Rogers 2009 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2009 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44 ROGERS COMMUNICATIONS INC. 2009 ANNUAL REPORT

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

by 24 cents versus the U.S. dollar resulting in a foreign exchange

loss of $99 million, primarily related to the US$750 million of

U.S. dollar-denominated long-term debt that is not hedged for

accounting purposes.

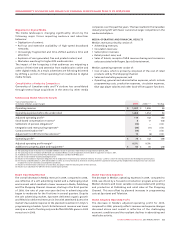

Debt Issuance Costs

We recorded debt issuance costs of $11 million during 2009 due to

the transaction costs incurred in connection with the $2.0 billion of

issuances, including the $1.0 billion of 5.80% Senior Notes due 2016

issued on May 26, 2009 and the $500 million of 5.38% Senior Notes

due 2019 and $500 million of 6.68% Senior Notes due 2039 issued on

November 4, 2009.

Interest on Long-Term Debt

The $72 million increase in interest expense during 2009, compared

to 2008, is primarily due to the increase in our long-term debt at

December 31, 2009, compared to December 31, 2008, including the

impact of Derivatives.

Operating Income

The increase in our operating income of $544 million, compared

to the prior year, is due to the growth in revenue of $396 million

and the reduction of operating expenses of $148 million. See the

detailed discussion on respective segment results included in this

section entitled “Segment Review” above.

Impairment Losses on Goodwill, Intangible Assets and Other

Long-Term Assets

In the fourth quarter of 2009, we determined that the fair value of

a radio station licence of Media was lower than its carrying value.

This primarily resulted from the weakening of advertising revenues

in a local market. As a result, we recorded a non-cash impairment

charge of $4 million related to one of our Ontario radio licences. In

addition, and also related to declines in advertising revenue, we

recorded an impairment charge of $14 million related to our OMNI

television network with the following components: $1 million

related to the broadcast licences and $13 million related to other

long-lived assets.

In the fourth quarter of 2008, we determined that the fair value of

the conventional television business of Media was lower than its

carrying value. This primarily resulted from weakening of industry

expectations and declines in advertising revenues amidst the

slowing economy. As a result, we recorded an aggregate non-cash

impairment charge of $294 million with the following components:

$154 million related to goodwill, $75 million related to broadcast

licences and $65 million related to intangible assets and other

long-term assets.

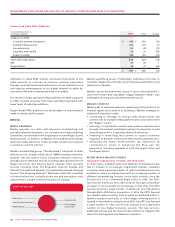

Depreciation and Amortization Expense

The increase in depreciation and amortization expense for the

year ended December 31, 2009, over 2008, primarily reflects the

$1.9 billion of additions to PP&E during 2009, partially offset by a

decrease in amortization of intangible assets resulting from certain

intangible assets that were acquired in the Fido acquisition, which

have now been fully amortized.

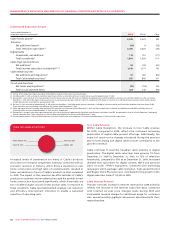

Stock-based Compensation

Our employee stock option plans attach cash settled share

appreciation rights (“SARs”) to all new and previously granted

options. The SAR feature allows the option holder to elect to

receive in cash an amount equal to the intrinsic value, being the

excess market price of the Class B Non-Voting share over the

exercise price of the option, instead of exercising the option and

acquiring Class B Non-Voting shares. All outstanding stock options

are classified as liabilities and are carried at their intrinsic value,

as adjusted for vesting, measured as the difference between the

current stock price and the option exercise price. The intrinsic value

of the liability is marked-to-market each period and is amortized to

expense over the period in which the related services are rendered,

which is usually the graded vesting period, or, as applicable, over

the period to the date an employee is eligible to retire, whichever

is shorter.

The liability for stock-based compensation expense is recorded

based on the intrinsic value of the options, as described above, and

the expense is impacted by the change in the price of RCI’s Class

B Non-Voting shares during the life of the option. At December

31, 2009, we had a liability of $178 million related to stock-based

compensation recorded at its intrinsic value, including stock

options, restricted share units and deferred share units. In the year

ended December 31, 2009, $63 million (2008 – $106 million) was paid

to holders upon exercise of restricted share units and stock options

using the SAR feature.

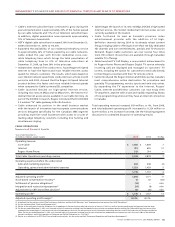

A summary of stock-based compensation expense is as follows:

Stock-based Compensation

Expense (Recovery) Included

in Operating, General and

Administrative Expenses

Years ended December 31,

(In millions of dollars) 2009 2008

Wireless $ – $ (5)

Cable (12) (32)

Media (8) (17)

Corporate (13) (46)

$ (33) $ (100)

Integration and Restructuring Expenses

During the year ended December 31, 2009, we incurred $117 million

of integration and restructuring expenses related to: i) severances

resulting from the targeted restructuring of our employee base to

combine our Cable and Wireless businesses into a communications

organization and to improve our cost structure in light of the current

economic and competitive conditions ($87 million); ii) severances

and restructuring expenses related to the outsourcing of certain