Rogers 2009 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2009 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92 ROGERS COMMUNICATIONS INC. 2009 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

manner as the value of goodwill is determined in a business

combination, is compared with its carrying amount to measure

the amount of the impairment loss, if any.

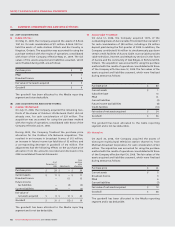

(iii) Intangible assets:

Intangible assets acquired in a business combination are

recorded at their fair values. Intangible assets with finite

useful lives are amortized over their estimated useful lives and

are tested for impairment, as described in note 2(q). Intangible

assets having an indefinite life, being spectrum and broadcast

licences, are not amortized but are tested for impairment on

an annual or more frequent basis by comparing their fair value

to their carrying amount. An impairment loss on an indefinite

life intangible asset is recognized when the carrying amount

of the asset exceeds its fair value.

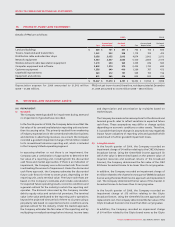

Intangible assets with finite useful lives are amortized on a

straight-line basis over their estimated useful lives as follows:

Brand name – Rogers 20 years

Brand name – Fido 5 years

Brand name – Citytv 5 years

Subscriber bases 2¼ to 4²⁄ ³ years

Roaming agreements 12 years

Dealer networks 4 years

Marketing agreement 5 years

The Company tested goodwill and intangible assets with indefinite

lives for impairment during 2009 and recorded a write-down in

intangible assets of $5 million related to the CIKZ Kitchener and

OMNI broadcast licences (note 11(a)). The Company tested goodwill

and intangible assets with indefinite lives for impairment during

2008 and recorded a write-down of $154 million related to the

goodwill of the conventional television reporting unit and $75

million related to the Citytv broadcast licence (note 11(a)).

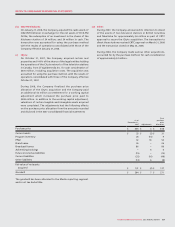

(Q) IMPAIRMENT OF LONG-LIVED ASSETS:

The Company reviews long-lived assets, which include PP&E and

intangible assets with finite useful lives, for impairment annually

or more frequently if events or changes in circumstances indicate

that the carrying amount may not be recoverable. If the sum of

the undiscounted future cash flows expected to result from the

use and eventual disposition of a group of assets is less than its

carrying amount, it is considered to be impaired. An impairment

loss is measured as the amount by which the carrying amount of

the group of assets exceeds its fair value.

The Company tested long-lived assets with finite useful lives

for impairment during 2009 and recorded a write-down of $13

million related to the OMNI Canadian Radio-television and

Telecommunication Commission (“CRTC”) commitments asset (note

13). The Company tested long-lived assets with finite useful lives for

impairment during 2008 and recorded a write-down of $51 million

related to the Citytv CRTC commitments asset (note 13) and $14

million related to the Citytv brand name (note 11(a)(ii)).

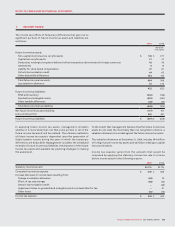

(R) ASSET RETIREMENT OBLIGATIONS:

Asset retirement obligations are legal obligations associated with

the retirement of PP&E that result from their acquisition, lease,

construction, development or normal operations. The Company

records the estimated fair value of a liability for an asset retirement

obligation in the year in which it is incurred and when a reasonable

estimate of fair value can be made. The fair value of a liability for

an asset retirement obligation is the amount at which that liability

could be settled in a current transaction between willing parties,

that is, other than in a forced or liquidation transaction and, in the

absence of observable market transactions, is determined as the

present value of expected cash flows. The Company subsequently

allocates the asset retirement cost to expense using a systematic

and rational method over the asset’s useful life, and records the

accretion of the liability as a charge to operating expenses.

(S) USE OF ESTIMATES:

The preparation of financial statements requires management to

make estimates and assumptions that affect the reported amounts

of assets and liabilities and disclosure of contingent assets and

liabilities at the date of the financial statements and the reported

amounts of revenue and expenses during the years. Actual results

could differ from those estimates.

Key areas of estimation, where management has made difficult,

complex or subjective judgments, often as a result of matters

that are inherently uncertain, include the allowance for doubtful

accounts and certain accrued liabilities, the ability to use income

tax loss carryforwards and other future income tax assets and

liabilities, capitalization of internal labour and overhead, useful

lives of depreciable assets and intangible assets with finite useful

lives, discount rates and expected returns on plan assets affecting

pension expense and the deferred pension asset, estimation of

Credit Spreads for determination of the fair value of derivative

instruments and the assessment of the recoverability or impairment

of long-lived assets, goodwill and intangible assets, which require

estimates of future cash flows and discount rates. For business

combinations, key areas of estimation and judgment include the

allocation of the purchase price and related severance costs.

Significant changes in the assumptions, including those with respect

to future business plans and cash flows, could materially change the

recorded carrying amounts.

(T) RECENT CANADIAN ACCOUNTING PRONOUNCEMENTS:

(i) Business Combinations:

In October 2008, the CICA issued Handbook Section 1582,

Business Combinations (“CICA 1582”), concurrently with

Handbook Sections 1601, Consolidated Financial Statements

(“CICA 1601”), and 1602, Non-controlling Interests (“CICA 1602”).

CICA 1582, which replaces Handbook Section 1581, Business

Combinations, establishes standards for the measurement of

a business combination and the recognition and measurement

of assets acquired and liabilities assumed. CICA 1601, which

replaces Handbook Section 1600, carries forward the