Rogers 2009 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2009 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28 ROGERS COMMUNICATIONS INC. 2009 ANNUAL REPORT

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

20092008

2007

2008

2007

2009

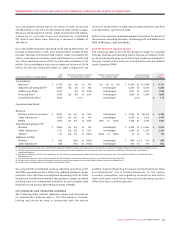

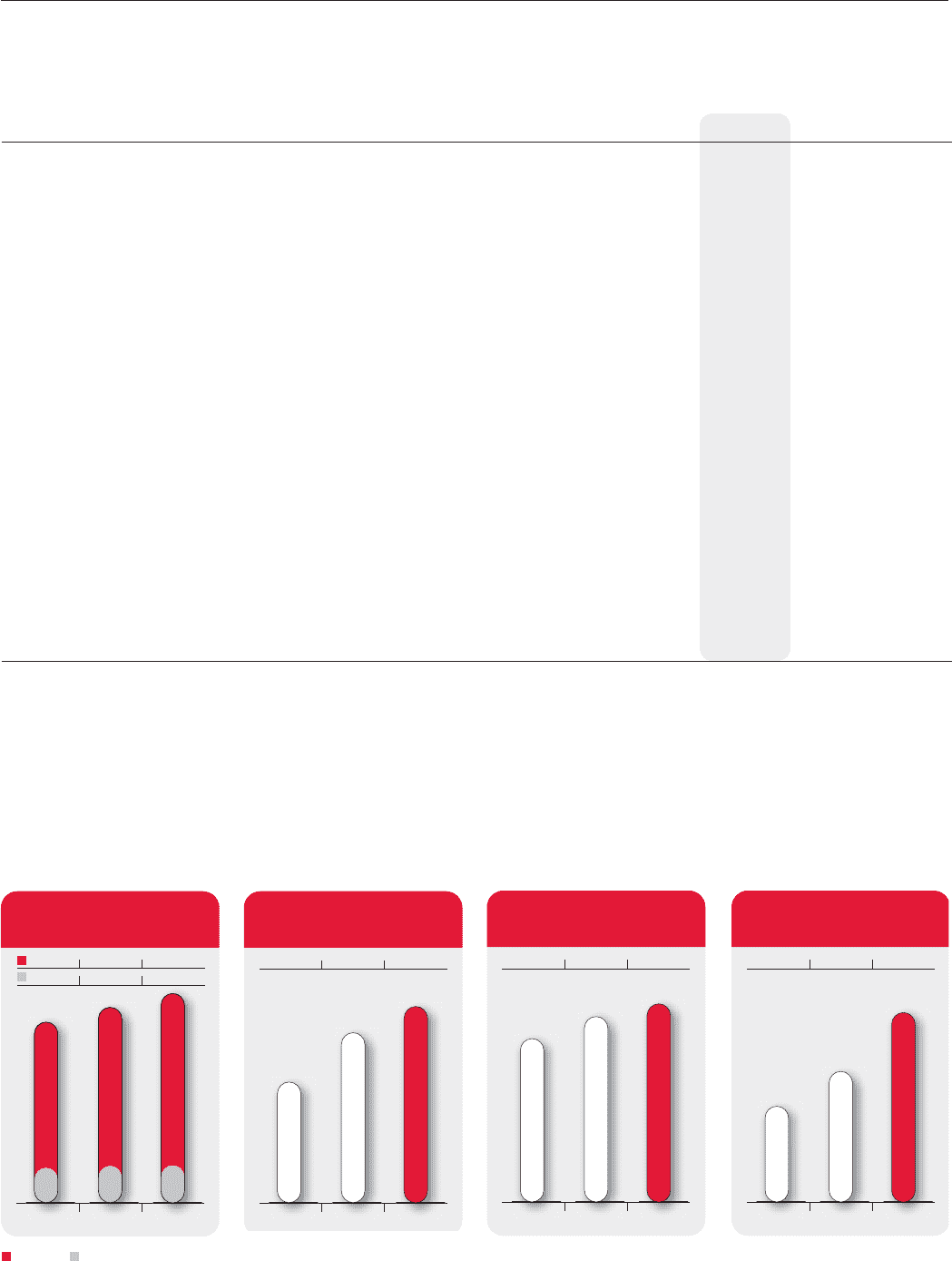

6,9796,4515,914

1,5151,4911,424

Postpaid Prepaid

WIRELESS POSTPAID AND

PREPAID SUBSCRIBERS

(In thousands)

20092008

2007

2008

2007

2009

$4,416$4,261$3,824

LIFE-TIME REVENUE

PER SUBSCRIBER

20092008

2007

2008

2007

2009

$6,245$5,843$5,154

WIRELESS NETWORK

REVENUE

(In millions of dollars)

20092008

2007

200

8

2007

2009

$1,366$946$683

WIRELESS DATA

REVENUE

(In millions of dollars)

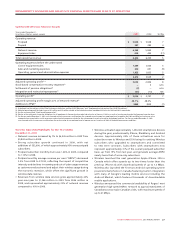

Wireless Subscribers and Network Revenue

The year-over-year decrease in subscriber additions primarily

reflects slower overall market growth, increased competitive

intensity in certain segments of the market, and the unusually high

number of additions during the second half of 2008 following the

Canadian iPhone launch.

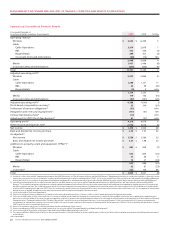

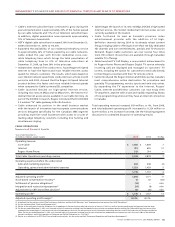

Summarized Wireless Subscriber Results

Years ended December 31,

(Subscriber statistics in thousands, except ARPU, churn and usage) 2009 2008 Chg

Postpaid

Gross additions(1) 1,377 1,341 36

Net additions 528 537 (9)

Total postpaid retail subscribers 6,979 6,451 528

Average monthly revenue per user (“ARPU”)(2) $ 73.93 $ 75.41 $ (1.48)

Average monthly minutes of usage 585 589 (4)

Monthly churn 1.06% 1.10% (0.04%)

Prepaid

Gross additions 582 632 (50)

Net additions 24 67 (43)

Total prepaid retail subscribers 1,515 1,491 24

ARPU(2) $ 16.73 $ 16.65 $ 0.08

Average monthly minutes of usage 121 131 (10)

Monthly churn 3.15% 3.31% (0.16%)

Total Postpaid and Prepaid

Gross additions 1,959 1,973 (14)

Net additions 552 604 (52)

Total postpaid and prepaid retail subscribers 8,494 7,942 552

Monthly churn 1.44% 1.51% (0.07%)

Blended ARPU(2) $ 63.59 $ 64.34 $ (0.75)

Blended average monthly minutes of usage 500 502 (2)

(1) During the third quarter of 2008, an adjustment associated with laptop wireless data card (“data card”) subscribers resulted in the addition of approximately 11,000 subscribers to

Wireless’ postpaid subscriber base. This adjustment is included in gross additions for the year ended December 31, 2008. Beginning in the third quarter of 2008, data cards are included

in the gross additions for postpaid subscribers.

(2) As defined. See the section entitled “Key Performance Indicators and Non-GAAP Measures”. As calculated in the “Supplementary Information: Non-GAAP Calculations” section.

The increase in network revenue in 2009 compared to 2008 was

driven predominantly by the continued growth of Wireless’

postpaid subscriber base and the year-over-year growth of wireless

data. Year-over-year, blended ARPU declined by 1.2%, which

reflects the impact of declines in roaming and out-of-plan usage

revenues as customers curtailed travel and adjusted their wireless