Rogers 2009 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2009 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2009 ANNUAL REPORT 37

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

With the high-speed Internet base now at approximately

1.6 million subscribers, Internet penetration is approximately

45% of the homes passed by our cable networks and 71% of our

television customer base.

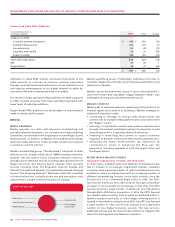

Rogers Home Phone Revenue

The Rogers Home Phone revenue for 2009 is relatively unchanged

year-over-year as revenue generated from the growth in the cable

telephony customer base revenue is offset by the ongoing decline

of the circuit-switched telephony and long-distance only customer

bases. The lower net additions of cable telephony lines in 2009

versus 2008 reflects the impact of the economic recession in

Ontario and product maturation as Rogers’ market share increases,

combined with intensified win-back activities by incumbent

telecom providers.

Cable telephony lines in service grew 12% from December 31, 2008

to December 31, 2009. At December 31, 2009, cable telephony lines

represented 26% of the homes passed by our cable networks and

41% of television subscribers.

Cable continues to focus principally on growing its on-net cable

telephony line base. As part of this on-net focus, Cable continued

to significantly de-emphasize circuit-switched sales through 2009

and intensified its efforts to convert circuit-switched lines that

are within the cable territory onto its cable telephony platform.

Of the 97,000 net line additions to cable telephony during 2009,

approximately 17,000 were migrations of lines from our circuit-

switched platform to our cable telephony platform. Because of the

strategic decision in early 2008 to de-emphasize sales of the circuit-

switched telephony product outside of the cable footprint, Cable

expects that circuit-switched net line losses will continue as that

base of subscribers continues to contract over time.

Excluding the impact of the shrinking circuit-switched telephony

customer base, the year-over-year revenue growth for Rogers

Home Phone and Cable Operations for 2009 would have been 19%

and 10%, respectively.

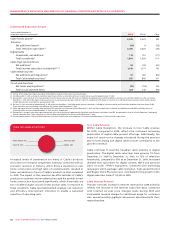

Cable Operations Operating Expenses

The increase in Cable Operations’ operating expenses for 2009

compared to 2008 was primarily driven by the increases in the digital

cable, Internet and Rogers Home Phone subscriber bases, resulting

in higher costs associated with programming and other content,

subscriber equipment, network operations, credit and collections

and information technology. Partially offsetting these increases

was a reduction in certain other costs resulting from lower volumes

of subscriber net additions in 2009, cost reduction and efficiency

initiatives across various functions, and the reversal of that portion

of CRTC Part II fees accruals relating to the 2009 broadcast year.

Cable Operations continues to focus on implementing cost

reduction and efficiency improvement initiatives to further control

the overall growth in operating expenses.

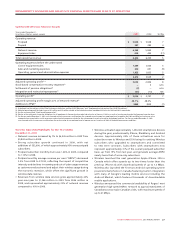

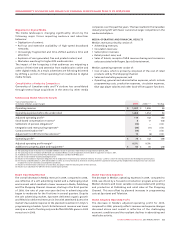

20092008

2007

2008

2007

2009

1,664

72%

67%

59%

1,5501,353

DIGITAL HOUSEHOLDS

AND PENETRATION OF

TELEVISION CUSTOMERS

(In thousands)

20092008

2007

2008

2007

2009

715568361

HIGH-DEFINITION

HOUSEHOLDS

(In thousands)

20092008

2007

2008

2007

2009

1,619

45%

44%

41%

1,5711,451

INTERNET SUBSCRIBERS

AND PENETRATION

OF HOMES PASSED (In thousands)

20092008

2007

2008

2007

2009

937

26%

24%

18%

840656

CABLE TELEPHONY SUBSCRIBERS

AND PENETRATION OF

HOMES PASSED (In thousands)

