Rogers 2009 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2009 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30 ROGERS COMMUNICATIONS INC. 2009 ANNUAL REPORT

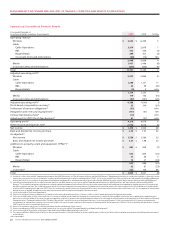

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The increase in cost of equipment sales for 2009, compared to 2008,

was primarily the result of the higher mix of smartphone sales.

The year-over-year decrease in sales and marketing expenses for

2009, compared to 2008, was driven by cost containment initiatives.

The year-over-year increase in operating, general and administrative

expenses for 2009, compared to 2008, excluding retention spending

discussed below, were partially driven by growth in the Wireless

subscriber base. In addition, increases in information technology

and customer care as a result of the complexity of supporting

more sophisticated devices and services were predominately

offset by savings related to operating and scale efficiencies across

various functions.

Total retention spending, including subsidies on handset upgrades,

was $588 million in 2009, compared to $536 million in 2008. The

retention spending for 2009 increased compared to 2008 as a result

of higher upgrade activity and an increase in the mix of upgrades

more heavily towards smartphone devices by existing subscribers

during 2009.

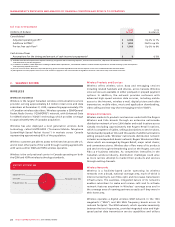

Wireless Adjusted

Operating Profit

The 8% year-over-year increase

in adjusted operating profit and

the 48.7% adjusted operating

profit margin on network

reve n u e (w h i c h e xc l u d e s

equipment sales revenue) for

2009 primarily reflects the

increase in network revenue

and the decrease in sale s

a n d ma r ke t i n g e x p e n s e s

discussed above.

Wireless Additions to

Property, Plant and Equipment

Wireless additions to PP&E

are classified into the following

categories:

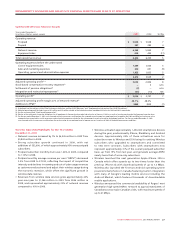

Additions to Wireless PP&E for 2009 reflect spending on network

capacity, such as radio channel additions and network enhancing

features. Additions to PP&E associated with the deployment of our

HSPA network were mainly for the continued roll-out to various

markets across Canada along with upgrades to the network to

enable higher throughput speeds. Other network-related PP&E

additions included national site build activities, test and monitoring

equipment, network sectorization work, operating support system

activities, investments in network reliability and renewal initiatives,

infrastructure upgrades, and new product platforms. Information

technology and other wireless specific system initiatives included

billing and back-office system upgrades, and other facilities and

equipment spending.

HSPA spending increased year-over-year due to the expansion of 21

Mbps speeds in major urban centres. Capacity spending increased

over the same period in the prior year due to the acquisition of

IP transmission interfaces and augmentation to the radio access

network to meet demand for migrations from GSM to HSPA due

to a faster adoption of 3G devices. Offsetting these increases from

the corresponding period of the prior year was lower spending

on enhancements to services and capabilities included in other

network additions due to lower site build activity.

20092008

2007

200

8

2007

2009

$3,042$2,806$2,589

WIRELESS ADJUSTED

OPERATING PROFIT

(In millions of dollars)

Years ended December 31,

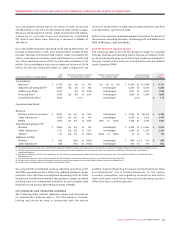

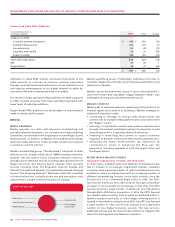

(In millions of dollars) 2009 2008 %Chg

Additions to PP&E

High-Speed Packet Access (“HSPA”) $ 345 $ 315 10

Network - capacity 239 200 20

Network - other 152 262 (42)

Information technology and other 129 152 (15)

Total additions to PP&E $ 865 $ 929 (7)

Other 15%

Network 45%

HSPA 40%

WIRELESS ADDITIONS TO PP&E

(%)