Rogers 2009 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2009 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72 ROGERS COMMUNICATIONS INC. 2009 ANNUAL REPORT

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

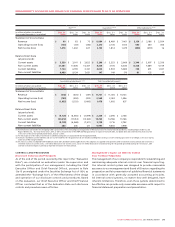

The overall impact of the above differences has not been finalized

however it has been estimated to result in a significant reduction

in the net pension asset and to give rise to an estimated opening

pension liability reflecting the deficit position of the plan at the

date of transition. This adjustment will be offset through opening

retained earnings.

Borrowing Costs

IAS 23, Borrowing Costs (“IAS 23”), requires the capitalization

of borrowing costs directly attributable to the acquisition,

construction or production of a qualifying asset as part of the

cost of that asset. Under Canadian GAAP, the Company elected

the accounting policy choice to expense these costs as incurred.

IFRS 1 provides an election that permits the Company to apply the

requirements of IAS 23 prospectively from the date of transition,

January 1, 2010. The Company intends to apply this election and

consequently, the Company does not expect to have an adjustment

on its opening IFRS balance sheet.

Joint Ventures

IAS 31, Interests in Joint Ventures (“IAS 31”) currently provides

the entity with a policy choice to account for joint ventures using

either proportionate consolidation or the equity method. The

IASB is currently considering Exposure Draft 9, Joint Arrangements

(“ED 9”), that is intended to modify IAS 31. The IASB has indicated

that it expects to issue a new standard to replace IAS 31 in 2010.

Currently, under Canadian GAAP, we proportionately account for

interests in joint ventures. ED 9 proposes to eliminate the option to

proportionately consolidate such interests that exists in IAS 31, and

require an entity to recognize its interest in a joint venture, using

the equity method. While our decision to use the equity method

will not be finally confirmed until the new standard is issued,

the impact of using the equity method is anticipated to result in

reductions of the opening balances for Current Assets, Property,

Plant & Equipment, Intangible Assets and Current Liabilities with

an offsetting increase in Investments.

Financial Instruments: Transaction Costs

IAS 39, Financial Instruments: Recognition and Measurement

(“IAS 39”) requires that transaction costs incurred upon initial

acquisition of a financial instrument be deferred and amortized

into profit and loss over the life of the instrument. Under Canadian

GAAP these costs are recognized immediately in net income. Initial

application of IAS 39 will result in a reduction in long-term debt

on the date of transition. This adjustment will be offset through

opening retained earnings.

Financial Instruments: Hedge Accounting

When assessing hedge effectiveness under IAS 39, the Company

will be required to include in its test the risk that the parties to

the hedging instrument will default by failing to make payment.

Under Canadian GAAP, the Company elected not to include credit

risk in the hedge effectiveness tests. Upon transition to IFRS, the

Company intends to continue to apply hedge accounting to all its

hedging arrangements to which Canadian GAAP hedge accounting

is applied and which meet the IFRS hedge accounting criteria,

including passing the revised effectiveness tests.

the anticipated impacts expected on our IFRS opening balance

sheet for some of the differences. In other areas we are not yet

able to reliably quantify the impacts to the consolidated financial

statements for these differences. These quantifications will be

completed throughout 2010. See the section entitled “Caution

Regarding Forward-Looking Statements, Risk and Assumptions”.

Set out below are the key areas where changes in accounting policies

are expected to impact our consolidated financial statements. The

list and comments should not be regarded as a complete list of

changes that will result from transition to IFRS and are intended to

highlight those areas we believe to be most significant.

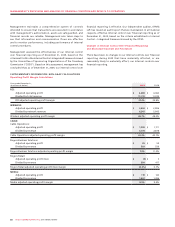

Share-Based Payments

IFRS 2, Share-Based Payments, requires that cash-settled

share-based payments to employees be measured (both initially and

at each reporting date) based on fair values of the awards. Canadian

GAAP requires that such payments be measured based on intrinsic

values of the awards. This difference is expected to impact the

accounting measurement of our stock-based payments, including

our stock options, restricted share units and deferred share units.

While we have not yet recalculated the impact of changing from

intrinsic value to fair value, we expect that the change will result in

an insignificant increase in the Company’s liability for share based

payments. Per the requirements of IFRS 1, this adjustment will be

offset in opening retained earnings upon transition to IFRS.

Employee Benefits

IAS 19, Employee Benefits, (“IAS 19”) requires the past service

cost element of defined benefit plans be expensed on an accelerated

basis, with vested past service costs expensed immediately

and unvested past service costs recognized on a straight-line basis

until the benefits become vested. Under Canadian GAAP, past

service costs are generally amortized on a straight-line basis over

the average remaining service period of active employees expected

under the plan. All of the past service costs for the Company’s

pension plan are vested; therefore, we expect that the impact of

transition will result in a reduction of the opening pension asset

balance equal to the amount of any previously unrecognized past

service costs.

In addition, IAS 19 requires an entity to make an accounting policy

choice regarding the treatment of actuarial gains and losses. The

Company intends to adopt the option allowing the immediate

recognition of actuarial gains and losses directly in equity with no

impact on profit or loss. The impact of this policy choice will be

to further reduce the Company’s pension asset by the amount of

any unamortized net actuarial losses and unrecognized transitional

assets that exist at the date of transition.

Furthermore, IAS 19 requires that the defined benefit obligation

and plan assets be measured at the balance sheet date while

Canadian GAAP allows the measurement date of the defined

benefit obligation and plan assets to be up to three months prior

to the date of the financial statements. The Company’s current

accounting policy is to measure the defined benefit obligation

and plan assets at September 30, 2009. The impact of this difference

has not been finalized, but is expected to further reduce the

pension asset.