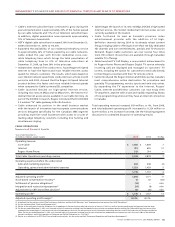

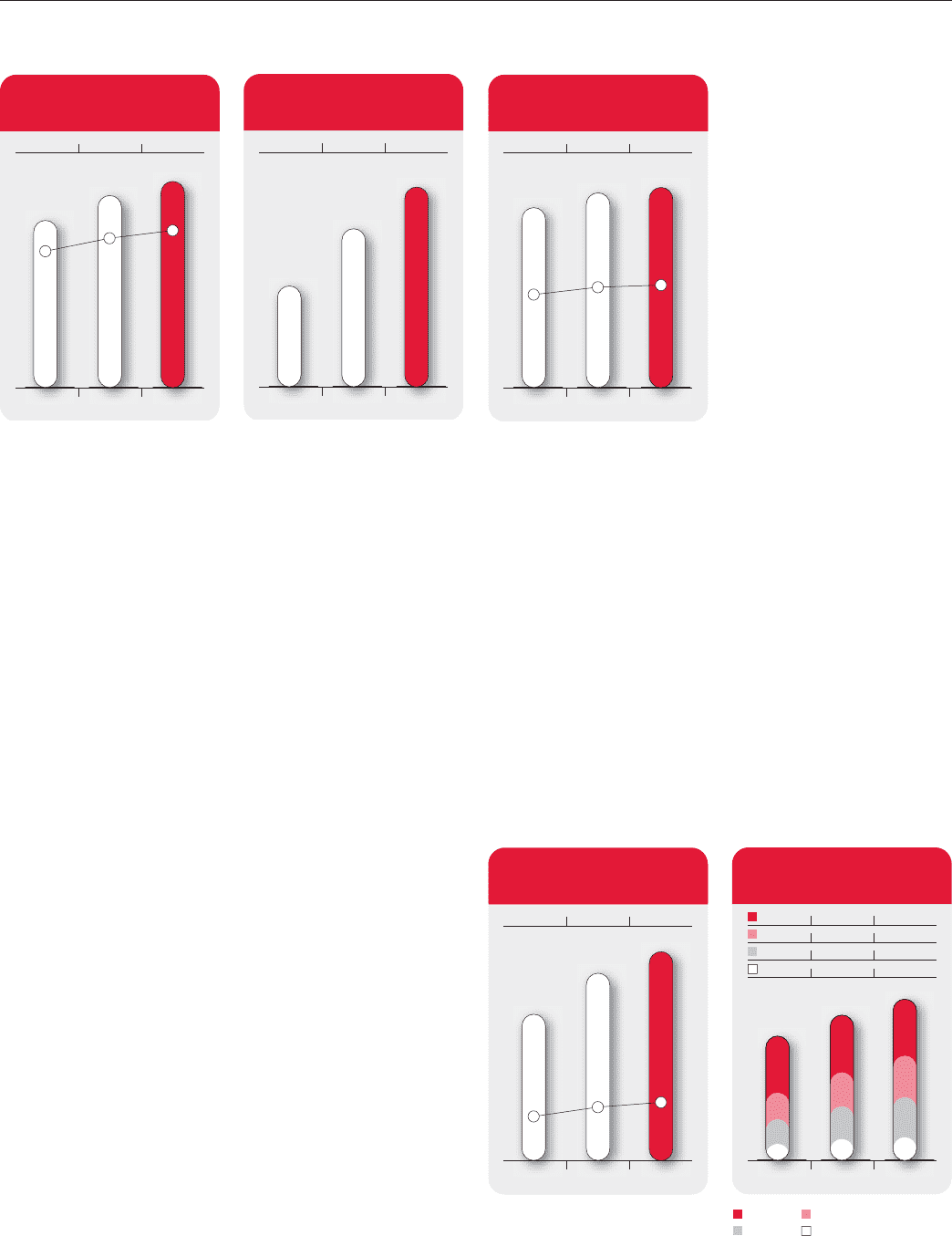

20092008

2007

2008

2007

2009

1,6641,5501,353

1,6191,5711,451

937840656

2,2962,3202,295

Television Digital

Internet Home Phone

CABLE SUBSCRIBER

BREAKDOWN

(In thousands)