Rogers 2009 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2009 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70 ROGERS COMMUNICATIONS INC. 2009 ANNUAL REPORT

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Allowance for Doubtful Accounts

A significant portion of our revenue is earned from selling on credit

to individual consumers and business customers. The allowance

for doubtful accounts is calculated by taking into account factors

such as our historical collection and write-off experience, the

number of days the customer is past due and the status of the

customer’s account with respect to whether or not the customer is

continuing to receive service. As a result, fluctuations in the aging

of subscriber accounts will directly impact the reported amount of

bad debt expense. For example, events or circumstances that result

in a deterioration in the aging of subscriber accounts will in turn

increase the reported amount of bad debt expense. Conversely,

as circumstances improve and customer accounts are adjusted and

brought current, the reported bad debt expense will decline.

NEW ACCOUNTING STANDARDS

Goodwill and Intangible Assets

In 2008, the CICA issued Handbook Section 3064, Goodwill and

Intangible Assets (“CICA 3064”). CICA 3064, which replaces Section

3062, Goodwill and Intangible Assets, and Section 3450, Research

and Development Costs, establishes standards for the recognition,

measurement and disclosure of goodwill and intangible assets.

The provisions relating to the definition and initial recognition of

intangible assets, including internally generated intangible assets,

are equivalent to the corresponding provisions of IAS 38, Intangible

Assets. This new standard is effective for our Interim and Annual

Consolidated Financial Statements commencing January 1, 2009

and was applied retrospectively, with restatement of prior periods.

The adoption of CICA 3064 resulted in a $16 million decrease in

long-term other assets relating to deferred commissions and pre-

operating costs, and an $11 million decrease in retained earnings

at January 1, 2008, net of income taxes of $5 million and had no

material impact on previously reported net income in 2008.

Financial Instruments – Disclosures

In June 2009, the CICA amended Section 3862, “Financial Instruments

– Disclosures”, to include additional disclosure requirements about

fair value measurement for financial instruments and liquidity risk

disclosures. These amendments require a three-level hierarchy

that reflects the significance of the inputs used in making the fair

value measurements. Fair value of financial assets and financial

liabilities included in Level 1 are determined by reference to

quoted prices in active markets for identical assets and liabilities.

Assets and liabilities in Level 2 include valuations using inputs

other than the quoted prices for which all significant inputs are

based on observable market data, either directly or indirectly.

Level 3 valuations are based on inputs that are not based on

observable market data. The amendments to Section 3862 apply for

annual financial statements relating to fiscal years ending after

September 30, 2009.

The amendment to this standard did not have any impact

on the classification and measurement of our financial instruments.

The new disclosures pursuant to these new Handbook Sections

are included in Note 15 of the 2009 Audited Consolidated

Financial Statements.

RECENT CANADIAN ACCOUNTING PRONOUNCEMENTS

Business Combinations

In October 2008, the CICA issued Handbook Section 1582, Business

Combinations (“CICA 1582”), concurrently with Handbook Sections

1601, Consolidated Financial Statements (“CICA 1601”), and 1602,

Non-Controlling Interests (“CICA 1602”). CICA 1582, which replaces

Handbook Section 1581, Business Combinations, establishes

standards for the measurement of a business combination and

the recognition and measurement of assets acquired and liabilities

assumed. CICA 1601, which replaces Handbook Section 1600,

carries forward the existing Canadian guidance on aspects of

the preparation of consolidated financial statements subsequent

to acquisition other than non-controlling interests. CICA 1602

establishes guidance for the treatment of non-controlling interests

subsequent to acquisition through a business combination. These

new standards are effective for the Company’s interim and annual

consolidated financial statements commencing on January 1, 2011

with earlier adoption permitted as of the beginning of a fiscal year.

The Company is assessing the impact of the new standards on its

consolidated financial statements.

Multiple Deliverable Revenue Arrangements

In December 2009, the CICA issued EIC-175, Multiple Deliverable

Revenue Arrangements (“EIC-175”). EIC-175, which replaces EIC-142,

Revenue Arrangements with Multiple Deliverables, addresses some

aspects of the accounting by a vendor for arrangements under

which it will perform multiple revenue-generating activities. These

new standards are effective for the Company’s interim and annual

consolidated financial statements commencing on January 1, 2011

with earlier adoption permitted as of the beginning of a fiscal year.

The Company is assessing the impact of the new standards on its

consolidated financial statements.

International Financial Reporting Standards (“IFRS”)

In February 2008, the Accounting Standards Board (“AcSB”)

confirmed that IFRS will be mandatory in Canada for profit-oriented

publicly accountable entities for fiscal periods beginning on or after

January 1, 2011. Our first annual IFRS financial statements will be for

the year ending December 31, 2011 and will include the comparative

period of 2010. Starting in the first quarter of 2011, we will provide

unaudited consolidated financial information in accordance with

IFRS including comparative figures for 2010.

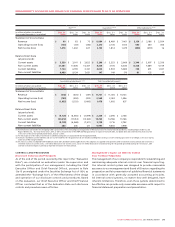

The following table illustrates key elements of our conversion plan,

our major milestones and current status. Our conversion plan is

organized in phases over time and by area. We have completed all

activities to date per our detailed project plan and expect to meet

all milestones through to completion of the conversion to IFRS.

During the fourth quarter, we have finalized the changes to our

systems and processes required for implementation to ensure we

are ready for our conversion strategy to produce a parallel set of

IFRS financial records in 2010.