Rogers 2009 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2009 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68 ROGERS COMMUNICATIONS INC. 2009 ANNUAL REPORT

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Capitalization of Direct Labour and Overhead

Certain direct labour and indirect costs associated with the

acquisition, construction, development or betterment of our

networks are capitalized to PP&E. The capitalized amounts are

calculated based on estimated costs of projects that are capital

in nature, and are generally based on a rate per hour. Although

interest costs are permitted to be capitalized during construction

under Canadian GAAP, it is our policy not to capitalize interest.

Accrued Liabilities

The preparation of financial statements requires management to

make estimates and assumptions that affect the reported amounts

of accrued liabilities at the date of the financial statements and the

reported amounts expensed during the year. Actual results could

differ from those estimates.

Amortization of Intangible Assets

We amortize the cost of finite-lived intangible assets over their

estimated useful lives. These estimates of useful lives involve

considerable judgment. During 2004 and 2005, the acquisitions of

Fido, Call-Net, the minority interests in Wireless and Sportsnet,

together with the consolidation of the Blue Jays, as well as the

acquisitions of Futureway and Citytv in 2007, and Aurora Cable and

channel m in 2008, resulted in significant increases to our intangible

asset balances. Judgment is also involved in determining that

spectrum and broadcast licences have indefinite lives, and are

therefore not amortized.

The determination of the estimated useful lives of brand names

involves historical experience, marketing considerations and the

nature of the industries in which we operate. The useful lives of

subscriber bases are based on the historical churn rates of the

underlying subscribers and judgments as to the applicability of

these rates going forward. The useful lives of roaming agreements

are based on estimates of the useful lives of the related network

equipment. The useful lives of wholesale agreements and dealer

networks are based on the underlying contractual lives. The useful

life of the marketing agreement is based on historical customer

lives. The determination of the estimated useful lives of intangible

assets impacts amortization expense in the current period as well

as future periods. The impact on net income on a full-year basis of

changing the useful lives of the finite-lived intangible assets by one

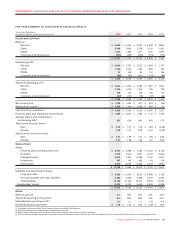

year is shown in the chart below.

Impact of Changes in Estimated Useful Lives

(In millions of dollars)

Amorization

Period

Increase in Net Income

if Life Increased by 1 year

Decrease in Net Income

if Life Decreased by 1 year

Brand names

Rogers 20.0 years $ 1 $ (1)

Fido 5.0 years $ 3 $ (5)

Citytv 5.0 years $ 0 $ (1)

Subscriber base

Rogers 4.7 years $ 30 $ (46)

Cable 3.0 years $ 2 $ (3)

Roaming agreements 12.0 years $ 3 $ (4)

Marketing agreement 5.0 years $ 2 $ (3)

Impairment of Goodwill, Indefinite-Lived Intangible Assets

and Long-Lived Assets

Indefinite-lived intangible assets, including goodwill and spectrum/

broadcast licences, as well as long-lived assets, including PP&E and

other intangible assets, are assessed for impairment on at least

an annual basis or more often if events or circumstances warrant.

These impairment tests involve the use of both undiscounted

and discounted net cash flow analyses to assess the recoverability

of the carrying value of these assets and the fair value of both

indefinite-lived and long-lived assets, if applicable. These analyses

involve estimates of future cash flows, estimated periods of use and

applicable discount rates. During 2009, we recorded an impairment

charge of $18 million related to certain of our broadcast assets, and

during 2008, we recorded an impairment charge of $294 million

relating to our conventional television business. These impairments

resulted from challenging economic conditions and weakening

industry expectations in the conventional television business and a

decline in advertising revenues.

Income Tax Estimates

We use judgment in the estimation of income taxes and future

income tax assets and liabilities. In the preparation of our

Consolidated Financial Statements, we are required to estimate

income taxes in each of the jurisdictions in which we operate.

This involves estimating actual current tax expense, together

with assessing temporary differences that result from differing

treatments in items for accounting purposes versus tax purposes,

and in estimating the recoverability of the benefits arising from tax

loss carryforwards. We are required to assess whether it is more

likely than not that future income tax assets will be realized prior

to the expiration of the related tax loss carryforwards. Judgment

is required to determine if a valuation allowance is needed against

either all or a portion of our future income tax assets. Various

considerations are reflected in this judgment, including future

profitability of related companies, tax planning strategies that

are being implemented or could be implemented to recognize the

benefits of these tax assets, as well as the expiration of the tax loss

carryforwards. Judgments and estimates made to assess the tax