Rogers 2009 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2009 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

100 ROGERS COMMUNICATIONS INC. 2009 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

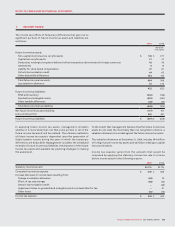

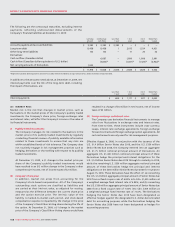

During 2009, the Company released $64 million of its valuation

allowance as an income tax recovery in the consolidated statements

of income. Of this amount, $14 million relates to a decrease of future

tax assets in foreign jurisdictions arising from foreign exchange

fluctuations and the remaining $50 million relates to unrealized

gains on investments and financial instruments.

During 2008, the Company recorded an increase in its valuation

allowance of $25 million. Of this increase, $19 million relates to

future tax assets in foreign jurisdictions and was recorded as an

increase in income tax expense in the consolidated statements of

income. The remaining $6 million relates primarily to unrealized

losses on investments and financial instruments and was charged to

other comprehensive income.

During 2008, the Company recorded the benefit of an income tax

credit of $65 million arising from the harmonization of the Ontario

provincial income tax system with the Canadian federal income tax

system. The resulting income tax credit will be available to reduce

future Ontario income taxes until 2013.

Income taxes payable of $207 million (2008 – $1 million) is included

in accounts payable and accrued liabilities.

As at December 31, 2009, the Company has the following Canadian

non-capital income tax losses available to reduce future years’

income for income tax purposes:

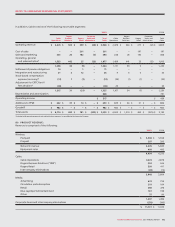

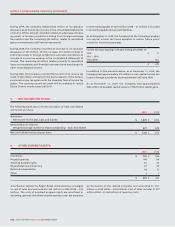

Income tax losses expiring in the year ending December 31:

2010 $ 17

2011 – 2014 –

Thereafter 353

$ 370

In addition to the amounts above, as at December 31, 2009, the

Company had approximately $73 million in non-capital income tax

losses in foreign subsidiaries expiring between 2023 and 2028.

As at December 31, 2009, the Company had approximately

$246 million of available capital losses to offset future capital gains.

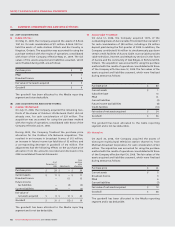

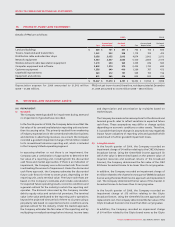

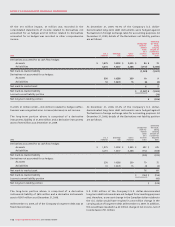

The following table sets forth the calculation of basic and diluted

net income per share:

8. NET INCOME PER SHARE:

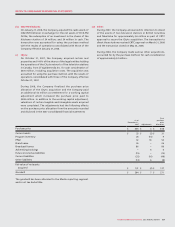

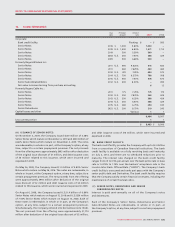

9. OTHER CURRENT ASSETS:

2009 2008

Numerator:

Net income for the year, basic and diluted $ 1,478 $ 1,002

Denominator (in millions):

Weighted average number of shares outstanding – basic and diluted 621 638

Basic and diluted net income per share $ 2.38 $ 1.57

2009 2008

Inventories $ 129 $ 256

Prepaid expenses 110 99

Acquired program rights 61 43

Rogers Retail rental inventory 27 29

Deferred compensation 10 12

Other 13

$ 338 $ 442

Amortization expense for Rogers Retail rental inventory is charged

to cost of sales and amounted to $43 million in 2009 (2008 – $43

million). The costs of acquired program rights are amortized to

operating, general and administrative expenses over the expected

performances of the related programs and amounted to $131

million in 2009 (2008 – $103 million). Cost of sales includes $1,337

million (2008 – $1,260 million) of inventory costs.