms; and

• Enhancing the Sports Entertainment fan experience by

continuing to invest in enhancing the Blue Jays fan

experience, including upgrades to both the player roster and

the Rogers Centre.

RECENT MEDIA INDUSTRY TRENDS

Increased Fragmentation of Radio and TV Markets

In recent years, Canadian radio and television broadcasters have

had to operate in increasingly fragmented markets. Canadian

consumers have a growing number of radio and television services

available to them, providing them with an increasing number of

different programming formats. In the radio industry, since the

introduction of its Commercial Radio Policy in 1998, the CRTC

has licenced numerous new radio stations through competitive

processes in most markets across Canada. In that time, the CRTC

has also licenced a large number of additional new FM stations

through AM to FM station conversions. In 2005, the CRTC licenced

two satellite radio providers, both of which are affiliated with U.S.

satellite operators and both of which began offering service in

Canada. In the television industry since 2000, the CRTC has licenced

a small number of new, over-the-air stations and a significant

number of new digital television services. The new services,

additional licences and the new formats combine to fragment the

market for existing radio and television operators.

Additions to Cable PP&E include continued investments in the

cable network to continue to enhance customer experience

through increased speed and performance of our Internet service

and capacity enhancements to our digital network to allow for

incremental HD and on-demand services to be added.

The decline in Cable Operations PP&E additions for 2009, compared

to 2008, resulted primarily from lower spending associated with

lower levels of subscriber additions.

Rogers Retail PP&E additions are attributable to improvements

made to certain retail locations.

MEDIA

MEDIA’S BUSINESS

Media operates our radio and television broadcasting and

speciality television businesses, our consumer and trade publishing

operations, our televised home shopping service and Rogers Sports

Entertainment. In addition to Media’s more traditional broadcast

and print media platforms, it also provides content and conducts

e-commerce over the Internet.

Media’s broadcasting group (“Broadcasting”) comprises 54 radio

stations across Canada; multicultural OMNI broadcast television

stations; the five station Citytv broadcast television network;

specialty sports television services including regional sports service

Rogers Sportsnet and Setanta Sports Canada; other specialty

services including OLN, The Biography Channel Canada and

G4TechTV Canada; and Canada’s only nationally televised shopping

service (“The Shopping Channel”). Media also holds 50% ownership

in Dome Productions, a mobile production and distribution joint

venture that is a leader in HDTV production in Canada.

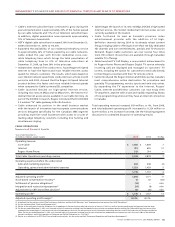

Summarized Cable PP&E Additions

Years ended December 31,

(In millions of dollars) 2009 2008 %Chg

Additions to PP&E

Customer premise equipment $ 185 $ 284 (35)

Scalable infrastructure 259 279 (7)

Line extensions 40 48 (17)

Upgrades and rebuild 20 35 (43)

Support capital 138 183 (25)

Total Cable Operations 642 829 (23)

RBS 37 36 3

Rogers Retail 14 21 (33)

$ 693 $ 886 (22)

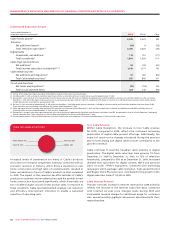

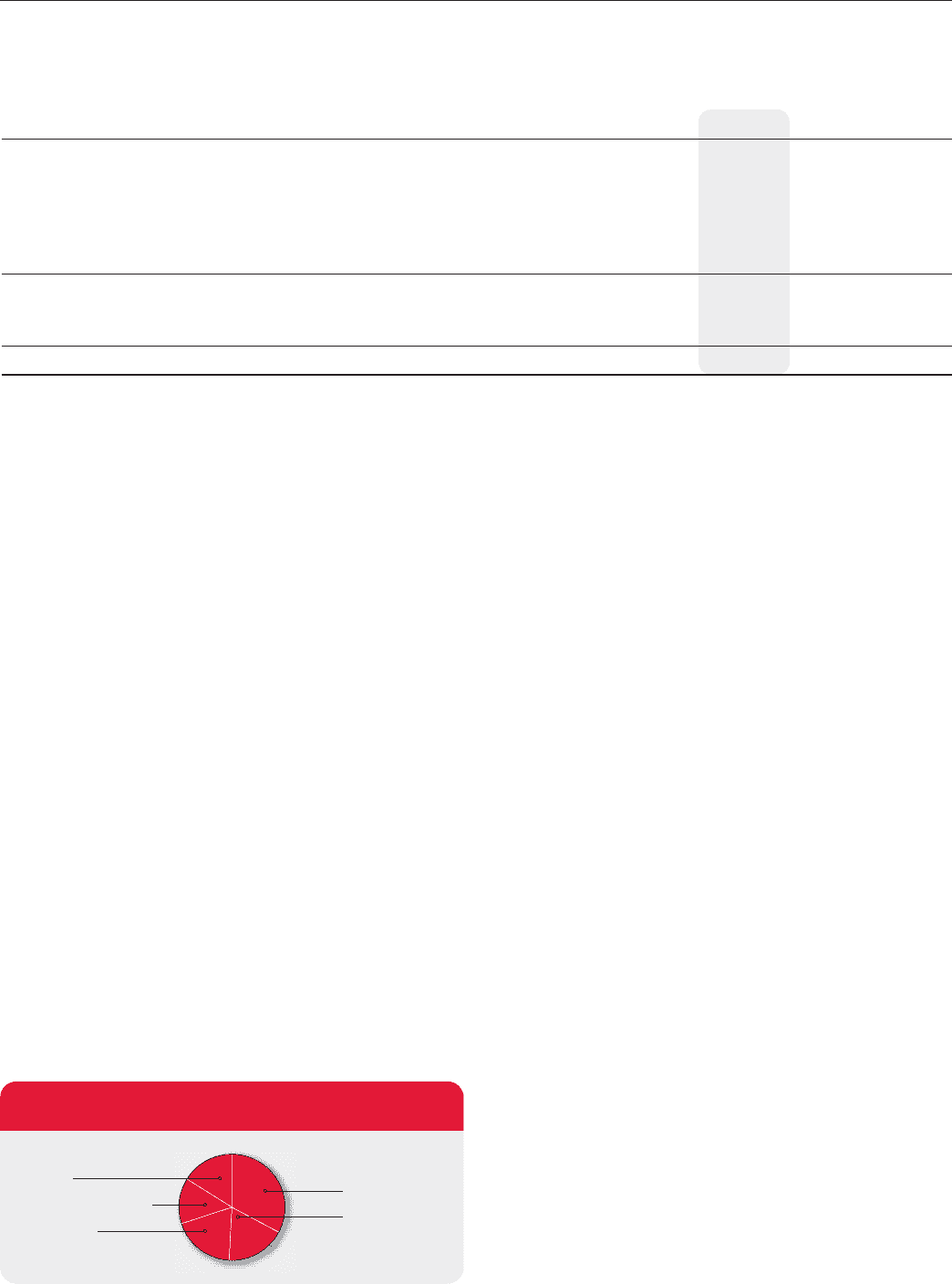

Radio 16%

Television 33%

Sports Entertainment 14%

The Shopping

Channel 18%

Publishing 19%

MEDIA REVENUE MIX

(%)