Rogers 2009 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2009 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2009 ANNUAL REPORT 45

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

information technology functions ($23 million); iii) the integration

of previously acquired businesses and related restructuring

($3 million); and iv) the closure of certain retail stores ($4 million).

Contract Termination Fees

During the year ended December 31, 2009, the Blue Jays released

certain players from the remaining term of their contracts, which

resulted in a $19 million charge to operating profit.

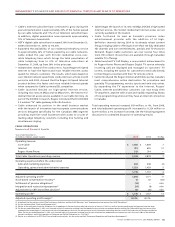

Adjusted Operating Profit

As discussed above, Wireless and Cable both contributed to the

increase in adjusted operating profit for the year ended December

31, 2009, partially offset by a decrease in Media’s adjusted operating

profit for 2009 compared to 2008.

Consolidated adjusted operating profit increased to $4,388 million

in 2009, compared to $4,060 million in 2008. Adjusted operating

profit excludes: (i) stock-based compensation (recovery) expense

of $(33) million in 2009 and $(100) million in 2008; (ii) integration

and restructuring expenses of $117 million in 2009 and $51 million

in 2008; (iii) an adjustment for CRTC Part II fees related to prior

periods of $(61) million in 2009 and $31 million in 2008; (iv) contract

termination fees of $19 million in 2009; and (v) pension settlement

of $30 million in 2009.

For details on the determination of adjusted operating profit, which

is a non-GAAP measure, see the sections entitled “Supplementary

Information: Non-GAAP Calculations” and “Key Performance

Indicators and Non-GAAP Measures”.

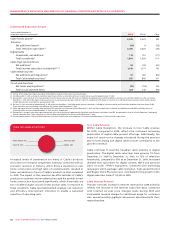

Employees

Employee remuneration represents a material portion of our

expenses. At December 31, 2009, we had approximately 25,900

full-time equivalent employees (“FTEs”) across all of our operating

groups, including our shared services organization and corporate

office, which was essentially unchanged from the level at

December 31, 2008. Increases in our shared services staffing and

customer facing functions were partially offset by reductions

associated with operational efficiencies and the integration of our

Cable and Wireless organizations during the year and reductions

in Media associated with improvements to its cost structure. Total

remuneration paid to employees (both full and part-time) in 2009

was approximately $1,715 million, an increase of approximately $149

million from $1,566 million in 2008. The increase in remuneration

paid to employees is primarily attributed to the change in

stock prices resulting in a $33 million recovery to stock-based

compensation compared to a $100 million recovery in 2008 and an

increase in the FTEs during the first half of 2009 compared to 2008.

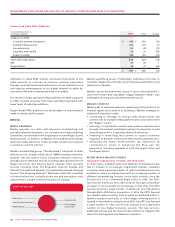

ADDITIONS TO PP&E

For details on the additions of PP&E for the Wireless, Cable and

Media segments, refer to the section entitled “Segment Review”.

Corporate Additions to PP&E

The corporate additions to PP&E included $151 million for the

year ended December 31, 2009 and $38 million for the year ended

December 31, 2008, both of which related to spending on an

enterprise-wide billing and business support system initiative.

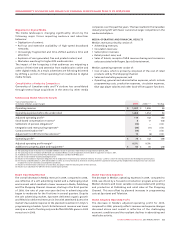

3. CONSOLIDATED LIQUIDITY AND FINANCING

LIQUIDITY AND CAPITAL RESOURCES

Operations

For 2009, cash generated from operations before changes in

non-cash operating items, which is calculated by removing the effect

of all non-cash items from net income, increased to $3,526 million

from $3,500 million in 2008. The $26 million increase is primarily the

result of a $328 million increase in adjusted operating profit, most

notably offset by the $66 million increase in the integration and

restructuring charge, $72 million increase in interest expense and

$61 million cash contribution to the Company’s pension plans to

fund annuity purchases.

Taking into account the changes in non-cash working capital

items for 2009, cash generated from operations was $3,790

million, compared to $3,285 million in 2008. The cash generated

from operations of $3,790 million, together with the following

items, resulted in total net funds of approximately $5,795 million

generated or raised in 2009:

• Receipt of $2.0 billion aggregate gross proceeds from the issu-

ance of $1.0 billion 5.80% Senior Notes due 2016, $500 million

5.38% Senior Notes due 2019 and $500 million 6.68% Senior Notes

due 2039 public debt;

• Receipt of $3 million from the issuance of Class B Non-Voting

shares under the exercise of employee stock options; and

• Receipt of $2 million in net proceeds from the settlement of

US$408 million aggregate amount of forward contracts

relating to the redemption of our US$400 million 8.00%

Senior Subordinated Notes due 2012.

Net funds used during 2009 totalled approximately $5,393 million,

the details of which include the following:

• Additions to PP&E of $1,910 million, including $55 million of

related changes in non-cash working capital;

• The purchase for cancellation of 43,776,200 Class B Non-Voting

shares for an aggregate purchase price of $1,347 million;

• The payment of quarterly dividends aggregating $704 million on

our Class A Voting and Class B Non-Voting shares;

• Net repayments under our bank credit facility aggregating $585

million and capital leases aggregating $1 million;

• Payment of $424 million for the redemption of our US$400 million

8.00% Subordinated Notes due 2012 and $8 million repayment

premium;

• Additions to program rights aggregating $185 million;

• The payment of $40 million for the acquisition of the spectrum

licences of Look Communications; and

• Acquisitions and other net investments aggregating $189 million,

including $163 million to purchase 3.2 million shares of Cogeco

Cable Inc. and 1.6 million shares of Cogeco Inc., $11 million to

acquire K-Rock and KIX Country, Kingston FM radio stations, and

$15 million of other net investments.

Taking into account the cash deficiency of $19 million at the

beginning of the year and the cash sources and uses described

above, cash and cash equivalents at December 31, 2009 was

$383 million.