Rogers 2009 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2009 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18 ROGERS COMMUNICATIONS INC. 2009 ANNUAL REPORT

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

FOR THE YEAR ENDED DECEMBER 31, 2009

This Management’s Discussion and Analysis (“MD&A”) should be

read in conjunction with our 2009 Audited Consolidated Financial

Statements and Notes thereto. The financial information presented

herein has been prepared on the basis of Canadian generally accepted

accounting principles (“GAAP”) and is expressed in Canadian dollars,

unless otherwise stated. Please refer to Note 25 to the 2009 Audited

Consolidated Financial Statements for a summary of differences

between Canadian and United States (“U.S.”) GAAP. This MD&A,

which is current as of February 17, 2010, is organized into six sections.

In this MD&A, the terms “we”, “us”, “our”, “Rogers” and “the

Company” refer to Rogers Communications Inc. and our subsidiaries,

which were reported in the following segments for the year ended

December 31, 2009:

• “Wireless”, which refers to our wireless communications

operations, including Rogers Wireless Partnership (“RWP”) and

Fido Solutions Inc. (“Fido”);

• “Cable”,whichreferstoourcablecommunicationsoperations,

including Rogers Cable Communications Inc. (“RCCI”) and its

subsidiary, Rogers Cable Partnership; and

• “Media”,whichreferstoourwholly-ownedsubsidiaryRogers

Media Inc. and its subsidiaries, including Rogers Broadcasting,

which owns a group of 54 radio stations, the Citytv televi-

sion network, the Rogers Sportsnet television network, The

Shopping Channel, the OMNI television stations, and Canadian

specialty channels including The Biography Channel Canada,

G4TechTV and Outdoor Life Network; Rogers Publishing, which

publishes approximately 70 magazines and trade journals; and

Rogers Sports Entertainment, which owns the Toronto Blue Jays

Baseball Club (“Blue Jays”) and Rogers Centre. Media also holds

ownership interests in entities involved in specialty television

content, television production and broadcast sales.

“RCI” refers to the legal entity Rogers Communications Inc.

excluding our subsidiaries.

Substantially all of our operations are in Canada.

Throughout this MD&A, all percentage changes are calculated

using numbers rounded to the decimal to which they appear. Please

note that the charts, graphs and diagrams that follow have been

included for ease of reference and illustrative purposes only and do

not form part of management’s discussion and analysis.

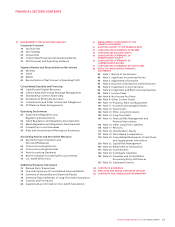

1CORPORATE OVERVIEW 2SEGMENT REVIEW AND

RECONCILIATION TO NET INCOME 3CONSOLIDATED LIQUIDITY

AND FINANCING

19 Our Business

20 Our Strategy

20 Acquisitions

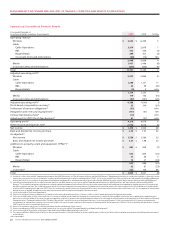

20 Consolidated Financial and

Operating Results

23 2010 Financial and

Operating Guidance

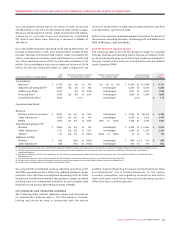

24 Wireless

31 Cable

40 Media

42 Reconciliation of Net Income

to Operating Profit

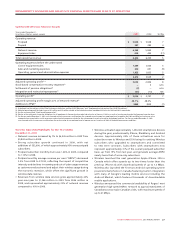

45 Liquidity and Capital Resources

48 Interest Rate and Foreign

Exchange Management

50 Outstanding Common Share Data

50 Dividends and Other Payments

on RCI Equity Securities

51 Commitments and Other

Contractual Obligations

52 Off-Balance Sheet Arrangements

52 Government Regulation and

Regulatory Developments

55 Cable Regulation and

Regulatory Developments

57 Media Regulation and

Regulatory Developments

57 Competition in our Businesses

59 Risks and Uncertainties Affecting

our Businesses

65 Key Performance Indicators and

Non-GAAP Measures

66 Critical Accounting Policies

67 Critical Accounting Estimates

70 New Accounting Standards

70 Recent Canadian Accounting

Pronouncements

74 U.S. GAAP Differences

74 Related Party Transactions

75 Five-Year Summary of

Consolidated Financial Results

76 Summary of Seasonality and

Quarterly Results

78 Summary Financial Results of

Long-Term Debt Guarantors

79 Controls and Procedures

80 Supplementary Information:

Non-GAAP Calculations

54 OPERATING ENVIRONMENT ACCOU NT I NG POL IC I ES AND

NON-GAAP MEASURES 6ADDI TIO NA L FINA NCI AL

INFORMATION