Rogers 2009 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2009 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2009 ANNUAL REPORT 71

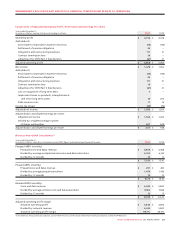

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

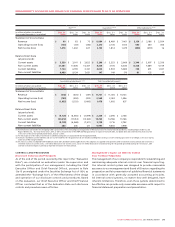

ACTIVITY MILESTONES STATUS

Financial reporting:

• Assessment of accounting and

reporting differences.

• SelectionofIFRSaccountingpolicies

and IFRS 1 elections.

• DevelopmentofIFRSnancial

statement format, including disclosures.

• Quanticationofeffectsofconversion.

• Senior management and Audit

Committee sign-off for policy

recommendations and IFRS 1 elections

during 2009.

• Senior management and Audit

Committee sign-off on financial

statement format during 2010.

• Final quantification of conversion

effects on 2010 comparative period by

Q1 2011.

• Senior management and Audit

Committee preliminary approval

obtained for IFRS accounting policies

and IFRS 1 elections.

• Monitoring of impacts on policy

recommendations of new or amended

IFRS standards issued ongoing.

• Preliminary IFRS financial statement

format and disclosures drafted.

Systems and processes:

• Assessment of impact of changes on

systems and processes.

• Implementationofanysystemand

process design changes including

training appropriate personnel.

• Documentationandtestingofinternal

controls over new systems and

processes.

• Systems, process and internal control

changes implemented and training

complete in time for parallel run in

2010.

• Testing of internal controls for 2010

comparatives completed by Q1 2011.

• Systems and process changes

completed in preparation for parallel

run. Internal reporting changes

underway.

• Internal controls for impacted process

and transition updated in preparation

for parallel run.

• Training on new systems, processes

and internal controls completed.

Business:

• Assessment of impacts on all areas of

the business, including contractual

arrangements and implement changes

as necessary.

• Communicateconversionplanand

progress internally and externally.

• Contracts updated/renegotiated by

the end of 2010.

• Communication at all levels

throughout the conversion process.

• Preliminary assessment of impacts

on other areas of the business

completed.

• Communication is ongoing.

• Training for employees on expected

impacts completed.

We have allocated sufficient resources to our conversion

project, which include certain full-time employees in addition to

contributions by other employees on a part-time or as needed

basis. We have completed the delivery of training to all employees

with responsibilities in the conversion process. As well, training

for all other employees who will be impacted by our conversion

to IFRS has been completed. Our training efforts have focused on

updating those individuals whose roles and responsibilities are

directly impacted by the changes being implemented and providing

general training to employees on the impacts transition to IFRS will

have on the Company.

Although our IFRS accounting policies have been approved by

senior management and the Audit Committee, such approval is

contingent upon the realization of our expectations regarding

the IFRS standards that will be effective at the time of transition.

Consequently, we are unable to make a final determination of the

full impact of conversion until all of the IFRS standards applicable

at the conversion date are known. Our preliminary analysis of

the impacts of transition to IFRS on specific areas is detailed on

following page. When we are able to preliminarily determine

the areas of significant impact on our financial reporting, including

on our key performance indicators, systems and processes, and

other areas of our business, we will disclose such impacts in our

future MD&As.

CHANGES IN ACCOUNTING POLICIES

In the period leading up to the changeover, the AcSB will continue

to issue accounting standards that are converged with IFRS, thus

mitigating the impact of adopting IFRS at the changeover date. The

International Accounting Standard Board (“IASB”) will also continue

to issue new accounting standards during the conversion period,

and as a result, the final impact of IFRS on our consolidated financial

statements will only be measured once all the IFRS applicable at the

conversion date are known. Consequently, our analysis of changes

and policy decisions have been made based on our expectations

regarding the accounting standards that we anticipate will be

effective at the time of transition. The future impacts of IFRS will

also depend on the particular circumstances prevailing in those

years. At this stage, we are only able to preliminarily estimate