Rogers 2009 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2009 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2009 ANNUAL REPORT 109

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Also effective on August 6, 2008, the Company re-couponed three

of its existing Derivatives by terminating the original Derivatives

aggregating U.S. $575 million notional principal amount and

simultaneously entering into three new Derivatives aggregating

U.S. $575 million notional principal amount at then current market

rates. In each case, only the fixed foreign exchange rate and the

Canadian dollar fixed interest rate were changed and all other terms

for the new Derivatives are identical to the respective terminated

Derivatives they are replacing. The termination of the three original

Derivatives resulted in the Company paying U.S. $360 million

(Cdn. $375 million) for the aggregate out-of-the-money fair value

for the terminated Derivatives on the date of termination, thereby

reducing by an equal amount, the fair value of the derivative

instruments liability on that date. The three new Derivatives have

the effect of converting U.S. $575 million aggregate notional

principal amount of U.S. dollar denominated debt from a weighted

average U.S. dollar fixed interest rate of 7.20% into notional

Cdn. $589 million ($1.025 exchange rate) at a weighted average

Canadian dollar fixed interest rate of 6.88%. In comparison, the

original Derivatives had the effect of converting U.S. $575 million

aggregate notional principal amount of U.S. dollar-denominated

debt from a weighted average U.S. dollar fixed interest rate of 7.20%

into notional Cdn. $815 million ($1.4177 exchange rate) at a weighted

average Canadian dollar fixed interest rate of 7.89%. Each of the

three new Derivatives has been designated as a hedge against the

designated U.S. dollar-denominated debt for accounting purposes.

Prior to the termination of the Derivatives noted above, changes in

the fair value of these Derivatives had been recorded in accumulated

other comprehensive income and were periodically reclassified to

income to offset foreign exchange gains or losses on related debt

or to modify interest expense to its hedged amount. The remaining

balance in accumulated other comprehensive income relating

to these terminated Derivatives on the termination date was

$144 million. The portion related to future periodic exchanges of

interest of $68 million, net of income taxes of $26 million, will be

recorded in income over the remaining life of the specific debt

securities to which the settled hedging items related using the

effective interest rate method. The portion of the remaining

balance that relates to the future principal exchange of $43 million,

net of income taxes of $7 million, will remain in accumulated other

comprehensive income until such time as the related debt is settled.

The total amortization of the terminated Derivatives is $6 million

for 2009 (2008 – $3 million) and is recorded in interest expense.

In addition, two Derivatives matured on December 15, 2008.

These Derivatives hedged the foreign exchange risk related to the

U.S. $400 million 8.00% Senior Subordinated Notes due 2012. As a

result of the maturity of these Derivatives, the Company’s U.S. $400

million 8.00% Senior Subordinated Notes due 2012 were not hedged

for the period from December 15, 2008 until their redemption on

December 15, 2009 (see note 14(c)). Proceeds of $494 million (U.S.

$400 million) were received on the settlement of the Derivatives

and a payment of $475 million was made. In addition, upon

settlement of forward foreign exchange contracts on December 15,

2008, proceeds of $476 million were received and payments on the

forward contracts of $494 million (U.S. $400 million) were made.

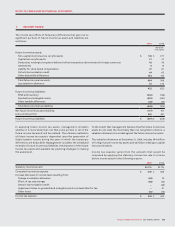

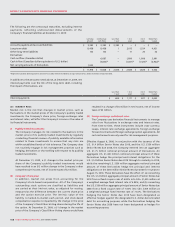

The effect of estimating fair value using credit-adjusted interest

rates on the Company’s Derivatives at December 31, 2009 is

illustrated in the table below. As at December 31, 2009, the credit-

adjusted net liability position of the Company’s derivative portfolio

was $1,002 million, which is $25 million less than the unadjusted risk-

free mark-to-market net liability position.

Of the $25 million impact, ($1) million was recorded in the

consolidated statements of income related to Derivatives

not accounted for as hedges and $26 million related to Derivatives

accounted for as hedges was recorded in other comprehensive

income.

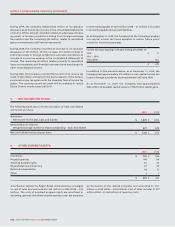

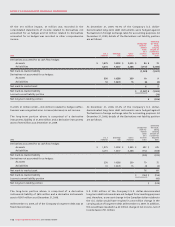

The effect of estimating fair value using credit-adjusted interest

rates on the Company’s Derivatives at December 31, 2008 is

illustrated in the table below. As at December 31, 2008, the

credit-adjusted net liability position of the Company’s derivative

portfolio was $154 million, which is $10 million more than the

unadjusted risk-free mark-to-market net liability position.

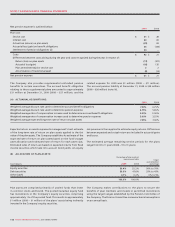

As at December 31, 2009

Derivatives

in an asset

position (A)

Derivatives

in a liability

position (B)

Net liability

position

(A) + (B)

Mark-to-market value – risk-free analysis $ 94 $ (1,121) $ (1,027)

Mark-to-market value – credit-adjusted estimate (carrying value) 82 (1,084) (1,002)

Difference $ 12 $ (37) $ 25

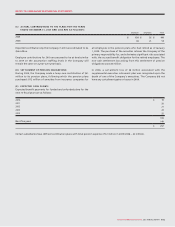

As at December 31, 2008

Derivatives

in an asset

position (A)

Derivatives

in a liability

position (B)

Net liability

position

(A) + (B)

Mark-to-market value – risk-free analysis $ 572 $ (716) $ (144)

Mark-to-market value – credit-adjusted estimate (carrying value) 507 (661) (154)

Difference $ 65 $ (55) $ (10)