Rogers 2009 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2009 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2009 ANNUAL REPORT 29

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

usage during the economic recession. These reductions in roaming

and out-of-plan usage caused a decline in the voice component

of postpaid ARPU compared to 2008, which was to a large degree

offset by the significant growth in wireless data.

During 2009, wireless data revenue increased by approximately

44% over 2008, to $1,366 million. This growth in wireless data

revenue reflects the continued penetration and growing usage

of smartphone and wireless laptop devices which are driving the

use of text messaging and e-mail, wireless Internet access, and

other wireless data applications and services. In 2009, data revenue

represented approximately 22% of total network revenue,

compared to 16% in 2008.

Wireless’ success in the continued year-over-year reduction of

postpaid churn reflects targeted customer retention activities and

continued enhancements in network coverage and quality.

Wireless activated approximately 1,450,000 smartphone devices,

predominately iPhone 3G, BlackBerry and Android devices, during

2009. Subscribers with smartphones represented approximately

31% of the overall postpaid subscriber base as at December 31,

2009, compared to 19% as at December 31, 2008. These subscribers

have committed to new multi-year term contracts and, in a majority

of cases, attached both voice and monthly data packages which

generate considerably above average ARPU.

Wireless Equipment Sales

The year-over-year decrease in revenue from equipment sales,

including activation fees and net of equipment subsidies, in 2009

versus 2008 reflects an overall increased mix to higher subsidy

smartphone devices, including the incremental subsidy required

with the iPhone 3GS launch in June 2009.

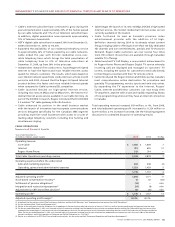

20092008

2007

2008

2007

2009

21.9%16.4%13.6%

DATA REVENUE PERCENT

OF BLENDED ARPU

(%)

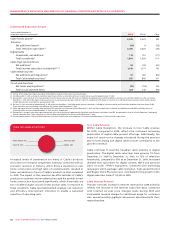

20092008

2008

2009

31.0%19.0%

SMARTPHONES AS A PERCENT

OF POSTPAID SUBSCRIBERS

(%)

Wireless Operating Expenses

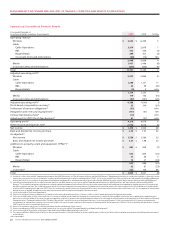

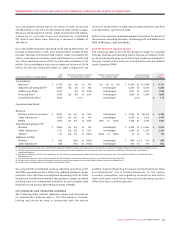

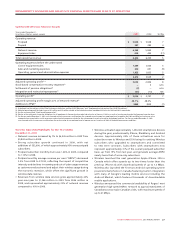

Years ended December 31,

(In millions of dollars) 2009 2008 %Chg

Operating expenses

Cost of equipment sales $ 1,059 $ 1,005 5

Sales and marketing expenses 630 691 (9)

Operating, general and administrative expenses 1,923 1,833 5

Operating expenses before the undernoted 3,612 3,529 2

Stock-based compensation expense (recovery)(1) – (5) n/m

Settlement of pension obligations(2) 3 – n/m

Integration and restructuring expenses(3) 33 14 136

Total operating expenses $ 3,648 $ 3,538 3

(1) See the section entitled “Stock-based Compensation”.

(2) Relates to the settlement of pension obligations for all employees in the pension plans who had retired as of January 1, 2009 as a result of annuity purchases by the Company’s pension plans.

(3) For the year ended December 31, 2009, costs incurred relate to severances resulting from the targeted restructuring of our employee base to combine the Cable and Wireless businesses into a

communications organization and to severances and restructuring expenses related to the outsourcing of certain information technology functions. For the year ended December 31, 2008,

costs incurred relate to severances resulting for the restructuring of our employee base to improve our cost structure in light of the declining economic conditions.