Rogers 2009 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2009 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2009 ANNUAL REPORT 43

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Net Income and Net Income per Share

We recorded net income of $1,478 million in 2009, or basic and

diluted net income per share of $2.38, compared to net income of

$1,002 million, or basic and diluted net income per share of $1.57 for

the year ended December 31, 2008. This increase in net income was

primarily due to the growth in operating income, foreign exchange

gains of $136 million mainly related to foreign exchange on our

U.S. dollar-denominated debt that is not hedged for accounting

purposes, reduced by impairment losses on intangible assets and

other long-term assets related to certain of our broadcast assets of

$18 million and by $65 million related to the change in the fair value

of derivative instruments.

Income Tax Expense

As illustrated in the table below, our effective income tax rate

for the years ended December 31, 2009 and 2008 was 25.4% and

29.7%, respectively. The 2009 effective income tax rate was less

than the 2009 statutory income tax rate of 32.3% primarily due to

an income tax recovery of $58 million resulting from reductions

in substantively enacted tax rates and the $64 million release of

our valuation allowance. The release of our valuation allowance

includes $14 million relating to a decrease of foreign tax assets

arising from foreign exchange rate fluctuations, and $50 million

due to unrealized gains on financial instruments.

Other Expense (Income)

Other income of $6 million in 2009 was primarily associated with

investment income received from certain of our investments, which

decreased from $28 million in 2008.

Change in Fair Value of Derivative Instruments

In 2009 and 2008, the changes in fair value of the derivative

instruments were primarily the result of the impact of the changes

in the value of the Canadian dollar relative to that of the U.S. dollar

related to the cross-currency interest rate exchange agreements

(“Derivatives”) hedging the US$350 million Senior Notes due 2038

that have not been designated as hedges for accounting purposes.

During 2009, the Canadian dollar strengthened by 17 cents versus

the U.S. dollar, while during 2008, the Canadian dollar weakened

by 24 cents versus the U.S. dollar. We have recorded our Derivatives

at an estimated credit-adjusted mark-to-market valuation. For the

impact, refer to the section entitled “Fair Value for Derivatives”.

Foreign Exchange Gain (Loss)

During 2009, the Canadian dollar strengthened by 17 cents

versus the U.S. dollar resulting in a foreign exchange gain of $136

million, primarily related to US$750 million of our U.S. dollar-

denominated long-term debt that is not hedged for accounting

purposes, comprising the US$400 million of Subordinated Notes

due 2012, which were not hedged and which were redeemed in

December 2009, and US$350 million of Senior Notes due 2038 for

which the Derivatives have not been designated as hedges for

accounting purposes. During 2008, the Canadian dollar weakened

During 2008, we recorded an

income tax credit of $65 million

arising from the harmonization

of the Ontario provincial income

tax system within the Canadian

federal income tax system. The

resulting income tax credit will

be available to reduce future

Ontario income taxes until 2013.

In addition, we recorded an

increase in income tax expense

of $51 million to recognize

that impairment losses on

go o d w ill an d in t an g i b le

assets are not deductible for

income tax purposes, and an

income tax recovery of $33

million reflecting the effect of

scheduled tax rate changes. We

also recorded an increase of $19 million in our valuation allowance

to offset the increase in foreign tax assets due to foreign exchange

rate fluctuations.

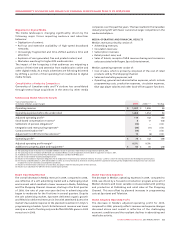

Income tax expense varies from the amounts that would be

computed by applying the statutory income tax rate to income

before income taxes for the following reasons:

20092008

2007

2008

2007

2009

$1,556$1,260$1,066

CONSOLIDATED ADJUSTED

NET INCOME

(In millions of dollars)

Years ended December 31,

(In millions of dollars) 2009 2008

Statutory income tax rates 32.3% 32.7%

Income before income taxes $ 1,980 $ 1,426

Income tax expense at statutory income tax rate

on income before income taxes $ 640 $ 466

Increase (decrease) in income taxes resulting from:

Ontario income tax harmonization credit – (65)

Change in valuation allowance (64) 19

Effect of tax rate changes (58) (33)

Impairment losses on goodwill and intangible assets not

deductible for income tax purposes – 51

Other items (16) (14)

Income tax expense $ 502 $ 424

Effective income tax rate 25.4% 29.7%