Rogers 2009 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2009 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2009 ANNUAL REPORT 49

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Fair Value of Derivatives

In accordance with Canadian GAAP, we have recorded our

Derivatives using an estimated credit-adjusted mark-to-market

valuation which is determined by increasing the treasury-related

discount rates used to calculate the risk-free estimated mark-to-

market valuation by an estimated bond spread (“Bond Spread”) for

the relevant term and counterparty for each derivative. In the case of

Derivatives accounted for as assets by Rogers (i.e. those Derivatives

for which the counterparties owe Rogers), the Bond Spread for

the bank counterparty was added to the risk-free discount rate to

determine the estimated credit-adjusted value whereas, in the case

of Derivatives accounted for as liabilities (i.e. those Derivatives for

which Rogers owes the counterparties), Rogers’ Bond Spread was

added to the risk-free discount rate. The estimated credit-adjusted

values of the Derivatives are subject to changes in credit spreads of

Rogers and its counterparties.

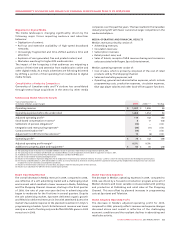

The effect of estimating the credit-adjusted fair value of

Derivatives at December 31, 2009, versus the unadjusted risk-free

mark-to-market value of Derivatives is illustrated in the table below.

As at December 31, 2009, the credit-adjusted estimated net liability

value of Rogers’ Derivatives portfolio was $1,002 million, which

is $25 million less than the unadjusted risk-free mark-to-market

net liability value.

Fixed 100% Floating 0%Fixed 93% Floating 7%Fixed 83% Floating 17%

FIXED VERSUS FLOATING DEBT COMPOSITION

(% at December 31)

200920082007

(In millions of dollars)

Derivatives in an

asset position (A)

Derivatives in a

liability position (B)

Net liability

position (A + B)

Mark-to-market value - risk-free analysis $ 94 $ (1,121) $ (1,027)

Mark-to-market value - credit-adjusted estimate (carrying value) $ 82 $ (1,084) $ (1,002)

Difference $ (12) $ 37 $ 25

Long-Term Debt Plus Net Derivative Liabilities

The aggregate of our long-term debt plus net derivative liabilities

at the mark-to-market values using risk-free analysis (“the risk-free

analytical value”) is used by us and many analysts to most closely

represent the Company’s net debt-related obligations for valuation

purposes, and is calculated as follows:

(In millions of dollars) December 31, 2009 December 31, 2008

Long-term debt(1) $ 8,464 $ 8,507

Net derivative liabilities at the

risk-free analytical value(1) $ 1,027 $ 144

Total $ 9,491 $ 8,651

(1) Includes current and long-term portions.

We believe that the non-GAAP financial measure of long-term

debt plus net derivative liabilities (assets) at the risk-free analytical

value provides the most relevant and practical measure of our

outstanding net debt-related obligations. We use this non-GAAP

measure internally to conduct valuation-related analysis and make

capital structure related decisions and it is reviewed regularly by

management. It is also useful to investors and analysts in enabling

them to analyze the enterprise and equity value of the Company

and to assess various leverage ratios as performance measures. This

non-GAAP measure does not have a standardized meaning and

should be viewed as a supplement to, and not a substitute for, our

results of operations or financial position reported under Canadian

and U.S. GAAP.