Rogers 2009 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2009 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2009 ANNUAL REPORT 117

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

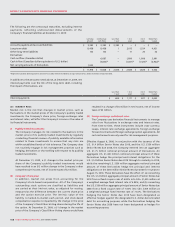

In 2008, the Company repurchased for cancellation 4,000,000 of

its outstanding Class B Non-Voting shares pursuant to private

agreements between the Company and an arm’s length third

party seller for an aggregate purchase price of $133.8 million. As

a result of these purchases, the Company recorded a reduction

to stated capital, contributed surplus and retained earnings of

$3.7 million, $126.1 million and $4.0 million, respectively. Each of

these purchases was made under issuer bid exemption orders

issued by the Ontario Securities Commission and will be included

in calculating the number of Class B Non-Voting shares that the

Company may purchase pursuant to the NCIB. In addition, the

Company repurchased for cancellation an aggregate 77,400 of its

outstanding Class B Non-Voting shares directly under the NCIB for

an aggregate purchase price of $2.9 million, resulting in a reduction

to stated capital, contributed surplus and retained earnings of

$0.1 million, $2.7 million and $0.1 million, respectively.

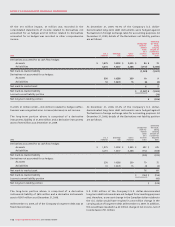

At December 31, 2009, the Company had a liability of $178 million

(2008 – $278 million), of which $164 million (2008 – $267 million) is

a current liability related to stock-based compensation recorded at

its intrinsic value, including stock options, restricted share units and

deferred share units. During the year ended December 31, 2009,

$63 million (2008 – $106 million) was paid to holders upon

exercise of restricted share units and stock options using the cash

settlement feature.

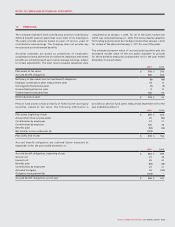

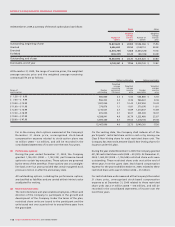

(A) STOCK OPTIONS:

(i) Stock option plans:

Options to purchase Class B Non-Voting shares of the Company

on a one-for-one basis may be granted to employees, directors

and officers of the Company and its affiliates by the Board of

Directors or by the Company’s Management Compensation

Committee. There are 30 million options authorized under the

2000 Plan, 25 million options authorized under the 1996 Plan,

and 9.5 million options authorized under the 1994 Plan. The

term of each option is 7 to 10 years and the vesting period is

generally four years but may be adjusted by the Management

Compensation Committee on the date of grant. The exercise

price for options is equal to the fair market value of the Class B

Non-Voting shares determined as the five-day average before

the grant date as quoted on the TSX.

19. STOCK-BASED COMPENSATION:

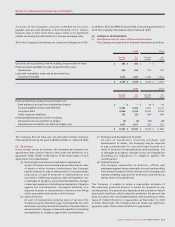

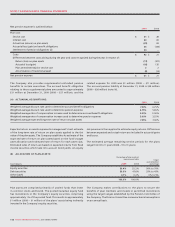

(D) ACCUMULATED OTHER COMPREHENSIVE INCOME (LOSS):

2009 2008

Unrealized gain on available-for-sale investments $ 219 $ 205

Unrealized loss on cash flow hedging instruments (256) (377)

Related income taxes 80 77

$ 43 $ (95)

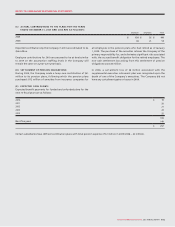

Stock options, share units and share purchase plans:

A summary of stock-based compensation expense (recovery), which is

included in operating, general and administrative expense, is as follows:

2009 2008

Stock-based compensation:

Stock options (a) $ (38) $ (104)

Restricted share units (b) 77

Deferred share units (c) (2) (3)

$ (33) $ (100)