Rogers 2009 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2009 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2009 ANNUAL REPORT 51

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

In February 2010, the Board

adopted a dividend policy

which increased the annual

dividend rate from $1.16 to $1.28

per Class A Voting and Class

B Non-Voting share effective

immediately to be paid in

quarterly amounts of $0.32 per

share. Such quarterly dividends

are only payable as and when

declared by our Board and

there is no entitlement to any

dividend prior thereto.

In addition, on February 17,

2010, the Board declared a

quarterly dividend totalling

$0.32 per share on each of its

outstanding Class B Non-Voting

shares and Class A Voting shares, such dividend to be paid on April

1, 2010, to shareholders of record on March 5, 2010, and is the first

quarterly dividend to reflect the newly increased $1.28 per share

annual dividend level.

In February 2009, the Board adopted a dividend policy which

increased the annual dividend rate from $1.00 to $1.16 per Class

A Voting and Class B Non-Voting share effective with the next

quarterly dividend.

In January 2008, the Board approved an increase in the annual

dividend from $0.50 to $1.00 per Class A Voting and Class B

Non-Voting share effective with the next quarterly dividend.

In May 2007, the Board approved an increase in the annual

dividend from $0.16 to $0.50 per share effective with the next

quarterly dividend.

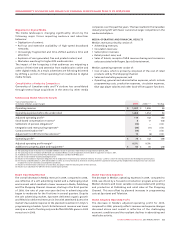

COMMITMENTS AND OTHER CONTRACTUAL OBLIGATIONS

Contractual Obligations

Our material obligations under firm contractual arrangements are

summarized below at December 31, 2009. See also Notes 14, 15 and

23 to the 2009 Audited Consolidated Financial Statements.

20092008

2007

2008

2007

2009

$1.16$1.00$0.50

ANNUALIZED DIVIDENDS

PER SHARE AT YEAR END

($)

CASH RETURNED TO SHAREHOLDERS

(In millions of dollars)

2009

Stock option buybacks: $63

Dividends: $704

$2,114

Share buybacks: $1,347

Material Obligations Under Firm Contractual Arrangements

(In millions of dollars) Less Than 1 Year 1-3 Years 4-5 Years After 5 Years Total

Long-term debt(1) – 2,012 1,524 4,922 8,458

Derivative instruments(2) – 503 282 69 854

Capital leases and other 1 – – – 1

Operating leases 156 225 143 78 602

Player contracts 91 62 54 11 218

Purchase obligations(3) 603 763 380 308 2,054

Pension obligation(4) 55 – – – 55

Other long-term liabilities – 71 20 42 133

Total 906 3,636 2,403 5,430 12,375

(1) Amounts reflect principal obligations due at maturity.

(2) Amounts reflect net disbursements due at maturity.

(3) Purchase obligations consist of agreements to purchase goods and services that are enforceable and legally binding and that specify all significant terms, including fixed or minimum quantities to be

purchased, price provisions and timing of the transaction. In addition, we incur expenditures for other items that are volume-dependent.

(4) Represents expected contributions to our pension plans in 2010. Contributions for the year ended December 31, 2011 and beyond cannot be reasonably estimated as they will depend on future economic

conditions and may be impacted by future government legislation.