Rogers 2009 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2009 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

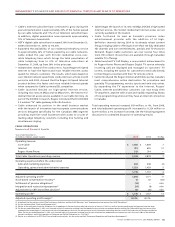

ROGERS COMMUNICATIONS INC. 2009 ANNUAL REPORT 39

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

(1) As defined. See the sections entitled “Key Performance Indicators and Non-GAAP Measures” and “Supplementary Information: Non-GAAP Calculations”.

(2) See the section entitled “Stock-based Compensation”.

(3) Relates to the settlement of pension obligations for all employees in the pension plans who had retired as of January 1, 2009 as a result of annuity purchases by the Company’s pension plans.

(4) For the year ended December 31, 2009, costs incurred relate to i) severances resulting from the targeted restructuring of our employee base to combine the Cable and Wireless businesses into

a communications organization; and ii) the closure of certain Rogers Retail stores. For the year ended December 31, 2008, costs incurred relate to i) severances resulting from the restructuring

of our employee base to improve our cost structure in light of the current economic conditions; and ii) the closure of certain Rogers Retail stores.

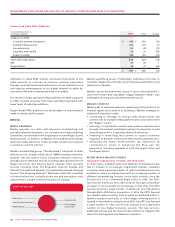

RBS Revenue

The decrease in RBS revenues reflects an ongoing decline in

the legacy portion of RBS’ business partially offset by an increase

in long-distance revenue. RBS is focused on leveraging on-net

revenue opportunities utilizing Cable’s existing network facilities

as well as maintaining its existing medium enterprise customer

base while growing the carrier portion of its business. RBS

continues to work to manage the profitability of existing enterprise

customers. For 2009, RBS long-distance revenues increased

$21 million and local and data revenues decreased by $21 million

and $23 million respectively.

RBS Operating Expenses

Operating, general and administrative expenses were relatively

unchanged for 2009, compared to 2008. An increase in long-

distance costs due to higher call volumes and country mix resulted

in higher operating costs which were offset by lower data and local

carriers charges.

Sales and marketing expenses were relatively unchanged year-over-

year and reflect cost control initiatives and targeted marketing

within the medium and large enterprise and carrier segments.

RBS Adjusted Operating Profit

RBS adjusted operating profit has declined year over year compared

to 2008 due to the decrease in revenues as RBS transitions away from

its legacy data and local revenues. As RBS is focusing its attention

on growing future revenue streams from on-net IP technologies

in voice and data it is investing in incremental operating costs to

support that growth and therefore offsetting the cost declines

from the legacy side of the business.

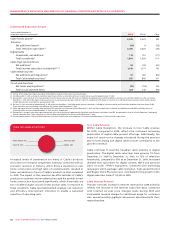

ROGERS RETAIL

Summarized Financial Results

Years ended December 31,

(In millions of dollars, except margin) 2009 2008 %Chg

Rogers Retail operating revenue $ 399 $ 417 (4)

Operating expenses before the undernoted 408 414 (1)

Adjusted operating (loss) profit(1) (9) 3 n/m

Stock-based compensation recovery(2) 1 1 -

Settlement of pension obligations(3) (1) - n/m

Integration and restructuring expenses(4) (12) (5) 140

Operating loss(1) $ (21) $ (1) n/m

Adjusted operating (loss) profit margin(1) (2.3%) 0.7%

Rogers Retail Revenue

The decrease in Rogers Retail revenue for 2009, compared to

2008, was the result of the continued decline in video rental and

sales combined with a lower volume of certain wireless product

upgrades in 2009 by existing Wireless customers, partially offset by

strong sales of Cable’s products.

Rogers Retail Adjusted Operating (Loss) Profit

Adjusted operating (loss) profit at Rogers Retail decreased for 2009,

compared to 2008, reflecting the trends noted above.

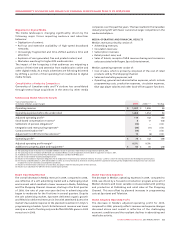

CABLE ADDITIONS TO PP&E

The Cable Operations segment categorizes its PP&E expenditures

according to a standardized set of reporting categories that were

developed and agreed to by the U.S. cable television industry

and which facilitate comparisons of additions to PP&E between

different cable companies. Under these industry definitions, Cable

Operations additions to PP&E are classified into the following five

categories:

• Customer premise equipment (“CPE”), which includes the

equipment for digital set-top terminals, Internet modems and

associated installation costs;

• Scalableinfrastructure, whichincludesnon-CPEcoststomeet

business growth and to provide service enhancements, including

many of the costs to-date of the cable telephony initiative;

• Line extensions, which includes network costs to enter new

service areas;

• Upgrades and rebuild, which includes the costs to modify

or replace existing co-axial cable, fibre-optic equipment and

network electronics; and

• Support capital,which includes the costsassociatedwith the

purchase, replacement or enhancement of non-network assets.

Business Solutions 5%

Retail 2%

Cable Operations 93%

CABLE ADDITIONS TO PP&E

(%)