Rogers 2009 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2009 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

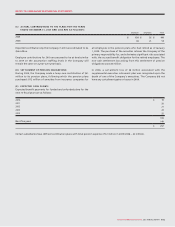

ROGERS COMMUNICATIONS INC. 2009 ANNUAL REPORT 121

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

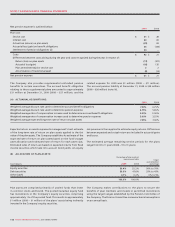

(A) The Company is committed, under the terms of its licences

issued by Industry Canada, to spend 2% of certain wireless revenues

earned in each year on research and development activities over

the license period.

(B) The Company enters into agreements with suppliers to provide

services and products that include minimum spend commitments.

The Company has agreements with certain telecommunications

companies that guarantee the long-term supply of network facilities

and agreements relating to the operations and maintenance of

the network.

(C) In the ordinary course of business and in addition to the

amounts recorded on the consolidated balance sheets and disclosed

elsewhere in the notes, the Company has entered into agreements

to acquire broadcasting rights to programs and films over the next

five years at a total cost of approximately $387 million. In addition,

the Company has commitments to pay access fees over the next

year totalling approximately $18 million.

(D) Pursuant to CRTC regulation, the Company is required to make

contributions to the Canadian Television Fund (“CTF”), which is a

cable industry fund designed to foster the production of Canadian

television programming. Contributions to the CTF are based on

a formula, including gross broadcast revenues and the number

of subscribers. The Company may elect to spend a portion of the

above amount for local television programming and may also elect

to contribute a portion to another CRTC-approved independent

production fund. The Company estimates that its total contribution

for 2010 will amount to approximately $74 million.

(E) Pursuant to CRTC regulation, the Company is required to

pay certain telecom contribution fees. These fees are based on a

formula including certain types of revenue, including the majority

of wireless revenue. The Company estimates that these fees for 2010

will amount to approximately $50 million.

(F) Pursuant to Industry Canada regulation, the Company is

required to pay certain fees for the use of its licensed radio spectrum.

These fees are primarily based on the bandwidth and population

covered by the spectrum licence. The Company estimates that these

fees for 2010 will amount to $78 million.

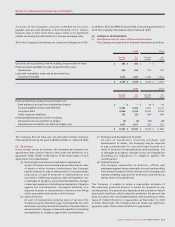

(G) In addition to the items listed above, the future minimum

lease payments under operating leases for the rental of premises,

distribution facilities, equipment and microwave towers,

commitments for player contracts, purchase obligations and other

contracts, including outsourcing arrangements, at December 31,

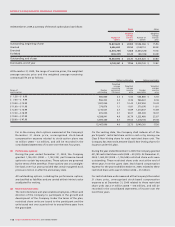

2009 are as follows:

Year ending December 31:

2010 $ 850

2011 638

2012 412

2013 303

2014 274

2015 and thereafter 397

$ 2,874

Re nt e x p e n s e f o r 2 0 0 9 a m o u nt e d t o $181 mi lli o n

(2008 – $178 million).

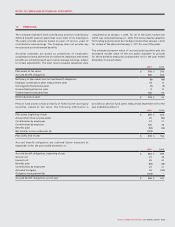

These transactions are recorded at the exchange amount, being the

amount agreed to by the related parties, and are reviewed by the

Audit Committee.

In January 2010, with the approval of the Board of Directors, the

Company closed an agreement to sell the Company’s aircraft

to a private Rogers’ family holding company for cash proceeds

of U.S. $18 million. The terms of the sale were negotiated by a

Special Committee of the Board of Directors comprised entirely

of independent directors. The Special Committee was advised by

several independent parties knowledgeable in aircraft valuations

to ensure that the sale price was within a range that was reflective

of current market value. As the aircraft was held for sale at

December 31, 2009, an additional $5 million of depreciation was

recorded in 2009 to write down the net book value of the aircraft to

approximate the amount realized from the sale of the aircraft.

23. COMMITMENTS: