Rogers 2009 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2009 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2009 ANNUAL REPORT 105

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

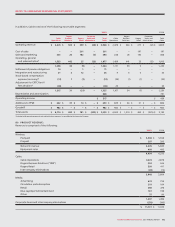

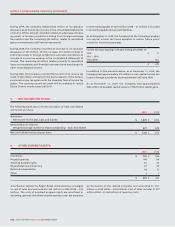

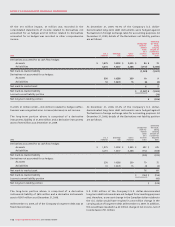

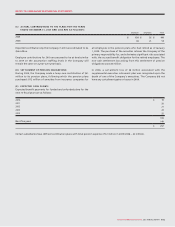

14. LONG-TERM DEBT:

Due

date

Principal

amount

Interest

rate 2009 2008

Corporate:

Bank credit facility Floating $ – $ 585

Senior Notes 2016 $ 1,000 5.80% 1,000 –

Senior Notes 2018 U.S. 1,400 6.80% 1,471 1,714

Senior Notes 2019 500 5.38% 500 –

Senior Notes 2038 U.S. 350 7.50% 368 429

Senior Notes 2039 500 6.68% 500 –

Formerly Rogers Wireless Inc.:

Senior Notes 2011 U.S. 490 9.625% 515 600

Senior Notes 2011 460 7.625% 460 460

Senior Notes 2012 U.S. 470 7.25% 494 575

Senior Notes 2014 U.S. 750 6.375% 788 918

Senior Notes 2015 U.S. 550 7.50% 578 673

Senior Subordinated Notes 2012 U.S. 400 8.00% –490

Fair value increment arising from purchase accounting 612

Formerly Rogers Cable Inc.:

Senior Notes 2011 175 7. 25% 175 175

Senior Notes 2012 U.S. 350 7.875% 368 429

Senior Notes 2013 U.S. 350 6.25% 368 429

Senior Notes 2014 U.S. 350 5.50% 368 429

Senior Notes 2015 U.S. 280 6.75% 294 343

Senior Debentures 2032 U.S. 200 8.75% 210 245

Capital leases and other Various 11

8,464 8,507

Less current portion 11

$ 8,463 $ 8,506

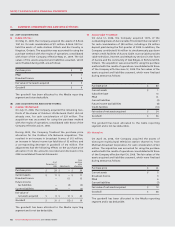

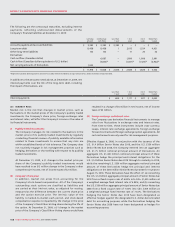

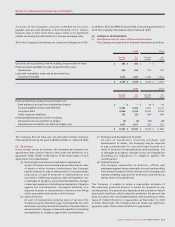

(A) ISSUANCE OF SENIOR NOTES:

On November 4, 2009, the Company issued $500 million of 5.38%

Senior Notes which mature on November 4, 2019 and $500 million of

6.68% Senior Notes which mature on November 4, 2039. The notes

are redeemable, in whole or in part, at the Company’s option, at any

time, subject to a certain prepayment premium. The net proceeds

from the offering were approximately $993 million after deduction

of the original issue discount of $1 million, and debt issuance costs

of $6 million related to this issuance, which were incurred and

expensed in 2009.

On May 26, 2009, the Company issued $1.0 billion of 5.80% Senior

Notes which mature on May 26, 2016. The notes are redeemable, in

whole or in part, at the Company’s option, at any time, subject to a

certain prepayment premium. The net proceeds from the offering

were approximately $993 million after deduction of the original

issue discount of $2 million and debt issuance costs of $5 million

related to this issuance, which were incurred and expensed in 2009.

On August 6, 2008, the Company issued U.S.$1.4 billion of 6.80%

Senior Notes which mature on August 15, 2018 and U.S.$350 million

of 7.50% Senior Notes which mature on August 15, 2038. Each of

these notes is redeemable, in whole or in part, at the Company’s

option, at any time, subject to a certain prepayment premium.

Simultaneously, the Company entered into Derivatives (note 15(d)).

The net proceeds from the offering were approximately $1,774

million after deduction of the original issue discount of $2 million,

and debt issuance costs of $16 million, which were incurred and

expensed in 2008.

(B) BANK CREDIT FACILITY:

The bank credit facility provides the Company with up to $2.4 billion

from a consortium of Canadian financial institutions. The bank

credit facility is available on a fully revolving basis until maturity

on July 2, 2013, and there are no scheduled reductions prior to

maturity. The interest rate charged on the bank credit facility

ranges from nil to 0.5% per annum over the bank prime rate or base

rate or 0.475% to 1.75% over the bankers’ acceptance rate or the

London Inter-Bank Offered Rate (“LIBOR”). The Company’s bank

credit facility is unsecured and ranks pari passu with the Company’s

senior public debt and Derivatives. The bank credit facility requires

that the Company satisfy certain financial covenants, including the

maintenance of certain financial ratios.

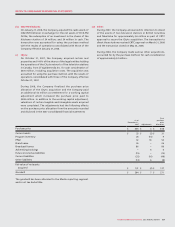

(C) SENIOR NOTES, DEBENTURES AND SENIOR

SUBORDINATED NOTES:

Interest is paid semi-annually on all of the Company’s notes

and debentures.

Each of the Company’s Senior Notes, Debentures and Senior

Subordinated Notes are redeemable, in whole or in part, at

the Company’s option, at any time, subject to a certain prepayment

premium.