Rogers 2009 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2009 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2009 ANNUAL REPORT 73

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Customer Loyalty Programs

IFRIC 13 Customer Loyalty Programmes (“IFRIC 13”) requires a

revenue approach in accounting for customer loyalty programs.

Canadian GAAP does not provide specific guidance on accounting

for customer loyalty programs. We have adopted a liability approach

for our customer loyalty program offered to Fido subscribers. The

current policy is to classify the liability for loyalty points as an

accrued liability on the balance sheet and to record the net cost of

the program in equipment revenue. The liability is initially recorded

at the face value of the loyalty awards granted and subsequently

adjusted based on redemption rates. The application of IFRIC 13

is expected to result in a reclassification of revenue between the

Network and Equipment categories as well as a reclassification on

the balance sheet for the deferred revenue balance from Accrued

Liabilities to Unearned Revenue. Furthermore, we will also be

required to defer a portion of the revenue for the initial sales

transaction in which the awards are granted based on the fair

value of the awards granted. While we have not yet calculated the

impact of applying the revenue approach for the accounting for

loyalty programs, we expect the difference to be insignificant on

adoption of IFRS.

Impairment of Assets

International Accounting Standard 36, Impairment of Assets

(“IAS 36”), uses a one-step approach for both testing for and

measurement of impairment, with asset carrying values compared

directly with the higher of fair value less costs to sell and value in

use (which uses discounted future cash flows). Canadian GAAP

however, uses a two-step approach to impairment testing: first

comparing asset carrying values with undiscounted future cash

flows to determine whether impairment exists; and then measuring

any impairment by comparing asset carrying values with fair

values. The difference in methodologies may potentially result in

additional asset impairments upon transition to IFRS.

Additionally, under Canadian GAAP assets are grouped at the lowest

level for which identifiable cash flows are largely independent of

the cash flows of other assets and liabilities for impairment testing

purposes. IFRS requires that assets be tested for impairment at

the level of cash generating units, which is the lowest level of

assets that generate largely independent cash inflows. This lower

level grouping could result in identification of impairment more

frequently under IFRS, but of potentially smaller amounts.

However, with the exception of goodwill, new write-downs may

potentially be offset by the requirement under IAS 36 to reverse

any previous impairment losses where circumstances have changed.

Canadian GAAP prohibits reversal of impairment losses.

At this time we have not yet finalized the impairment testing for

the opening balance sheet under IFRS and are unable to state

whether or not the results would differ from our Canadian GAAP

impairment tests.

Provisions for Onerous Contracts

IAS 37 Provisions, Contingent Liabilities and Contingent Assets (“IAS

37”), requires an entity to recognize a provision when a contract

becomes onerous, that is when it has a contract in which the

unavoidable costs of meeting the obligations under the contract

exceed the economic benefits expected to be received under it.

The unavoidable costs under a contract reflect the least net cost of

exiting from the contract, which is the lower of the cost of fulfilling

it and any compensation or penalties arising from failure to fulfill

it. If an entity has a contract that is onerous, the present obligation

under the contract shall be recognized and measured as a provision.

Canadian GAAP only requires the recognition of such a liability

in certain situations (e.g. for operating leases that the entity has

ceased to use). This difference could result in recognition of an

obligation under IFRS that was not previously recognized under

Canadian GAAP. The Company is in the process of reviewing all

contracts to determine if any were onerous at the date of transition

and cannot yet reliably quantify the impact of this difference on

the opening balance sheet.

First-Time Adoption of International Financial Reporting

Standards

Our adoption of IFRS will require the application of IFRS 1, First-Time

Adoption of International Financial Reporting Standards (“IFRS 1”),

which provides guidance for an entity’s initial adoption of IFRS. IFRS

1 generally requires that an entity apply all IFRS effective at the

end of its first IFRS reporting period retrospectively. However, IFRS

1 does include certain mandatory exceptions and limited optional

exemptions in specified areas of certain standards from this general

requirement. The following are the significant optional exemptions

available under IFRS 1 that we expect to apply in preparing our first

financial statements under IFRS.

The information above is provided to allow investors and others to

obtain a better understanding of our IFRS changeover plan and the

resulting possible effects on, for example, our financial statements

and operating performance measures. Readers are cautioned,

however, that it may not be appropriate to use such information for

any other purpose. This information also reflects our most recent

assumptions and expectations; circumstances may arise, such as

changes in IFRS, regulations or economic conditions, which could

change these assumptions or expectations.

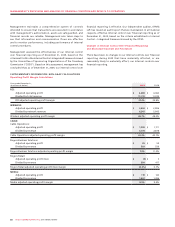

Business

Combinations

We expect to elect to not restate any

Business Combinations that have occurred

prior to January 1, 2010.

Borrowing

Costs

We expect to elect to apply the

requirements of IAS 23 Borrowing Costs

prospectively from January 1, 2010.

Employee

Benefits

We expect to elect to recognize any

actuarial gains/losses as at January 1, 2010

in retained earnings.