Rogers 2009 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2009 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

118 ROGERS COMMUNICATIONS INC. 2009 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

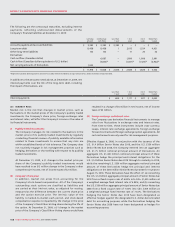

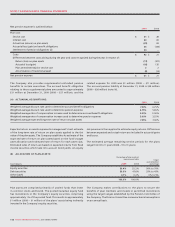

At December 31, 2009, a summary of the stock option plans is as follows:

2009 2008

Number of

options

Weighted

average

exercise

price

Number of

options

Weighted

average

exercise

price

Outstanding, beginning of year 13,841,620 $ 20.80 15,586,066 $ 15.96

Granted 2,636,600 29.50 2,148,110 38.83

Exercised (2,604,787) 12.88 (3,804,520) 10.55

Forfeited (406,337) 32.20 (88,036) 34.69

Outstanding, end of year 13,467,096 $ 23.73 13,841,620 $ 20.80

Exercisable, end of year 8,149,361 $ 17.56 9,228,740 $ 13.82

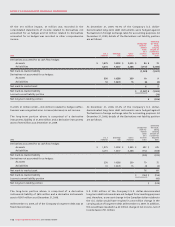

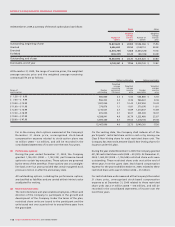

At December 31, 2009, the range of exercise prices, the weighted

average exercise price and the weighted average remaining

contractual life are as follows:

Options outstanding Options exercisable

Range of

exercise prices

Number

outstanding

Weighted

average

remaining

contractual

life (years)

Weighted

average

exercise

price

Number

exercisable

Weighted

average

exercise

price

$ 1.38 – $ 6.99 586,880 2.5 $ 5.50 586,880 $ 5.50

$ 7.00 – $ 9.99 966,422 3.4 8.36 966,422 8.36

$ 10.00 – $ 10.99 1,907,050 3.7 10.43 1,907,050 10.43

$ 11.00 – $ 11.99 370,876 1.1 11.81 370,876 11. 81

$ 12.00 – $ 16.99 1,214,547 2.7 13.89 1,214,547 13.89

$ 17.00 – $ 18.99 435,000 0.7 18.07 435,000 18.07

$ 19.00 – $ 37.99 4,288,941 4.9 26.79 1,323,480 22.87

$ 38.00 – $ 47.99 3,697,380 4.7 39.03 1,345,106 39.08

13,467,096 4.0 23.73 8,149,361 17.56

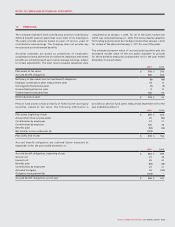

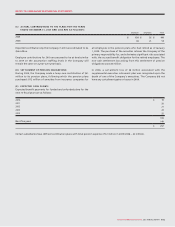

For in-the-money stock options measured at the Company’s

December 31 share price, unrecognized stock-based

compensation expense related to stock-option plans was

$5 million (2008 – $3 million), and will be recorded in the

consolidated statements of income over the next four years.

(ii) Performance options:

During the year ended December 31, 2009, the Company

granted 1,156,200 (2008 – 1,142,300) performance-based

options to certain key executives. These options are governed

by the terms of the 2000 Plan. These options vest on a straight-

line basis over four years provided that certain targeted stock

prices are met on or after the anniversary date.

All outstanding options, including the performance options,

are classified as liabilities and are carried at their intrinsic value

as adjusted for vesting.

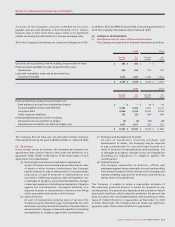

(b) Restricted share units:

The restricted share unit plan enables employees, officers and

directors of the Company to participate in the growth and

development of the Company. Under the terms of the plan,

restricted share units are issued to the participant and the

units issued vest over a period not to exceed three years from

the grant date.

On the vesting date, the Company shall redeem all of the

participants’ restricted share units in cash or by issuing one

Class B Non-Voting share for each restricted share unit. The

Company has reserved 4,000,000 Class B Non-Voting shares for

issuance under this plan.

During the year ended December 31, 2009, the Company granted

431,185 restricted share units (2008 – 451,535). At December 31,

2009, 1,060,223 (2008 – 1,126,548) restricted share units were

outstanding. These restricted share units vest at the end of

three years from the grant date. Stock-based compensation

expense for the year ended December 31, 2009, related to these

restricted share units was $7 million (2008 – $7 million).

For restricted share units measured at the Company’s December

31 share price, unrecognized stock-based compensation

expense as at December 31, 2009 related to these restricted

share units was $17 million (2008 – $16 million), and will be

recorded in the consolidated statements of income over the

next three years.