Rogers 2009 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2009 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48 ROGERS COMMUNICATIONS INC. 2009 ANNUAL REPORT

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

securities inasmuch as such ratings do not comment as to market

price or suitability for a particular investor. There is no assurance

that any rating will remain in effect for any given period of time,

or that any rating will not be revised or withdrawn entirely by a

rating agency in the future if in its judgment circumstances so

warrant. The ratings on RCI’s senior debt of BBB from Standard &

Poor’s and Fitch and of Baa2 from Moody’s represent investment

grade ratings.

Deficiency of Pension Plan Assets Over Accrued Obligations

In 2009, we made a lump-sum contribution of $61 million to our

pension plans, following which the pension plans purchased $172

million of annuities from insurance companies for employees

in the pension plans who had retired as of January 1, 2009. The

purchase of the annuities relieves us of primary responsibility for,

and eliminates significant risk associated with, the accrued benefit

obligation for the retired employees. The non-cash settlement loss

arising from this settlement of pension obligations was $30 million

and was recorded in 2009.

As disclosed in Note 17 to our 2009 Audited Consolidated Financial

Statements, our pension plans had a deficiency of plan assets over

accrued obligations of $8 million and $66 million at December 31,

2009, and December 31, 2008, respectively, related to funded plans,

and a deficiency of $31 million and $27 million at December 31, 2009

and December 31, 2008, respectively, related to unfunded plans.

Our pension plans had a deficiency on a solvency basis at December

31, 2008, and is anticipated to have a deficiency on a solvency basis

at December 31, 2009. Consequently, in addition to our regular

contributions, we are making certain minimum monthly special

payments to eliminate the solvency deficiency. In 2009, the special

payment totalled approximately $34 million. Our total estimated

annual funding requirements, which include both our regular

contributions and these special payments, are expected to decrease

from $120 million in 2009 (which included the $61 million lump

sum contribution discussed above) to $56 million in 2010, subject

to annual adjustments thereafter, due to various market factors

and the assumption that our staffing levels will remain relatively

stable year-over-year. We are contributing to the plans on this basis.

As further discussed in the section of this MD&A entitled “Critical

Accounting Estimates”, changes in factors such as the discount rate,

the rate of compensation increase and the expected return on

plan assets can impact the accrued benefit obligation, pension

expense and the deficiency of plan assets over accrued obligations

in the future.

INTEREST RATE AND FOREIGN EXCHANGE MANAGEMENT

Economic Hedge Analysis

For the purposes of our discussion on the hedged portion of long-

term debt, we have used non-GAAP measures in that we include all

Derivatives, whether or not they qualify as hedges for accounting

purposes, since all such Derivatives are used for risk management

purposes only and are designated as a hedge of specific debt

instruments for economic purposes. As a result, the Canadian dollar

equivalent of U.S. dollar-denominated long-term debt reflects

the contracted foreign exchange rate for all of our Derivatives

regardless of qualifications for accounting purposes as a hedge.

On December 15, 2009, we redeemed the entire outstanding

principal amount of our US$400 million 8.00% Senior Subordinated

Notes due 2012, which were not hedged on an economic basis nor

on an accounting basis. As a result of the redemption of these

unhedged Senior Subordinated Notes due 2012, on December 31,

2009, 100% of our U.S. dollar-denominated debt was hedged on an

economic basis while 94% of our U.S. dollar-denominated debt was

hedged on an accounting basis. The Derivatives hedging our US$350

million 7.50% Senior Notes due 2038 do not qualify as hedges for

accounting purposes.

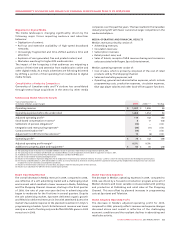

Consolidated Hedged Position

Years ended December 31,

(In millions of dollars, except percentages) December 31, 2009 December 31, 2008

U.S. dollar-denominated long-term debt US $ 5,540 US $ 5,940

Hedged with Derivatives US $ 5,540 US $ 5,540

Hedged exchange rate 1.2043 1.2043

Percent hedged 100.0%(1) 93.3%

Amount of long-term debt(2) at fixed rates:

Total long-term debt Cdn $ 9,307 Cdn $ 8,383

Total long-term debt at fixed rates Cdn $ 9,307 Cdn $ 7,798

Percent of long-term debt fixed 100.0% 93.0%

Weighted average interest rate on long-term debt 7.27% 7. 29%

(1) Pursuant to the requirements for hedge accounting under Canadian Institute of Chartered Accountants (“CICA”) Handbook Section 3865, Hedges, on December 31, 2009, RCI accounted for 93.5% of its

Derivatives as hedges against designated U.S. dollar denominated debt. As a result, 93.7% of our U.S. dollar-denominated debt is hedged for accounting purposes versus 100% on an economic basis.

(2) Long-term debt includes the effect of the Derivatives.